NEWS

4 Mar 2025 - 10k Words | February 2025

|

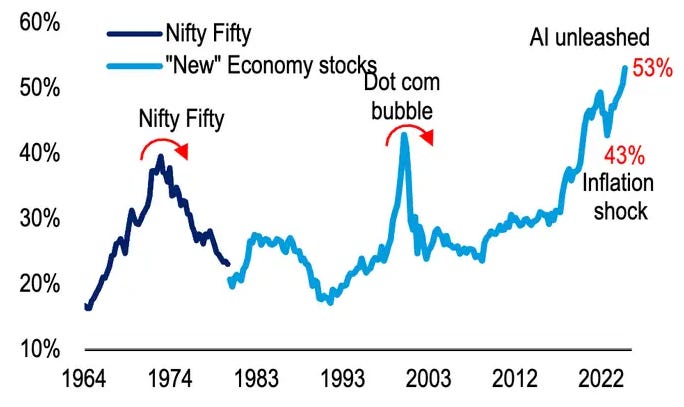

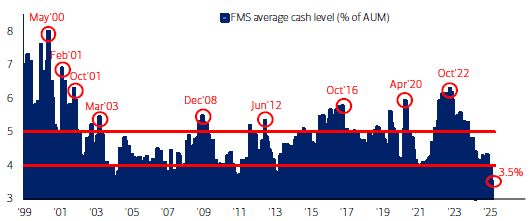

10k Words Equitable Investors February 2025 The AI theme is taking up greater share of S&P 500 market cap than previous growth "bubbles" while fund managers' cash holdings are at 15-year lows. US valuations have left Europe in the dust but sustainable high growth is scarce; and there is healthy debate over whether US valuations stack up (and on Morningstar's numbers Australian stocks are more overvalued than US peers). It is reporting season in Australia and the final week of February will be big. Be careful what you take away from it though - it seems CEO sentiment is not a reliable indicator. Meanwhile, US consumers are showing some distress in the form of credit cards 90+ days in arrears. There has been an uptick in non-performing personal loans and home mortgages as a % of bank assets in Australia too. With coffee bean prices surging, meanwhile, it is good to know the bean is only ~11.5% of the price of a cup of coffee. Market cap as % of S&P 500 for "market leadership" themes

Source: Bank of America Global Research Fund Manager Survey cash level (% of Assets Under Management)

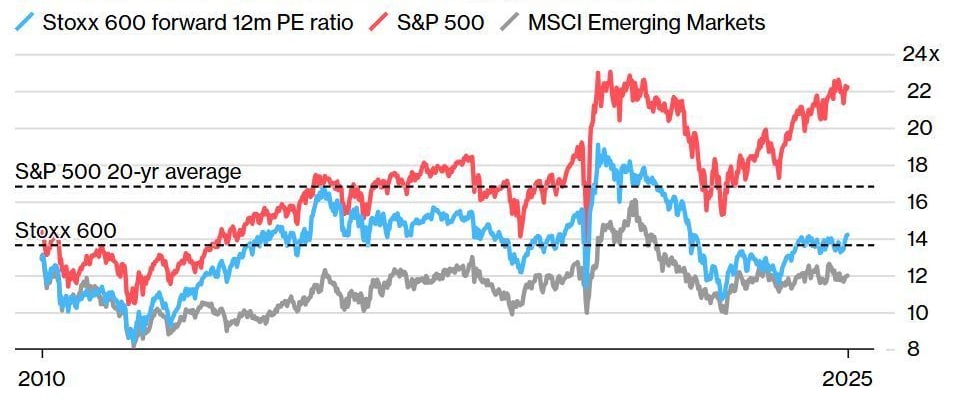

Source: Bank of America Global Research European market PE multiple at record discount to US

