After many years of limited activity on green bonds in Australia, we have seen a number of developments in this space recently, with the announcement of the Australian Government issuing a green bond. This reflects the substantial increase in activity in green bond development globally.

Joining the latest episode of the ESG in 10 podcast, is Tamar Hamlyn, portfolio manager at Ardea Investment Management, to take us through the developments in the green bond space in Australia and what this means for sovereign bond investors.

Find a Fund

Peer Group Analysis View All»

| Index Selector Links | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

6.76% |

8.70% |

5.59% |

|

32.64% |

63.18% |

37.71% |

|

4.60% |

2.01% |

1.46% |

|

7.73% |

10.39% |

6.85% |

|

8.97% |

9.73% |

6.54% |

|

6.32% |

7.54% |

4.40% |

|

13.05% |

11.19% |

7.09% |

|

18.84% |

9.83% |

9.13% |

|

16.92% |

7.81% |

6.79% |

|

10.07% |

8.60% |

6.46% |

|

2.39% |

-0.86% |

1.33% |

|

6.11% |

2.78% |

3.68% |

|

8.36% |

8.03% |

7.46% |

|

7.10% |

6.13% |

5.68% |

|

6.52% |

9.06% |

7.80% |

|

4.94% |

6.47% |

5.08% |

|

0.69% |

8.60% |

6.99% |

Hedge Clippings

25 Aug 2023 - Hedge Clippings | 25 August 2023

|

|

|

|

Hedge Clippings | 25 August 2023 Wow! What a funny old week that was... but then again when one stands back from the headlines, it was more like a slow moving train wreck - or in the case of Yevgeny Prigozhin's presumed mid-air "mishap", more a question of "what took so long"? From what we can glean so far, and given that news out of Russia is curated to say the least, nothing is yet confirmed, other than the fact that a private jet crashed with the loss of all on board. Was Yevgeny among them, was he a target, or was it a way for him to "distance himself" from the long arms of his ex mate, the President? Sooner or later Putin, not widely known for forgiveness, would have found a way to extract his final revenge, either via poisoning Prigozhin's food (which would have been ironic considering he was reportedly once Putin's chef) or some other means. If he was on the plane, it's difficult to have much sympathy. If he wasn't, the best advice would be to watch what you eat, and avoid tall buildings. And then there's the case of Donald, once (and still) known as "President" Trump, facing up to Fulton County Jail to have his mug shot recorded for posterity, and no doubt a whole lot more, along with a dozen other of his co-conspirators. Once again Trump stole the show, having previously (according to some) tried to steal the 2020 US Presidential election, or according to him, having it stolen from him. Sounds more "banana republicanish" to us than Republican, but probably just symptomatic of where the world, or at least the US of A is heading. No doubt he'll garner even more applause and support from his followers, while (just like Prigozhin) it remains to be seen if he survives, or swaps his famous red tie for a more mundane uniform and a potential 641 years in the slammer. Closer to home, even the government's chief media apologist the ABC was questioning the curious co-incidence of the PM's son winning the frequent flyer lottery, and ending up a member of the Qantas Chairman's Lounge. Soon to depart Qantas CEO Alan Joyce deflected questions on how that occurred, citing "privacy" concerns, while at the same time defending a full year profit of $2.47bn., and refusing to refund all or any of the close to $1billion in COVID-19 support the government handed out while he decimated the Qantas workforce. And while Qantas are enjoying record profits on the back of limited seat availability, Albo's transport minister refused to be drawn on the logic of refusing just 21 additional flights per week from Qatar Airways, citing Qantas as the "National Carrier" (actually a commercial and publicly listed company) as in the "national interest". Apparently, any benefits to the long suffering Australian traveling public don't come into the equation, maybe because Albo and co. either don't pay for their tickets, or fly on an RAF VIP aircraft. Barring a complete fall out in the Chinese economy it looks as if Australia will avoid a major recession - unless of course Xi presses ahead with his stated intention of invading Taiwan. That would create a dilemma across the globe for governments, and businesses alike given the level of dependence on China as the world's manufacturer, and consumer. That might make Xi think twice, but in the meantime businesses are moving to reduce that dependence by moving or reducing their exposure. Either way, that's not going to assist China's current economic slowdown. Finally, on a lighter note, we gather the Rolling Stones are quietly planning the release of a new album in September. Which brings us to the following image, or should that be the following question: Whoever thought, back in the 60's, that Mick Jagger would still be around, let alone pumping out music? News & Insights Market Update July | Australian Secure Capital Fund AI reaches an inflection point | Insync Fund Managers July 2023 Performance News Bennelong Emerging Companies Fund Emit Capital Climate Finance Equity Fund Equitable Investors Dragonfly Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

8 Sep 2023 - Sorting bubbles from justified inflations!

|

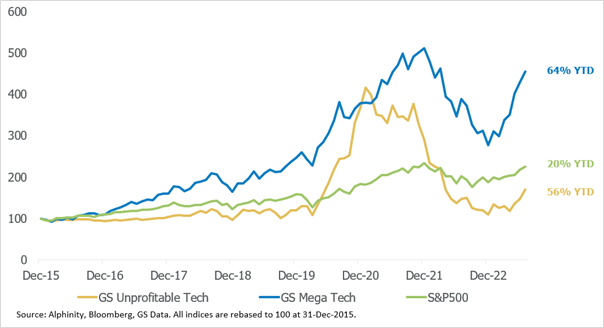

Sorting bubbles from justified inflations! Alphinity Investment Management August 2023 Since Chat GPT3 crashed onto the scene at the end of 2022, the world has been swept up in (generative) Artificial Intelligence (AI) euphoria. AI related stocks have all rallied, companies have expanded their capital plans and gone to great lengths to explain how and why they use AI, and analysts have sharpened their bull case scenarios for future growth opportunities. We've seen similar transformative technology breakthrough exuberance rise and fall in the past, such as Web 3, the metaverse and crypto architecture last year. Is AI just another tech bubble about to implode? Or something much more substantive? The answer is yes to both. In this note, we expand on why we remain excited about the use cases and subsequent earnings potential that can be built off the back of AI in the future and why we believe this technology shift, and the value that it can create, is real. Investors however need to be very selective as the monetisation potential of AI will flow through different elements of the chain at various levels an at different times. Two clear early winners in our view are Microsoft and Nvidia. The AI induced rally The release of Chat GPT did bring the technology sector heavily back into focus in the first half of the year with the Mega (or profitable) Tech index rallying 64% to the end of July. But this reborn tech euphoria also dragged the Unprofitable Tech stocks 37% higher, to outperform the broader US market by more than 40% and 15% respectively. AI enthused rally has boosted profitable and unprofitable tech stocks YTD

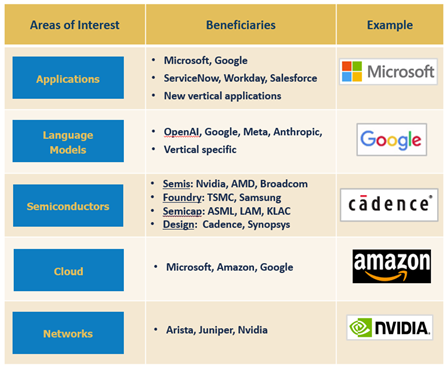

There is undoubtedly an element of AI froth that has come into the technology sector, as some companies have seen AI potential wash into their share prices before a clear articulation of how the earnings that will back these valuations will emerge. And we have seen the downside of this where companies such as Data Dog and Palantir have had solid falls after earnings disappointments, while some of the air has also come out of other companies such as MongoDB, Snowflake and Salesforce. We expect the market to become more discerning in terms of wanting to see a clearer monetisation path to determine who the key winners will be as opposed to the broad lifting of almost all boats even tangentially brushing up against the AI theme that we have seen so far this year. Use cases of generative AI In terms of winners in the AI space, it is all about a clear identification of use cases. AI is not a new theme. The difference now is generative AI developments expand these technological capabilities and put them within the reach of hundreds of millions of new users each month. The IDC estimates the global AI market will see 19% compound annual growth between now and 2026 to reach US$900bn while Goldman Sachs predicts generative AI alone could drive 7% or an almost $7trn increase in annual global GDP growth over the coming decade. There are various elements of the tech ecosystem where value will emerge to varying degrees. At the front end you have the key enablers such as semiconductor designers like Nvidia that will benefit along with foundry businesses like TSMC and Samsung and the semiconductor equipment players such as ASML, Applied Materials and Lam Research who supply them. Then you shift towards the infrastructure names such as networks businesses like Arista, and the cloud players that span Microsofts Azure, Amazons AWS and Googles GCP. But the really exciting opportunities should emerge beyond the initial enablers and infrastructure players and be in those businesses that can create applications based on AI. Established businesses such as ServiceNow, Workday and Salesforce are working to embed AI within their current offering, but the real opportunity is likely to be in the emergence of a business that applies AI to a deep revenue pool and owns that vertical. Whether that be in healthcare, finance or customer service, there is potential for an AI leader to emerge that could be the next big tech name in 5yrs. AI offers a plethora of investment opportunities, but not all created equal

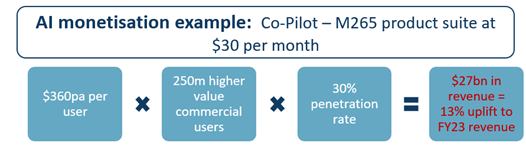

Source: Alphinity, 31 July 2023 Two clear early winners currently - Microsoft & Nvidia Investing in AI is like investing in any other idea for Alphinity; find the investment ideas that are showing earnings leadership, come wrapped in a quality business, and are bound by a reasonable valuation. In AI it comes down to identifying a tangible use case and the monetisation potential that flows off the back of this to driving earnings outperformance, exceptional returns and valuation upside. Microsoft and Nvidia are two clear early winners in AI that display these characteristics. Microsoft (MSFT) - Well positioned for broad secular trends in technology and a leader in AI Microsoft has multiple legs of opportunity flowing from AI. At the front end, it has announced pricing for its AI infused M365 co-pilot product at $30per user per month. Applying this pricing to Microsoft's 250m commercial users of it's higher value products, we estimate Co-pilot can drive an extra $27bn in revenue, or 13%, over a 3-5yr period, assuming a conservative 30% penetration rate. There is also the uplift in consumption that will run through Microsofts cloud business Azure, a potentially simpler Ai product for the extra 200m commercial users on simple product sets, plus incremental gains from any shift in search traffic from Google to Bing. Wrap this together and while the Microsoft share price has risen in 1H23, investors are currently paying 30x Price to Earnings for a business that can grow mid-teens over the next 3 with multiple growth drivers. MSFT offers tangible AI monetisation

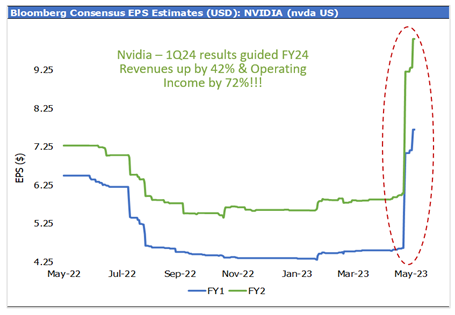

Source: Alphinity, Bloomberg, 31 July 2023 Nvidia (NVDA) - Global leader in Graphics Processing Units with generative AI a gamechanger Nvidia is the other key initial beneficiary from AI, with their most recent result generating an almost unprecedented upgrade in earnings expectations for a business of its scale. Generative Ai is all about GPU's given their ability to run calculations and simulations in parallel; the key tasks for AI. And Nvidia sits front and centre as the leader in terms of GPU performance coupled with a powerful software capability making their GPU's flexible and programmable. The key to the Nvidia investment case is ensuring that the current demand is not just a flash in the pan. To our mind, there is sustainability to this demand given that generative AI has triggered a shift in data centre infrastructure from CPU's towards GPU's. With around $1tr of datacentre infrastructure installed, and this infrastructure turning over around every 4 years, this provides rich structural tailwinds that should drive Nvidia earnings for years to come. On our estimates, NVDA should generate around $30bn in datacentre revenue this year (2/3rds of total revenue). If we push the shift from CPU to GPU through our discounted cashflow model, we estimate that datacentre revenues can increase to $80bn CY27. Investors are paying c40x FY24 Price/Earnings, with what looks like growth to come for the years ahead. Revenue & margin uplifts driving unprecedented EPS upgrades over next two years

Source: Alphinity, Bloomberg, 31 July 2023 In summary, AI is an exciting investment opportunity, with many growth tangents still to be discovered. But like any investment, investors need to be able to have a line of sight to the earnings potential and be disciplined in terms of what they pay for these companies to ensure that they are not riding a bubble that may eventually pop. Authors: Elfreda Jonker, Client Portfolio Manager & Investment Specialist and Trent Masters, Global Portfolio Manager |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

7 Sep 2023 - Fear Not - 5 Steps to Successfully Navigate a Stock Market Fall

|

Fear Not - 5 Steps to Successfully Navigate a Stock Market Fall Marcus Today August 2023 |

|

No doubt a lot of you, scarred by the GFC, by the 2020 pandemic-inspired drop in the market, or by the next potential sell-off, are constantly worried about a significant market correction. It's no fun investing in 'fear', and if that's you, then let me tell you about fear, and in so doing, rid yourself of the constant worry that the stock market is about to fall over and destroy your financial expectations. Sidenote: Anyone who is wealthy, inactive, or incapable of selling can stop reading here. First, You Need to Understand FearThere is always, always, always something to fear when it comes to the stock market, and fear is good, because it's the fear that creates opportunities. Rather than avoid fear, you should welcome it. It is in the grip of stock market fear and exuberance that the most money is made in the shortest timeframe. You should also understand that when fear starts, we will perpetuate it. Fear is great for us; for the financial media, the brokers, the financial planners, the fund managers, the financial advisers. In fact, it's great for the whole finance industry. Some commentators make a living out of fear, like Nouriel Roubini, or Marc Faber with his 'Doom and Gloom' report. Why? Because fear triggers insecurity which drives investors to us. Fear is the sheep dog of financial services. It rounds up the sheep so we can shear them. Yes, the sheep, that's you. Fear is also a powerful magnet when it comes to attracting eyeballs, and in a competition for clicks, when investors are at their most fearful, the clicks and eyeball numbers explode. Everyone wants advice, and we will provide. Advice is the 'Trojan Horse' of our commercial purpose. Fear achieves that for us. It is so much more effective than common cheerfulness.Fear and ClickbaitClickbait, in it's natural form, starts with the words "5 Things…". To capitalise on that, we chuck in some of the top clickbait keywords, and then, if the glorious moment (as now) presents, we throw in some fear. "5 Things", the keywords "Warren" and "Buffett", and a small sprinkling of fear, and you have the most commercial headline in finance. It goes like this: "5 Reasons Warren Buffett Thinks the Stock Market Will Crash" Publish and wait. A 5-Step Simple Plan of Action for You - When the market loses it's head in fear1) Stay cold, objective, and logical. Be 'Spock'. Look down on the fear, don't join in. Being emotional will not help you, it will cost you. 2) Accept what your shares are worth now. Don't dwell for a moment on the highs, and how much you were worth. The highs are gone and there's nothing you can do about it. Anchor yourself to yesterday's prices and it will deliver nothing but regret and a feeling of stupidity. Look at the bottom of the spreadsheet. That's what you're worth. Accept it. 3) Get excited. The market only presents great opportunities occasionally. One is coming. It is from moments like these that quick money is made. 4) Take an informed guess at what you think is going to happen next. The only thing that matters is what's going to happen, not what has happened. Read the Marcus Today newsletter and decide for yourself if the sell-off is a blip or a trend. 5) Decide what to do, if anything. Understand that no one knows. Do your best. Just decide. And live with it. Accept the outcome, right or wrong. The only crime is deciding nothing and letting it all happen to you. So, My Thought Process in Preparing for the Next Sell Off Goes Like This:1) Take ten seconds - For a few moments of weakness, I thought about how I could have called this earlier in the newsletter, before each fall in the market. Tiger Woods says you are allowed ten seconds to express your emotion after a golf shot. But that's all. Take ten seconds. It's good for you. But there's nothing to be done about that now. It is what it is. Time to move on and decide what to do next. 2) Identify the core issues - I read a lot (as always), and quickly (it's pretty obvious) identified the core of the issues for the last correction. Macro stuff. In this case, inflation, interest rates and the fear of a US recession, with a sprinkling of China lockdowns and Russian risk. 3) Decide if it's a 'blip' or a 'trend' - I made an assessment of whether the main issues were likely to persist, or turn on a sixpence. I decided they were more likely to persist. 4) Do something, or decide to do nothing - I sold the three market-related ETFs in our 'Strategy Portfolio', and almost every stock in our 'Ideas Portfolio'. I'm good at selling, it's a thing I do well. You should learn to do it. It's cathartic. You wake up the next day hoping the market collapses, rather than fearing it will. It's empowering to have cash and be "ready to go". 5) Take it day by day until the bottom - Now the game is to watch and wait for 'peak fear'. The market will bottom one day. It could be tomorrow, or it could be in a year. You must take it one day at a time. Wake up every morning and react. There's no predicting it. I know I'll make more money in the recovery from the bottom, and more than I lost in the last few days of any correction. If I can get it right, and if I can time it right for our subscribers, it will be fabulous. And that's how you approach this moment when it comes again. With the intention to exploit everyone else's fear. By the way. You can time the bottom. Don't listen to those feeble commentators that say you can't. They want it to be impossible, so they don't have to do it. For financial professionals, it's a lot more effort handling active clients than it is handling docile 'buy and hold' sheep, and the more clients they can convince that timing can't be done, the less activity they incur for the same amount of fees. Just saying. The Bottom LineYou should welcome corrections and other people's fears. The most exploitable moments of the market are the fabulous, exponential, irrational, exuberant bits at the top and the most fearful, despondent, capitulations at the bottom. They are the bits, the extremes, and the opportunities, that make the market worthwhile. Those extremes, those moments of stupidity, absurdity, farce, ridiculousness, and nonsense are brought on by other people's irrational fear and exuberance. You should expect them, look forward to them, and use them, not avoid them. A good investor watches and exploits the herd. They don't join the herd. Let that be you. Author: Marcus Padley, Founder of Marcus Today |