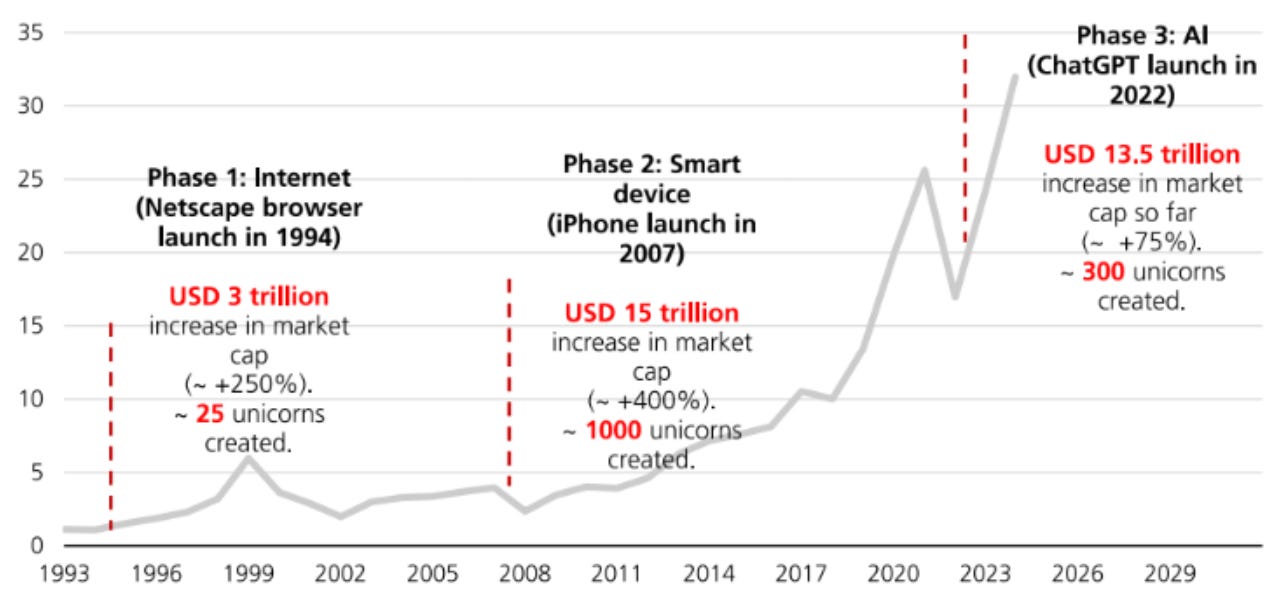

Source: Bloomberg via @BobEUnlimited Growth in market cap of the Nasdaq Composite - historical & forecast

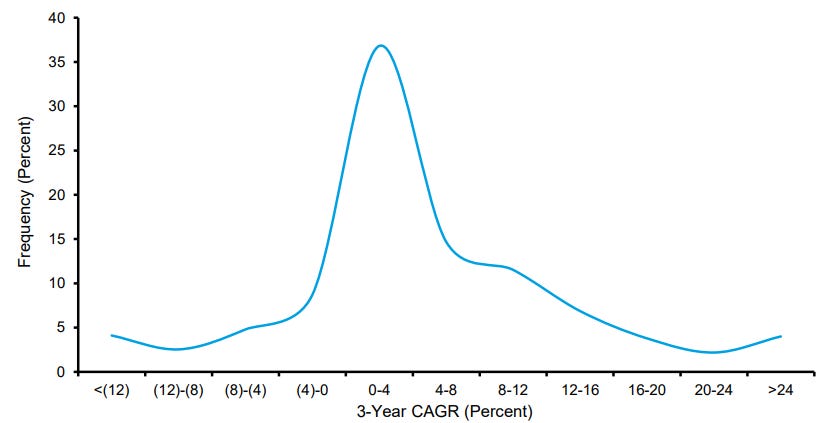

Source: UBS Three-year compound annual sales growth rates for US companies, 1962-2024