|

Funds operated by this manager: |

6 Sep 2023 - Compelling case for bonds as recession looms

|

Compelling case for bonds as recession looms JCB Jamieson Coote Bonds August 2023

Central banks the world over have hiked rates with unprecedented velocity and ferociousness as they look to rein in inflation. With this hiking cycle now nearing its peak, Jamieson Coote Bonds senior portfolio manager, James Wilson says investors should assess their portfolios and take advantage of emerging opportunities in fixed income. KEY TAKEAWAYS

BRACING FOR A SLOWDOWNSince March 2020, the geopolitical forces shaping markets have shifted dramatically. Markets have lurched from a global pandemic to the outbreak of Europe's first land war since conflict rocked the Balkans in the 1990s. Meanwhile, rising nationalist sentiment across other major economies has polarised the political landscape - particularly in the US. Economics and markets: a dose of reality Source: Jamieson Coote Bonds More recently, Mr Wilson said investors have contended with a "world of overshoots". "We've seen oil travel from -US$30 to over US$120, and back to somewhere in the eighties where we are now. "We've had the Bitcoin bubble. We've gone from US$5,000 to US$68,000 where we all wanted to be part of the big bubble there until it all popped and went back to US$16,000. And that's since recovered again. Now we are seeing equities being led by Artificial Intelligence. "All this is happening in a highly indebted world where US mortgage-holders are under trillions and trillions of dollars of debt."

It's not just mortgage debt that's expected to provide headwinds for markets. Mr Wilson noted that US credit card debt is hovering around the US$1 trillion mark1. Taken together, Mr Wilson said these indicators suggest the market is "cycling between the late 'upswing phase' and the 'economy slows' phase. In blunter terms, global markets appear to be heading towards recession. Where are we at in the business/investing cycle? Source: Jamieson Coote Bonds team analysis CHARTING A COURSE FORWARDLooking ahead, Mr Wilson said the uncertainty hanging over markets will likely remain, however clues to what might play out can be found by looking back to 2007, right before the Global Financial Crisis struck. "As we know, nothing really happened, and then everything happened," he said. "Rates hit 5%. You could buy a 3-month T-Bill for above 5% for more than a year, and then everything came crashing down." Precisely what will cause a recession this time around is more difficult to pinpoint, Mr Wilson said - and the lagging effects of monetary policy mean the trigger could still be a while off. When it does hit, however, Mr Wilson said the United Kingdom and Europe will likely feel its effects first. "They've got big exposure to energy, and they're against the US dollar," he said. "Then the US and then Australia would go into recession as inflation and jobs will lead unemployment rates to go higher." Historically, Mr Wilson said, rate hiking cycles undertaken by the US Fed invariably create a financial crisis somewhere in the world. INFLATION EASING SLOWLYInflation has become a hot-button issue for investors, policymakers and a majority of households over the past two years. The US Consumer Price Index (CPI) peaked at 9.1% in June last year, with Australian CPI reaching a peak of 7.8% in December that same year. Since then, CPI figures have steadily reduced. In the US, inflation is sitting just above 3%, while Australia's July CPI print came in at 6%. "These are outstanding moves," Mr Wilson said. "I know central bankers aren't making many friends hiking interest rates as the cost of living pressures that everyone's suffering from globally, but it's been the right idea. It's going to help economies." Mr Wilson added that the Citi Inflation Surprise index - which measures forecasters' expectations against realised inflation data - showed that since 2020, inflation was consistently higher than expected. In the past few months, this trend has been broken. "We're no longer seeing surprises to the upside," Mr Wilson said, "which means we're not getting the volatility in the data, which means we most likely aren't going to see binary moves in the actual bond yields." Although inflation expectations are starting to ease, Mr Wilson said he doesn't expect to see CPI dip below 2% "anytime soon", and that inflation will likely remain 'sticky' for some time. OPPORTUNITIES EMERGING FOR ACTIVE MANAGERSLeading into the Jackson Hole symposium, US bond markets are pricing in rate cuts between 120 and 130 basis points for the year ahead. "That isn't necessarily saying that we (Australia) are going to have 120 basis points of rate cuts. What that could be saying to bond traders is that there could be a 50% chance of close to 250 basis points of cuts," Mr Wilson said. In Australia, market pricing tells a different story - one more interest rate hike (likely before the end of the year) and no 'big' rate cutting cycle like US markets are expecting. Interestingly, Australia's three-year bond rate currently sits at 3.8% - 30 basis points below the cash rate. In the US, that gap between the three-year bond rate and the cash rate is closer to 100 basis points. "If you think about that level, Australian three-year bonds are actually quite cheap in that sense because they're not pricing in any of the rate cutting cycle. There are definitely opportunities to be owning those assets," Mr Wilson said. Mr Wilson also noted that bond and share market yield curves are "not too dissimilar", suggesting the credit stack is upside down. Bond yields are genuinely compelling for investors Where are investors securing their yield from, and at what cost to the portfolio? Source: JCB team analysis, based on data from Bloomberg Similarly, property cap rates are starting to 'come into line' with bond yields, Mr Wilson said, making a 'compelling' case for bond investment. This is further evidenced by the state of US deficits, Mr Wilson said, which suggest there's a huge amount of issuance yet to come. "And at some price point, bonds will clear. There is a price that's going to cheapen up, but bonds will clear at some price and someone will buy the US treasuries and the Australian government bonds for that matter at a level." The money used to purchase those assets somewhere - whether credit, equities or something else, the money will come from somewhere to fund these purchases, Mr Wilson said. "We're already seeing that in asset allocations, that makes bonds a very compelling investment option over time, and we expect this to continue." 1. A Saphir, 'US credit card debt tops $1 trillion, overall consumer debt little changed', Reuters, August 9 2023, accessed 15 August 2023 Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) Important InformationThis article has been prepared by JamiesonCooteBonds Pty Ltd ('JCB') ACN 165 890 282 AFSL 459018. This article is supplied on the following conditions which are expressly accepted and agreed to by each interested party ('Recipient').The information is provided only to wholesale or sophisticated investor Recipients as defined by the Corporations Act 2001 (Cth). JCB is not licensed in Australia to provide financial product advice or other financial services to retail investors. The information in this article is general financial product advice only and has been prepared without taking into account the objectives, financial situation or needs of any particular person.The information is not intended for any general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of JCB and respecting JCB and its investment activities; its use is restricted accordingly. This article does not purport to contain all of the information that may be required to evaluate JCB or their funds and the Recipient should conduct their own independent review, investigations and analysis of JCB and of the information contained or referred to in this presentation.Neither JCB nor their representatives and respective employees or officers (collectively, 'the Beneficiaries') make any representation or warranty, express or implied, as to the accuracy, reliability or completeness of the information contained in this article or subsequently provided to the Recipient or its advisers by any of the Beneficiaries, including, without limitation, any historical financial information, the estimates and projections and any other financial information derived there from, and nothing contained in this article is, or shall be relied upon, as a promise or representation, whether as to the past or the future. Past performance is not a reliable indicator of future performance. The information in this article has not been the subject of complete due diligence nor has all such information been the subject of proper verification by the Beneficiaries.Except insofar as liability under any law cannot be excluded, the Beneficiaries shall have no responsibility arising in respect of the information contained in this article or subsequently provided by them or in any other way for errors or omissions (including responsibility to any person by reason of negligence). An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor's objectives, financial situation and needs. For further information and before investing, please read the Product Disclosure Statement ('PDS') which is available at www.jamiesoncootebonds.com.au. |