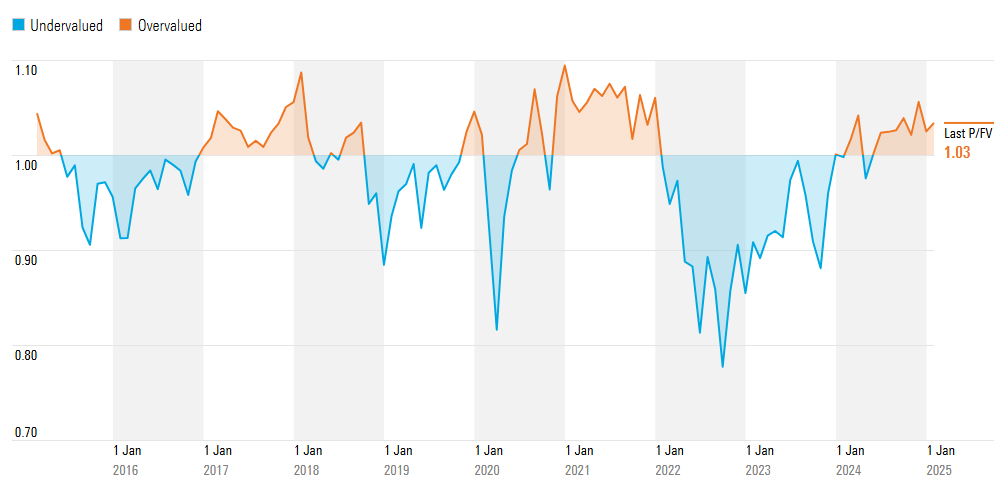

Source: Morgan Stanley Morningstar's bottom-up fair value estimate of the US market

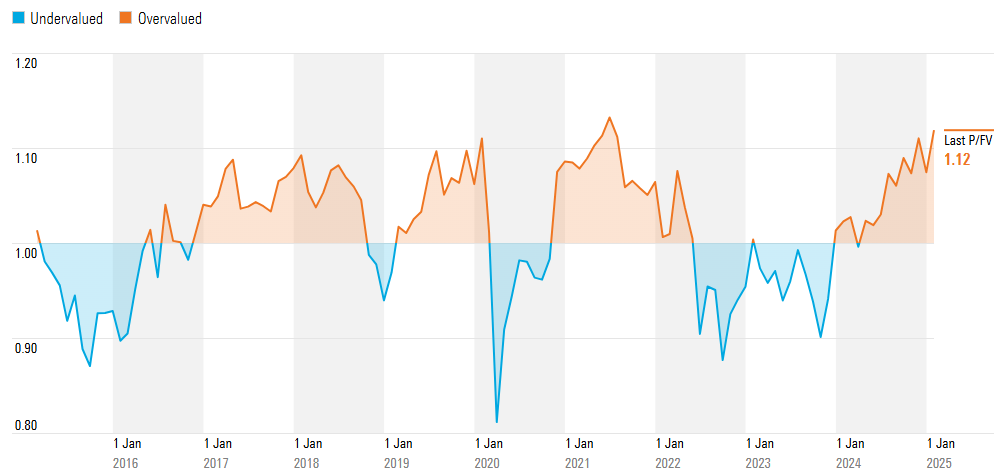

Source: Morningstar Morningstar's bottom-up fair value estimate of the Australian market

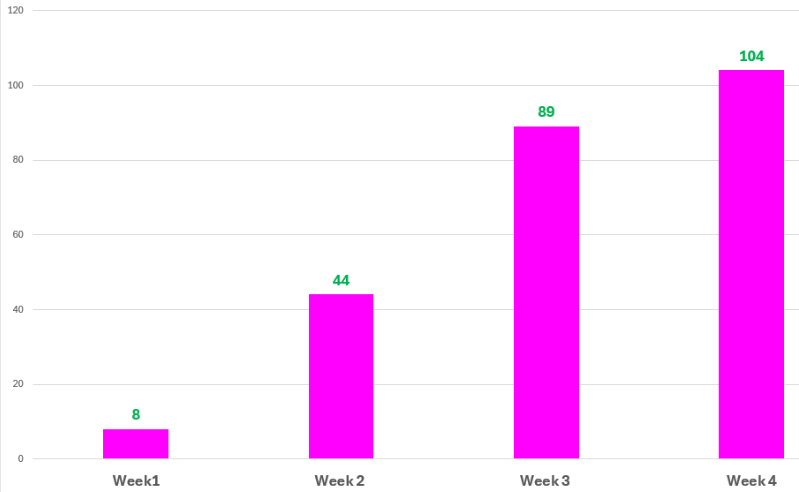

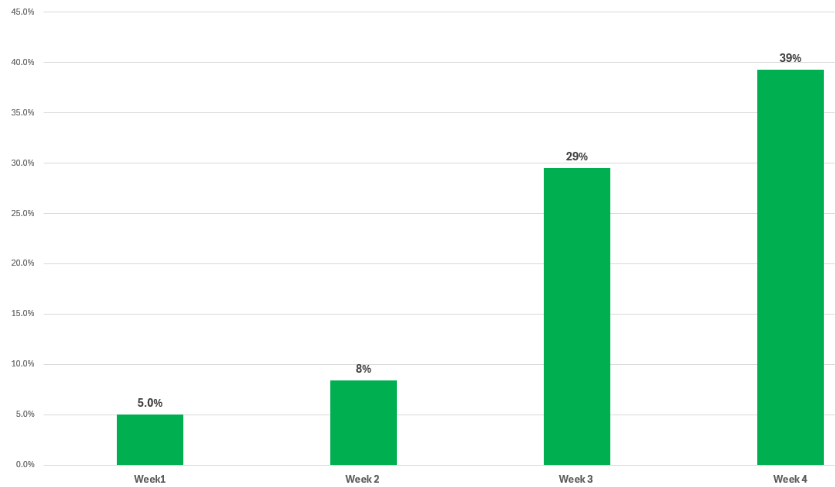

Source: Morningstar No. of ASX-listed companies reporting each week of February reporting season

Source: Coppo Report S&P/ASX Small Ordinaries weighting (% of index) reporting each week of February