5 Sep 2023 - The Experiences Megatrend

|

The Experiences Megatrend Insync Fund Managers August 2023

Despite Covid's interruption it has continued to gain momentum. Its recovery is proving remarkable, as experiences remain a potent megatrend with substantial growth potential ahead, even amidst short-term economic woes. Despite the headlines throughout the pandemic and general market commentator's gloomy predictions, our research at Insync told us otherwise. For players that had strong capital bases, tight reins on expenses, and prudent investment allocation strategies, they could endure the worst the pandemic could throw at them. These businesses emerged stronger, such as the prime stock in our portfolio did. Many of its peers however weren't as strong, with some folding or forcibly downsized. Additionally, entire sectors of travel/experiences almost collapsed (e.g. cruise lines). For those left standing, their hold on the market and thus their margins became bigger and stronger. An increase in interest rates and inflation had minimal impact on their performance in the post pandemic recovery.

These businesses emerged stronger, such as the prime stock in our portfolio did. Many of its peers however weren't as strong, with some folding or forcibly downsized. Additionally, entire sectors of travel/experiences almost collapsed (e.g. cruise lines). For those left standing, their hold on the market and thus their margins became bigger and stronger. An increase in interest rates and inflation had minimal impact on their performance in the post pandemic recovery. What and who is driving this megatrend? Over the past decade, the desire of consumers has shifted towards experience-based offerings and is influencing people's spending priorities. This shift spearheaded initially by millennials has spread across all age groups. Ironically it gained further traction from covid's travel restrictions. A proof point can be found in air travel; that whilst business trips are relatively flat compared to pre-covid, overall commercial flights hit a global record in June this year. A significant majority of 74% of Americans, as a further example, now prioritize experiences over material possessions according to a third-party research study. This is no different to us here in Australia and New Zealand or in Europe. Notably, millennials and Gen Zers are leading this trend as travel becomes an increasingly regular and a vital priority for these age groups . With 44% of travellers aged 18 to 34 asserting that travel is more important post-pandemic, it's evident that this generational shift is taking hold.

The fast approaching impact of AI on this megatrend. With AI developing quickly it is vital to understand its impact on business models of all companies that we invest in. Our research shows that online travel agencies(OTAs) are extremely well placed, contrary to many investors placing them in the AI loser's basket.

This is because the OTAs operate far downstream of where AI will have its heaviest and nearest impacts. Consider this single aspect; OTAs employ tens of thousands of staff in local markets around the world to source then continue to manage the fragmented accommodation supply to make it homogenously, digitally bookable globally. Importantly, our prime holding is already investing heavily in utilising AI. This is a critical piece of OTA infrastructure that the likes of Google or ChatGPT will both struggle to execute and match the capabilities of dominant OTAs. Indeed Google recently tried and failed to gain a foothold in this sector after significant investment and effort. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

4 Sep 2023 - Hybrid securities - How risky are they?

|

Hybrid securities - How risky are they? PURE Asset Management August 2023

Hybrid securities is a catch-all term and refers to both preference shares and convertible loan notes. They are financial instruments that combine the characteristics of both debt and equity. This article will focus on Convertible Loans, or simply, Convertibles. These instruments, like traditional debt, pay a rate of interest and have more protections than shares, but they also have the option to be converted into the shares of the Company at some point in the future. The conversion feature makes them attractive to investors who believe that the value of the Company's shares will increase over time. By holding a Convertible, investors have the potential to participate in the share price appreciation, while also receiving interest while they wait. The conversion price is typically set at a premium to the current market price of the shares, or it can be based on a discount to a future pricing event, for example an IPO. When the share price rises above the conversion price, the holder can convert into shares and make a profit. Convertibles can be a way to gain exposure to both income and growth, but like any investment they come with some risks, which could largely be considered to sit between the risk of shares and the risk of traditional debt. What are the main risks?Credit riskThe largest risk of a Convertible is credit risk. Credit risk is the risk of default, if the borrowing Company is unable to pay the interest on the loan, or even payback the original capital, which may be result in a partial or a complete loss of capital. A key factor influencing the level of risk is the level of security attached to the Convertible. The capital of all companies sits in a capital stack (see below). At the top of the stack is a senior secured loan and at the bottom, equity. The risk of an investment is largely correlated to where the capital sits in the capital stack. Convertibles are typically the top three, so less risky than preference or ordinary shares. (Note that a Company may not have all the layers in the table, but most will have several.)

In an efficient market, higher levels of credit risk will be associated with higher borrowing costs as the investor wants to receive a higher return for the perceived risk of the investment. In simplistic terms, the higher up the stack, the more other investors' capital there is that would first need to be lost, before the investors above them suffers loss. In a private market, lenders and borrowers negotiate directly. A savvy lender/private debt manager will attempt to negotiate with the borrower the appropriate terms and conditions, controls, reporting obligations, covenants, and security to ensure the lender has greater influence over the loan terms in an effort to mitigate potential loss risk. Covenants and ongoing borrower reporting requirements are negotiated in order to provide protection and early warning of changing risks. Liquidity riskLiquidity risk refers to the inability to sell or trade an investment when needed. Unlisted hybrid securities are an illiquid investment, and therefore carry the risk that if something goes wrong in the Company, such as a credit risk event, the holder may not be able to liquidate their position in a timely manner. While hybrid listed on the ASX may offer some liquidity, most are often less liquid than the ordinary shares making them harder to sell. Conversion riskWhen the Convertible converts into shares, the number of shares to be issued to the holder will typically be calculated by dividing the loan amount plus any accumulated interest by a certain share price. This conversion price will often be pre-determined as a fixed price, or it can be priced with a reference to future prevailing share price. What is not know at the time of investing is what level of profit, or even loss, will result at the conversion event. Some Convertibles have an enforced conversion event, for example at IPO, and in other cases, the Conversion is at the direction of the holder. If the holder retains the right to choose and elects not to convert, the Company must repay the capital plus any accrued interest. This structure is preferable as it carries less risk of loss on conversion if the Company has performed poorly. Convertibles vs. traditional debtConvertibles can be more complex than traditional debt and may have a higher level of return because of the attractive feature of being able to participate in the upside if things go well. Convertibles vs. equitiesEquities represent ownership in a Company, and their value can fluctuate based on a variety of factors such as company performance, industry trends, and overall market conditions. They can be considered riskier than debt because the value of the shares can fluctuate greatly. Convertibles, on the other hand, pay a fixed or floating rate of interest and also have some of the characteristics of ordinary shares, such as potential for capital appreciation. They tend to be less risky than equities because they typically provide a consistent income stream and also have some or all of the protections intrinsic to debt. As with any investment, it's important for investors to conduct their own research and consider their own risk tolerance before investing in hybrid securities. It's also important to diversify your portfolio and not to put all of your eggs in one basket. Funds operated by this manager: |