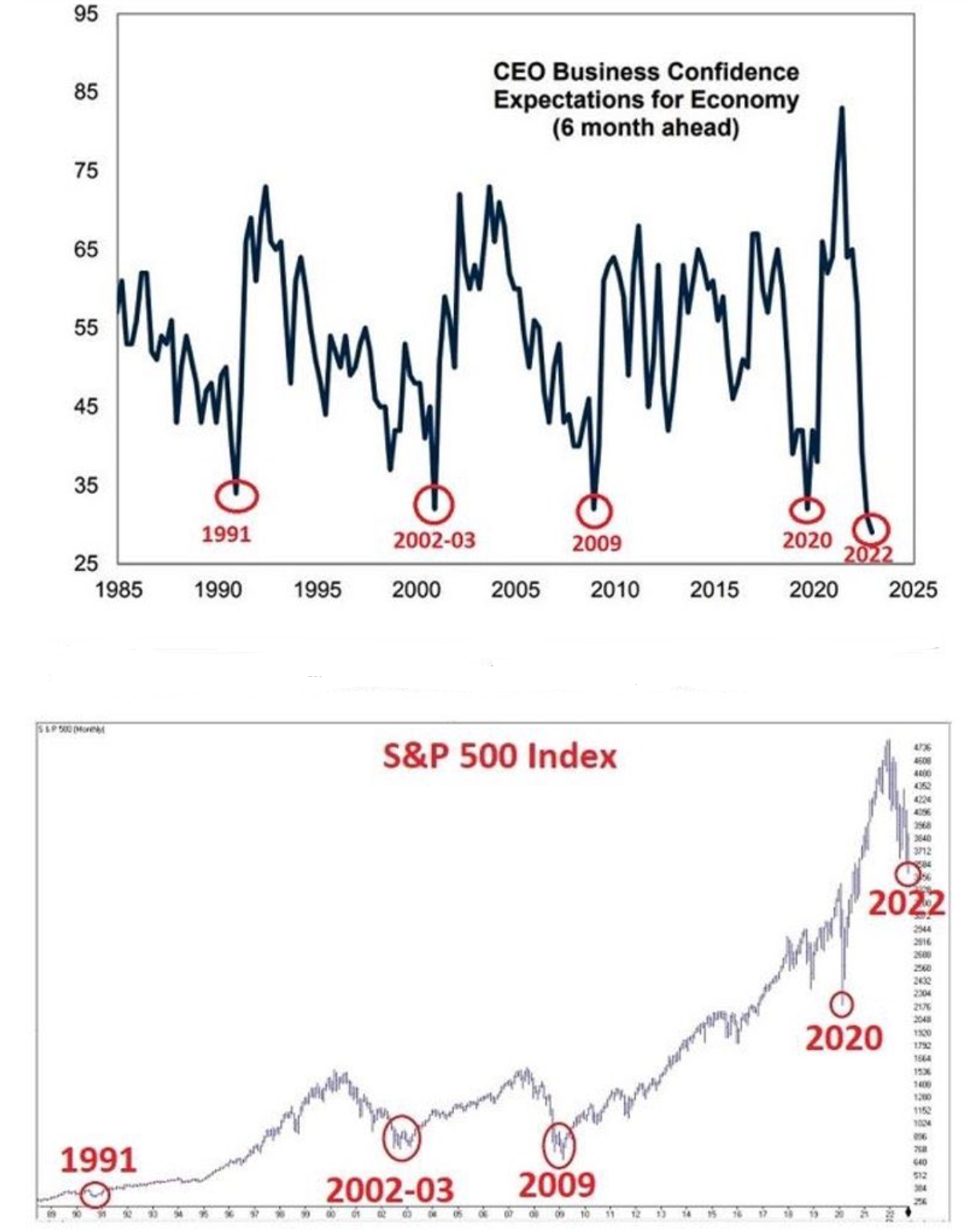

Source: Coppo Report CEOs bad at market timing

Source: Goldman Saches, @BrianFeroldi US consumer credit: percent of balance 90+ days delinquent by loan type

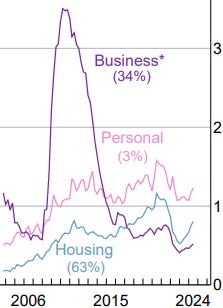

Source: New York Fed Australian banks' non-performing assets - as % of assets by type

Source: RBA Historical price of Coffee (Arabica)

Source: Financial Times Cost composition of a cup of coffee

Source: Pablo & Rusty's February 2025 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