1 Sep 2023 - The dangers of long COVID

|

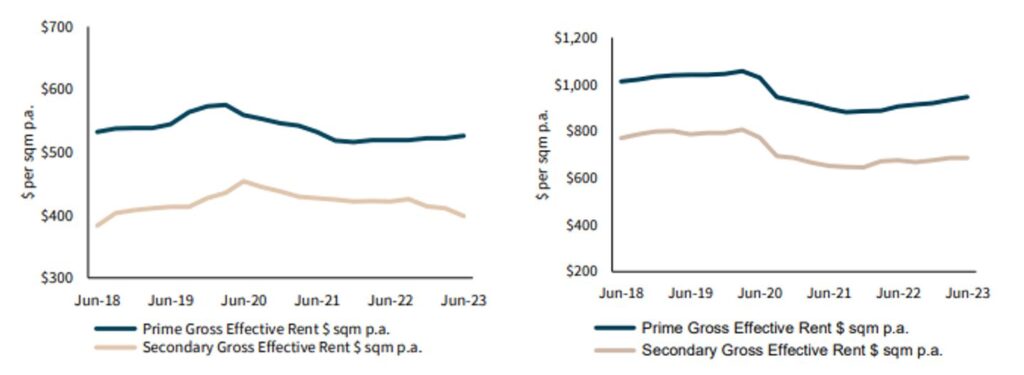

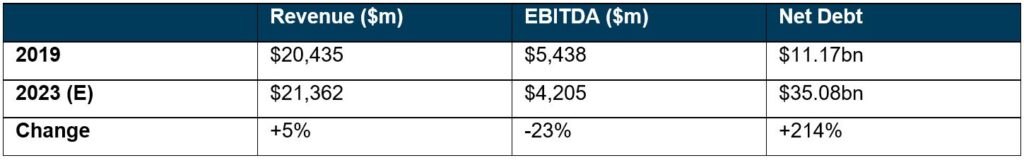

The dangers of long COVID Challenger Investment Management August 2023 Like most, the memories of COVID seem like a dream. For most of society, lives have moved back to normal with a few exceptions such as the working from home revolution. But some are still suffering the after-effects of COVID and are a shadow of the people they were back in those innocent days of 2019. We still talk about long COVID, which refers to a bout of COVID where the symptoms persist for longer than 4 weeks, but these days we are talking about companies and not individuals. A company with long COVID is one where earnings are trailing 2019 levels combined with a balance sheet saddled with more debt. Even if they are still recovering, companies suffering from long COVID may never get back to where they were in 2019. Even if revenues get back to 2019, earnings will be weighed down by higher interest costs and elevated debt levels with balance sheets acutely exposed if a recession does happen in the next few years. If a recession does indeed eventuate, interest costs will likely increase pushing balance sheet repair further into the future. Long COVID could really be looooooooong COVID. In our view, credit markets are not sufficiently pricing for long COVID risk. For an investment grade borrower, long COVID may mean that a borrower can never return to the credit risk profile it had in 2019. For a high yield borrower, long COVID may mean that a borrower is wholly reliant on equity to avoid a default. We've already written about the office sector of the commercial real estate market. Over the last four years, gross effective yields rents have gone backwards as the same time as debt levels have increased. The rise in interest rates has pushed interest coverage close to one time meaning after interest payments there is little ability to pay down debt to right size the capital structure. The only cure for long COVID is for the asset owner to tip in more equity to pay down debt and right size the capital stack but who has appetite for that when asset values themselves are declining. Gross Effective Rents Melbourne (LHC) and Sydney (RHC) Source: JLL Research as at Q2 2023 However long COVID has spread well beyond commercial real estate. Across the ASX300, around 10% of companies have seen earnings decline over the past 4 years and debt increase by 50%. In the United States, 6% of companies have seen earnings decline and debt increase by 50%. Consider the tourism sector. The post COVID rebound feels immense but then so was the hole that COVID created. A good example of this is Carnival Corporation, one of the largest cruise line operators in the world. COVID was a horror period for them with effectively no revenue for two years but over the past 12 months their customers have returned in droves, seemingly putting COVID in the rear view mirror.

While revenues have recovered, earnings are expected to finish 2023 around 20% below 2019 levels before returning to 2019 levels in 2024. Even at 2019 earnings, free cash flow is only expected to be $1-2 billion per annum implying that without an equity injection it would potentially take up to two decades to get back to 2019 levels of debt. While that may seem dire, consider that if a recession takes place and earnings flatline at 2023 levels there will be no free cash flow to pay down debt. Indeed in 2023 net debt is expected to increase by over $1 billion. Despite this outlook, S&P has Carnival B-rated with a positive outlook. Secured debt is rated BB-. S&P sees leverage at around 7 times, improving to 5 times by end of 2024, essentially implying earnings around 15% higher than 2019 levels. The market seems to agree with this sentiment pricing a recent senior secured deal at a spread of 2.85%, broadly flat to the BB high yield index. While it may seem as though we are trying to second guess the rating agencies and even market pricing of Carnival credit risk, that is not our intention. The key point is that sufferers of long COVID are acutely exposed to the combination of elevated interest rates and the risk of recession. We are still far from 2019 levels of health. If earnings flatline, it is difficult to see how borrowers who are still suffering from long COVID can return to health. Funds operated by this manager: Challenger IM Credit Income Fund, Challenger IM Multi-Sector Private Lending Fund |

31 Aug 2023 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

31 Aug 2023 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

30 Aug 2023 - Investing Essentials: How a financial adviser can help

|

Investing Essentials: How a financial adviser can help Bennelong Funds Management August 2023 |

|

Many of us want to save effectively, invest well, and generate sufficient funds to pay for a home, children's education, travel and, ultimately, a secure retirement. But navigating a complex financial landscape can be intimidating. Fortunately, there are professionals who can guide you. Seeking the advice of a qualified financial adviser may add significant value over your lifetime. Here is a snapshot of some of the things an adviser can assist with. Budgeting and managing debtIn order to invest, you need to work out where the money will come from. A financial adviser can help you manage your income more effectively by carefully identifying and monitoring your spending patterns and expenses. They can also help you get the full picture on your debt load and work out which parts are:

Insurance: the importance of securityAdequate insurance coverage to provide you and your family financial security is crucial, particularly if you are self-employed or own a business. A mix of suitable life insurance, income insurance, business insurance and general insurance is highly individualised. Your financial adviser's expertise in this area can save you a great deal of time and worry. Building an investment portfolioOnly after budgeting and insurance do we get to investment. Your financial adviser will gather all of the relevant information on your personal financial circumstances, objectives and risk tolerance, and help you choose the right types of investments to fit your needs, personality, goals and time horizon. Your adviser can help you build a diversified investment portfolio, often spread among a range of asset classes to aim for positive returns while balancing the overall level of risk. What's more, they will regularly assess the plan to ensure it continues to meet your needs, altering your investments as you reach different stages of life (for example, wealth accumulation for younger investors versus a steady income stream for retirees). The three pillars of retirementYour financial adviser should be an expert on Australia's 'three-pillar' retirement-funding system: compulsory superannuation, the government-funded age pension, and voluntary contributions by individuals to their super accounts. Australia's superannuation system can seem complicated, and most people can benefit from sound technical advice from a professional - whether it's to maximise the benefits, or minimise the tax burden. What to look forChoosing a financial adviser is an important decision. Ideally, it will be a lifetime partnership (and even a multi-generation partnership, taking care of your family's needs). You need to establish a strong rapport: they will know all about your financial affairs, your dreams and aspirations, and even how you want your affairs managed after you die. You therefore need to ensure the person is a trustworthy and knowledgeable professional, and someone with whom you're comfortable working with over the long term, who can regularly maintain and review your financial goals as you enter different stages of life. There are several professional bodies who may be able to assist you in selecting a financial adviser, such as the Financial Advice Association Australia's find a planner page. |

|

For more insights visit www.bennelongfunds.com Disclaimer The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

29 Aug 2023 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

8 Sep 2023 - Sorting bubbles from justified inflations!

|

Sorting bubbles from justified inflations! Alphinity Investment Management August 2023 Since Chat GPT3 crashed onto the scene at the end of 2022, the world has been swept up in (generative) Artificial Intelligence (AI) euphoria. AI related stocks have all rallied, companies have expanded their capital plans and gone to great lengths to explain how and why they use AI, and analysts have sharpened their bull case scenarios for future growth opportunities. We've seen similar transformative technology breakthrough exuberance rise and fall in the past, such as Web 3, the metaverse and crypto architecture last year. Is AI just another tech bubble about to implode? Or something much more substantive? The answer is yes to both. In this note, we expand on why we remain excited about the use cases and subsequent earnings potential that can be built off the back of AI in the future and why we believe this technology shift, and the value that it can create, is real. Investors however need to be very selective as the monetisation potential of AI will flow through different elements of the chain at various levels an at different times. Two clear early winners in our view are Microsoft and Nvidia. The AI induced rally The release of Chat GPT did bring the technology sector heavily back into focus in the first half of the year with the Mega (or profitable) Tech index rallying 64% to the end of July. But this reborn tech euphoria also dragged the Unprofitable Tech stocks 37% higher, to outperform the broader US market by more than 40% and 15% respectively. AI enthused rally has boosted profitable and unprofitable tech stocks YTD

There is undoubtedly an element of AI froth that has come into the technology sector, as some companies have seen AI potential wash into their share prices before a clear articulation of how the earnings that will back these valuations will emerge. And we have seen the downside of this where companies such as Data Dog and Palantir have had solid falls after earnings disappointments, while some of the air has also come out of other companies such as MongoDB, Snowflake and Salesforce. We expect the market to become more discerning in terms of wanting to see a clearer monetisation path to determine who the key winners will be as opposed to the broad lifting of almost all boats even tangentially brushing up against the AI theme that we have seen so far this year. Use cases of generative AI In terms of winners in the AI space, it is all about a clear identification of use cases. AI is not a new theme. The difference now is generative AI developments expand these technological capabilities and put them within the reach of hundreds of millions of new users each month. The IDC estimates the global AI market will see 19% compound annual growth between now and 2026 to reach US$900bn while Goldman Sachs predicts generative AI alone could drive 7% or an almost $7trn increase in annual global GDP growth over the coming decade. There are various elements of the tech ecosystem where value will emerge to varying degrees. At the front end you have the key enablers such as semiconductor designers like Nvidia that will benefit along with foundry businesses like TSMC and Samsung and the semiconductor equipment players such as ASML, Applied Materials and Lam Research who supply them. Then you shift towards the infrastructure names such as networks businesses like Arista, and the cloud players that span Microsofts Azure, Amazons AWS and Googles GCP. But the really exciting opportunities should emerge beyond the initial enablers and infrastructure players and be in those businesses that can create applications based on AI. Established businesses such as ServiceNow, Workday and Salesforce are working to embed AI within their current offering, but the real opportunity is likely to be in the emergence of a business that applies AI to a deep revenue pool and owns that vertical. Whether that be in healthcare, finance or customer service, there is potential for an AI leader to emerge that could be the next big tech name in 5yrs. AI offers a plethora of investment opportunities, but not all created equal

Source: Alphinity, 31 July 2023 Two clear early winners currently - Microsoft & Nvidia Investing in AI is like investing in any other idea for Alphinity; find the investment ideas that are showing earnings leadership, come wrapped in a quality business, and are bound by a reasonable valuation. In AI it comes down to identifying a tangible use case and the monetisation potential that flows off the back of this to driving earnings outperformance, exceptional returns and valuation upside. Microsoft and Nvidia are two clear early winners in AI that display these characteristics. Microsoft (MSFT) - Well positioned for broad secular trends in technology and a leader in AI Microsoft has multiple legs of opportunity flowing from AI. At the front end, it has announced pricing for its AI infused M365 co-pilot product at $30per user per month. Applying this pricing to Microsoft's 250m commercial users of it's higher value products, we estimate Co-pilot can drive an extra $27bn in revenue, or 13%, over a 3-5yr period, assuming a conservative 30% penetration rate. There is also the uplift in consumption that will run through Microsofts cloud business Azure, a potentially simpler Ai product for the extra 200m commercial users on simple product sets, plus incremental gains from any shift in search traffic from Google to Bing. Wrap this together and while the Microsoft share price has risen in 1H23, investors are currently paying 30x Price to Earnings for a business that can grow mid-teens over the next 3 with multiple growth drivers. MSFT offers tangible AI monetisation

Source: Alphinity, Bloomberg, 31 July 2023 Nvidia (NVDA) - Global leader in Graphics Processing Units with generative AI a gamechanger Nvidia is the other key initial beneficiary from AI, with their most recent result generating an almost unprecedented upgrade in earnings expectations for a business of its scale. Generative Ai is all about GPU's given their ability to run calculations and simulations in parallel; the key tasks for AI. And Nvidia sits front and centre as the leader in terms of GPU performance coupled with a powerful software capability making their GPU's flexible and programmable. The key to the Nvidia investment case is ensuring that the current demand is not just a flash in the pan. To our mind, there is sustainability to this demand given that generative AI has triggered a shift in data centre infrastructure from CPU's towards GPU's. With around $1tr of datacentre infrastructure installed, and this infrastructure turning over around every 4 years, this provides rich structural tailwinds that should drive Nvidia earnings for years to come. On our estimates, NVDA should generate around $30bn in datacentre revenue this year (2/3rds of total revenue). If we push the shift from CPU to GPU through our discounted cashflow model, we estimate that datacentre revenues can increase to $80bn CY27. Investors are paying c40x FY24 Price/Earnings, with what looks like growth to come for the years ahead. Revenue & margin uplifts driving unprecedented EPS upgrades over next two years

Source: Alphinity, Bloomberg, 31 July 2023 In summary, AI is an exciting investment opportunity, with many growth tangents still to be discovered. But like any investment, investors need to be able to have a line of sight to the earnings potential and be disciplined in terms of what they pay for these companies to ensure that they are not riding a bubble that may eventually pop. Authors: Elfreda Jonker, Client Portfolio Manager & Investment Specialist and Trent Masters, Global Portfolio Manager |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

29 Aug 2023 - The Rate Debate - Ep 41: Uncertainty abounds in the face of economic challenges

|

The Rate Debate - Ep 41: Uncertainty abounds in the face of economic challenges Yarra Capital Management August 2023 Amidst ongoing economic uncertainties, the RBA has seen fit to keep rates on hold for a consecutive month and wait to see how the lagging effects of 12 rate hikes play out. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