28 Feb 2025 - 2025 EM Outlook: Reading the tea leaves

|

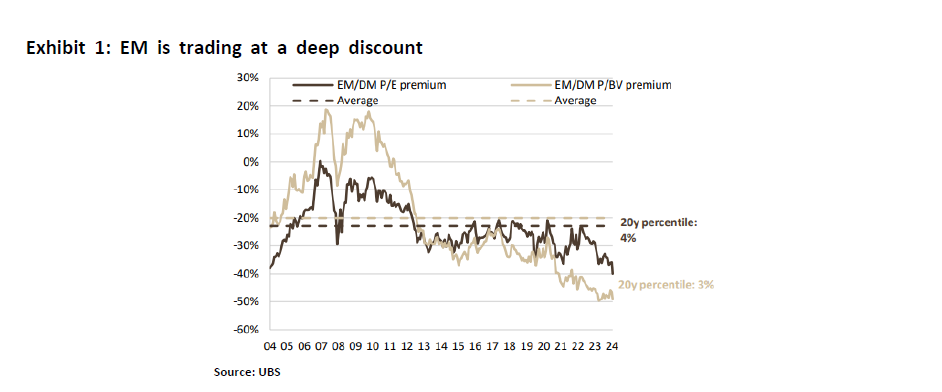

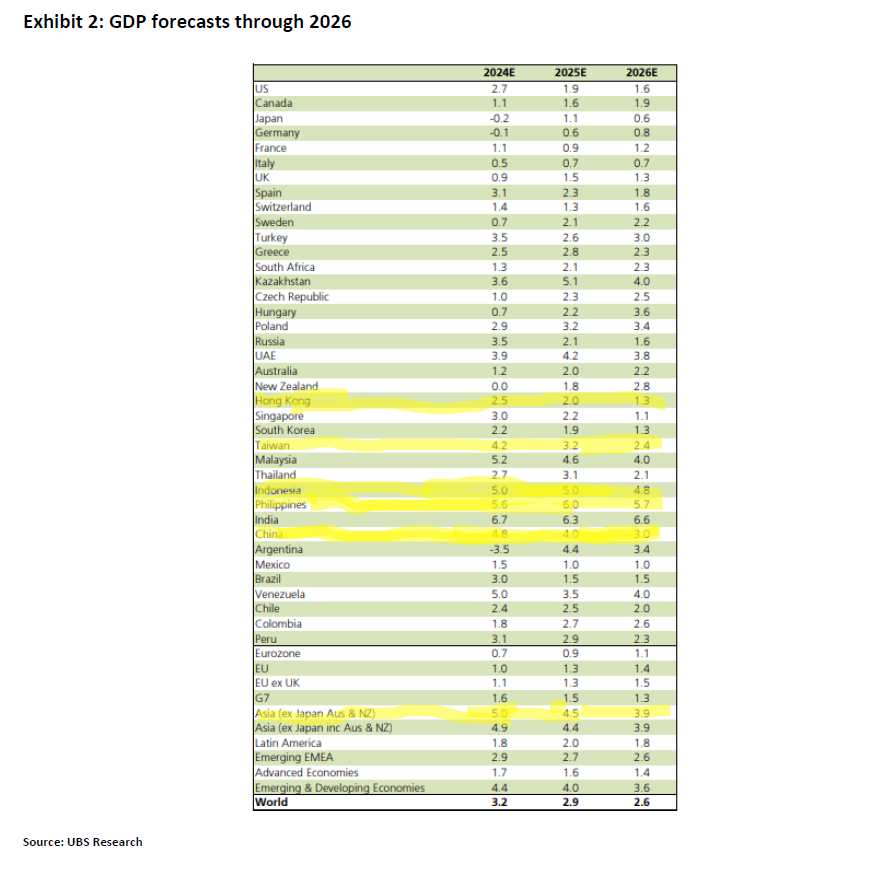

2025 EM Outlook: Reading the tea leaves Ox Capital (Fidante Partners) February 2025 Finding Alpha in an emerging multipolar worldWe are at an inflection point for emerging market equities. In 2024, the MSCI EM index returned 18.5% (AUD) and we expect positive momentum to continue through 2025 given robust fundamentals in EM economies. Emerging markets equity have derated and despite very attractive valuations, investors remain underweight the asset class. In our view, the recent period of underperformance is an outlier as the outperformance of developed markets was boosted by aggressive fiscal spending and accommodative Central Banks. The fundamental investment backdrop is shifting. Developed economies are beset with growing public deficits. Prolong elevated inflation is causing many Central Banks to remain vigilant. In contrast, in many emerging markets, fiscal balances are healthy while debt to GDP ratios are at reasonable levels. Corporates are in healthy positions. In 2025, we are likely to see weakening of the US Dollar as momentum peaks and structural concerns re-emerge. The persistent large US federal government debt and the uncertainties in implementation of new government policies may impact economic growth and are likely to temper expectations of continue USD strength. Emerging markets returns are likely to improve. We remain optimistic companies and outlooks in 2025. • Many developing economies have endogenous growth drivers. Governments have undertaken decades of economic reform. Infrastructure and manufacturing capabilities are much improved than years past. Their growing middle class aspire to a higher standard of living. These young countries will be able to grow at a fast clip in a generally slow global economy. • Attractive stock market valuation. Many stocks offer attractive dividend yields and earnings growth. Further funds flow can drive their valuations. • Finally, there are ample opportunities in China. The perceived structural problems in China are well known and discounted by the cheap valuations of Chinese stocks. Recent policy changes have led to price increases in major cities, monetary policy has shifted from prudence to "moderately loose", and fiscal policy is expected to relax further.

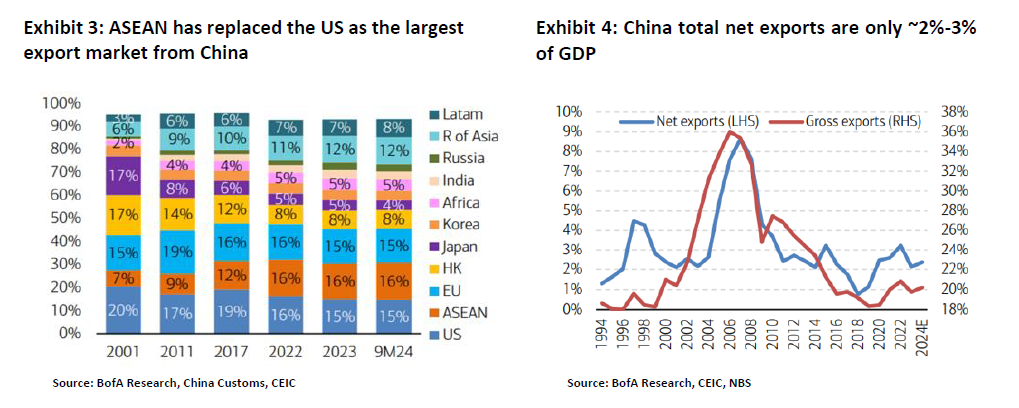

Market Commentary: Volatility creates opportunity. We believe the short-term focus on protectionism and trade tensions provides an opportunity to buy quality franchises across EMs as many emerging economies are poised to grow solidly in the coming years relative to developed markets.  China: Looking through the noise. The issues facing the Chinese economy are well understood and manageable. Despite geopolitical tension and correction in the property sector, the Chinese economy grew solidly (≈5%) in 2024. Noticeably, it has been over three years into the downturn and new property sales volumes have already adjusted sharply from peak. At the same time, secondary property sales remained resilient, indicating fundamental demand for better living quality in China. In our view, the domestic economy is gradually bottoming and the property market will pick up as confidence returns. In 2025, the Central government is committed to deliver solid economy growth. We expect geopolitical competition to persist in 2025. The new US government will likely impose trade tariffs on its trading partners. While no definitive polices have been announced, some economic forecasts indicate that a unilateral 60% tariff (which we believe is unlikely to be applied in full) on exports to USA will hit China GDP by ~2%. We believe this potential "headwind" to growth is manageable. We note: • The Chinese government will support the economy as needed, to deliver on its growth target of 4.5%-5% in 2025. China will actively use fiscal and monetary measures to counteract economic impacts of tariffs. We believe the recent China policy pivot is highly significant, with measures to support focused on stabilizing the housing market, fight deflation, and reflate the • China has developed other export markets. While USA remains an important trade partner to China, its importance has been declining. In 2017, USA accounted for 19% of China's exports, but it has dropped to ~15% in 2024. In contrast, ASEAN now represents ~16% of exports, up from 9% in 2011. Moreover, exports is not as big a part of the Chinese economy as most believe, it is only about 20%. So direct export to the US is only around 3% (20% export x 15%) of China's GDP. • Diversification of supply chains: Furthermore, companies in China have relocated supply chains that are more labour intensive in other regions to mitigate impacts from tariffs and to take advantage of the cheaper labour costs. In many cases, the key components may still be produced in China, with the assembly done outside. Over the last decade, Chinese companies' technological advancements have lifted the quality of the exports mix. China has become the centre of global supply chain of many key components and high value products. It is going to be highly costly to shift away from China's supply chain.

Despite the firm stance the U.S. has maintained toward China over the past eight years, recent statements from the incoming Trump administration suggests a reassessment of the relationship between the two nations is probable. We are hopeful of stabilisation of relationship between the two countries, driven by mutual interests. Finally, the funds flow problem facing the HK equity market is likely to be at least partially ameliorated by the continuation of the inflow via the China Connect program. In 2024, greater than USD100 billion dollars have flowed into the Hong Kong market, adding to the sustained inflow since the start of the program in 2013. To the extent that outflow in the Hong Kong is a drag to valuation, the rising Mainlander and local ownership offset that somewhat.