28 Aug 2023 - What really matters in investing

|

What really matters in investing Magellan Asset Management August 2023 |

|

Global Portfolio Managers, Arvid Streimann and Nikki Thomas dissect what's important and what's a distraction in the investment world. They talk us through where they are currently finding opportunities and how they are positioning the portfolio to benefit from structural tailwinds. Investment Analyst, Emma Henderson joins them to provide a deep dive into our restaurant holdings and why we like them. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

11 Aug 2023 - ESG in 10: Episode 9- The Australian Green Bond Program, with Ardea

|

ESG in 10: Episode 9 - The Australian Green Bond Program, with Ardea Fidante Partners July 2023 |

|

Funds operated by this manager: Bentham Asset Backed Securities Fund, Bentham Global Income Fund, Bentham Global Income Fund (NZD), Bentham High Yield Fund, Bentham Syndicated Loan Fund, Bentham Syndicated Loan Fund (NZD) |

8 Aug 2023 - Webinar Podcast 01 Aug 2023 | Infrastructure Funds - Analysing the Opportunities and Risks

|

Webinar Podcast | Infrastructure Funds - Analysing the Opportunities and Risks FundMonitors.com 01 August 2023 |

|

Listen to the podcast to discover the key insights and opportunities in this dynamic investment landscape. In this informative 45-minute session, we explored the potential benefits and risks of investing in infrastructure funds and uncovered the various types of infrastructure assets, including transportation, energy, and social infrastructure. Our panel consisting of Sarah Shaw from 4D Infrastructure, Ben McVicar from Magellan, and Matt Lorback from Atlas Infrastructure also delved into the regulatory and policy considerations impacting infrastructure investments. |

3 Aug 2023 - In Conversation with Airlie's Analysts

|

In Conversation with Airlie's Analysts Airlie Funds Management July 2023 |

|

Airlie Australian Share Fund Portfolio Manager, Emma Fisher, engages in a conversation with Airlie's senior analysts, Vinay Ranjan and Joe Wright. Emma discusses the performance of the Australian market during the past 12 months and asks Joe and Vinay to share insights on how some of their stocks have performed during the year within the Fund. This includes Mineral Resources, QBE Insurance and James Hardie. Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

2 Aug 2023 - Do they have your back or just your back pocket? The fun, games, and fees of equity investing

|

Do they have your back or just your back pocket? The fun, games, and fees of equity investing Collins St Asset Management July 2023 FY23 recap: ASX 200 defies the bears to end up +10% over last financial year It is often said that: When someone with money meets someone with experience, the person with the experience gets the money and the person with the money gets an experience. For equity investors, regardless of whether or not they choose their own investments or outsource some or all of that responsibility to an external manager/adviser, this remains a very real and important risk to be on top of. Many Directors and Management teams do not run companies for the benefit of shareholders despite all of the claims and promises of future gold and glory laid out in glossy annual reports. Fat salaries for start up company Directors, gifted equity to management in large established businesses and all manner of perks and parties along the way are, all too sadly, par for course. To that end, its important to understand the governance structure of a company and the way in which senior decision makers are remunerated before deciding whether or not to invest. Some key questions we at Collins St Asset Management seek to understand before deploying capital include:

Sadly, a rolling stone gathers no moss in much the same way as an upwardly mobile executive can suffer no financial pain by moving from one company to the next just before the next crisis is uncovered. Of course, Directors and senior Management are not alone in their pursuit of cushy rent-seeking corporate opportunities. Whilst many intermediaries in the funds management space are often no better, there are a variety of fee models on offer which invariably incentivise different behaviours. The table below provides an overview of some of the different ways professional fund managers may seek to charge their clients: Overview of fee structures Author: Rob Hay, Head of Distribution & Investor Relations For wholesale investors only |

|

Funds operated by this manager: |

31 Jul 2023 - Will service stations be stranded assets?

|

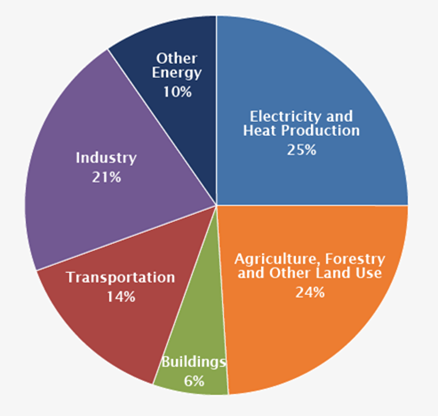

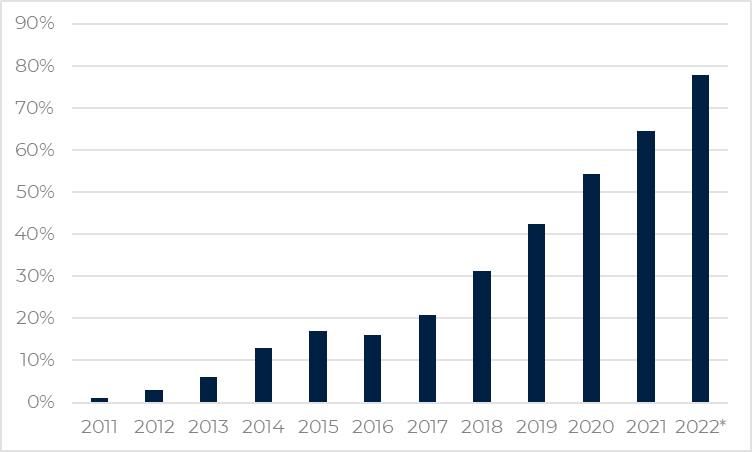

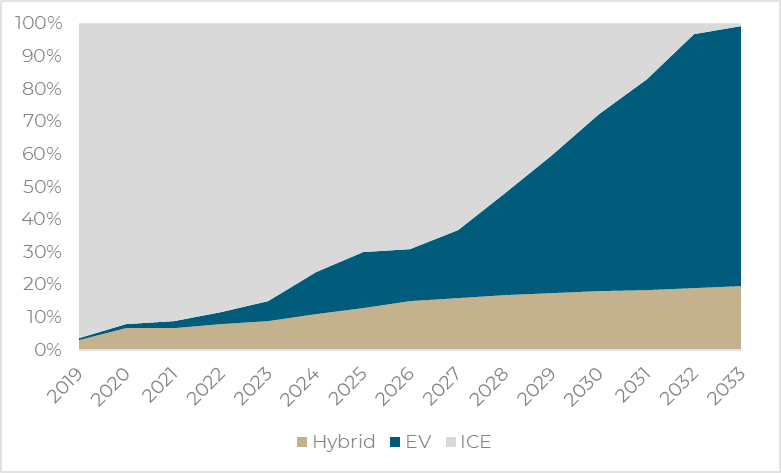

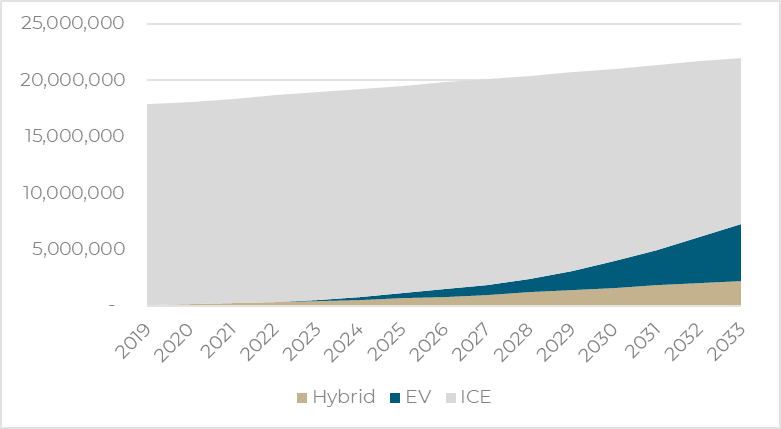

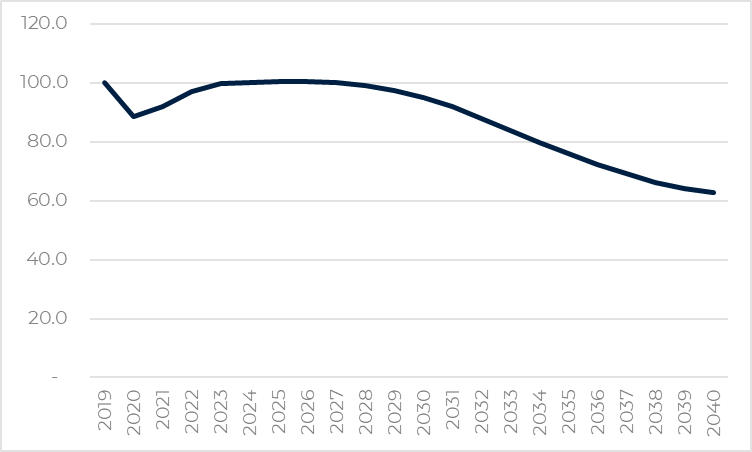

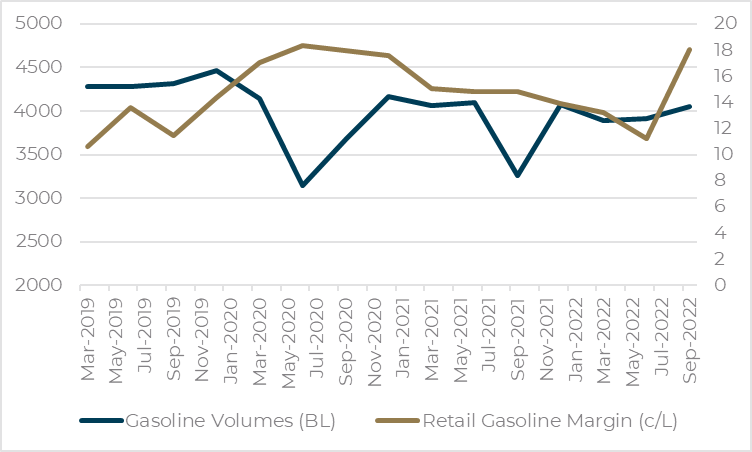

Will service stations be stranded assets? Tyndall Asset Management June 2022 At the same time as we are seeing global policy initiatives seeking to further accelerate the uptake of electric vehicles (EVs), corporate activity in the fuel and convenience retailing sector has stepped up. If the common belief that EVs will displace the need for Fuel Retailers, why are industry players increasing their capital allocation to the sector? We investigate the outlook for Fuel Retailers against the commonly held perception that they will ultimately be stranded assets. With the transport sector accounting for 14% of global carbon emissions (refer Figure 1), internal combustion engines (ICEs) are directly in the firing line of governments seeking to meet reductions targets. Further, the development of cost-competitive alternative technologies means that the transition to cleaner transport is not only achievable but now gathering significant momentum around the world. Figure 1: Global Greenhouse Gas Emissions by Economic Sector Source: US Environmental Protection Agency The consequence is that ICEs are likely to go the way of the steam engine over time. This begs the question - will service stations become stranded assets? What are the prospects for these sunset industries? Three years ago the answer to these questions was largely speculative. However, the COVID-19 period has created an ideal test environment in which the impact of a reduction in fuel volumes can be readily examined. This paper reviews the data and the risk that service stations become stranded assets. It is beyond debate that over the next two decades the vast majority of Australia's passenger vehicle fleet will transition to cleaner fuels. Car manufacturers are moving rapidly towards EVs, recognising the mega trend and the cost comparability. Governments around the world have varying incentives to assist in the transition, with adoption of EVs having increased rapidly as price-competitive and range issues have been overcome. Australia lags but won't foreverWhile adoption of EV's in Australia has been relatively slow to date, it would be naïve to consider that this will remain the case. Norway is the country most advanced in electric vehicle penetration of new car sales. This has come on the back of significant government incentives for the electric vehicles and support for infrastructure development. While EVs were only 1% of new car sales in 2011, the Norwegian Office of Vehicle Statistics reports that in the nine months to September 2022, EVs represented 77.8% of new car sales (refer Figure 2). Figure 2: Electric Vehicle Share of New Car Sales - Norway Source: Road Traffic Information Council (OFV); Electric Vehicle Association (Elbil). *Year to date September 2022. What would this adoption rate mean for Australian fuel volumes?We have modelled the implications of an adoption rate as rapid as Norway's for the Australian market, allowing us to map out the potential impact on retail fuel demand as the energy transition proceeds. We have also assumed that the uptake of hybrid vehicles accelerates from recent trend rates, as more models become available. Combined these assumptions indicate that ICE vehicles will be a rapidly declining proportion of new car sales, to the point that they are all but eliminated by 2033. Notably this is faster than the proposed legislated goal of ending ICE vehicle sales in the UK and EU by 2035 and close to the recent Biden Administration proposal to phase out ICE vehicles by 2032. Figure 3: Composition of New Car Sales (Australia) Source: VFACTS, Tyndall estimates While the composition of new car sales changes rapidly in a decade, the impact on the vehicle fleet (refer Figure 4) is a much slower process. Under this scenario, hybrids and electric vehicles will represent only one-third of the total fleet by 2033. Figure 4: Australia's Vehicle Fleet Mix Source: VFACTS, Tyndall estimates What is evident from this analysis is that the impact on volumes from the transition to electric vehicles is extraordinarily protracted (Refer Figure 5). Retail volumes are not forecast to decline from 2019 levels until 2029. And even then, the decline is only 1.3ppts. The impact does accelerate quite significantly during the following decade, with 2040 volumes forecast to be c33.5% lower than 2019 levels. Figure 5: Fuel Volumes (Indexed to 2019) Source: ABS, Tyndall estimates A longer-term volume contraction is only half the storyWhile significant and at face value perhaps alarming, a significant decline in fuel volume is only half the story. The other relevant variable of course is price, and the COVID-19 experience has demonstrated the ability of the fuel retailing industry to maintain dollar gross margin in the face of falling volumes. This rational industry response perhaps benefited from the recent memory of unprofitable discounting that occurred during calendar 2018. Chart 6 shows the trends in gasoline volumes and retail gasoline margins over the recent past - capturing the period of COVID disruption. As the chart shows, Fuel Retailers responded to lower volumes with price increases, such that dollar gross margins expanded. Figure 6: Retail Gasoline Margins and Volumes Source: Australian Petroleum Statistics, Department of Energy; Australia Institute of Petroleum; Tyndall In the June 2020 quarter, which includes the early part of the pandemic and national lockdowns, fuel volumes fell ~45%. Retail margins in that period averaged 18.3 cents/litre, ~46% above the 2019 average. Preparing for the futureAs highlighted above, the medium-term outlook for Fuel Retailers is sound, with the impacts of the fleet conversion to electric vehicles a very slow burn that will not materially impact volumes for a decade. That said, the longer-term outlook does point to significant erosion of fuel volumes. While pricing offsets to combat this have been proven possible through the COVID experience and at face value are not unaffordable, the very long-term scenario is that retail fuel volumes go to zero. We are watching this area closely and observing how the listed participants are progressing their strategies. Both Viva Energy and Ampol have de-risked their businesses by selling service station properties but with long-term options that provide ongoing control over the site. Author: Tim Johnston, Portfolio Manager Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund |

21 Jul 2023 - Why railroads are an attractive investment and how PSR is helping

|

Why railroads are an attractive investment and how PSR is helping Magellan Asset Management June 2023 |

|

Yathavan Suthaharan, Investment Analyst, discusses why railroads are an attractive infrastructure investment, recent events at Norfolk Southern and what the hype is around PSR. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

20 Jul 2023 - The Rate Debate - Ep 40: The winners and losers

|

The Rate Debate - Ep 40: The winners and losers Yarra Capital Management July 2023 The RBA has paused on hiking rates (for now) creating some big winners and losers. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

Online Applicatons

Free, simple and secure

Olivia123 - the fast simple and secure online alternative to completing paper based application forms.