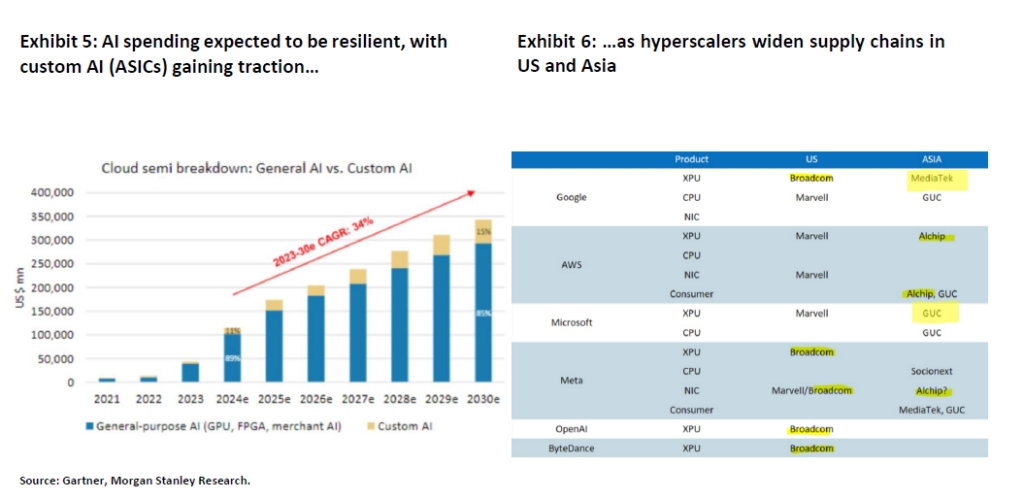

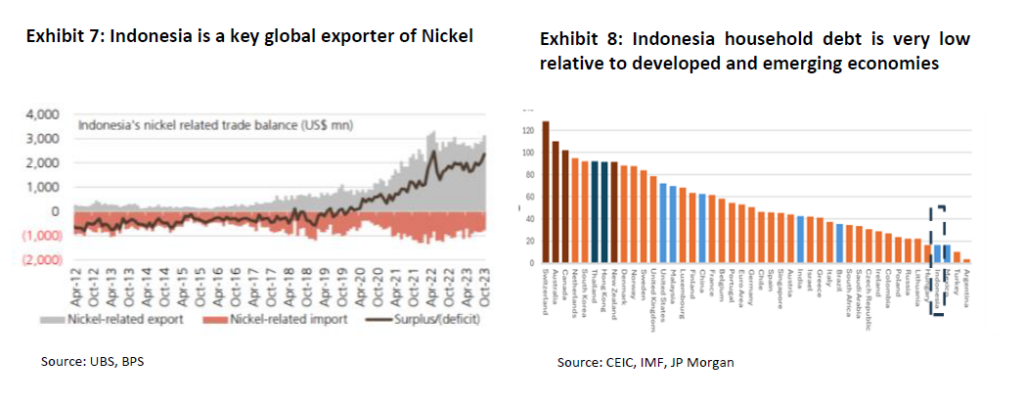

A significant portion of the global technology supply chain is concentrated in Taiwan and South Korea. The rapid push by major companies and hyperscalers worldwide to implement AI strategies has created an unexpectedly strong demand for semiconductor chips. This surge provided substantial benefits to South Korean and Taiwanese suppliers. • We anticipate that the AI technology spending is likely to continue, with ASICs (Custom AI chips) spending becoming more prominent in 2025.  ASEAN: A vital region to the world. Indonesia: An economic powerhouse. The Indonesian economy is undergoing a dramatic economic transformation that is underpinned by a young and growing population, abundant natural resources, and its strategic location in the Asean region. Companies such as BYD, are building plants in Indonesia to manufacture EVs for the domestic and export markets. Indonesia has also seen increasing investment in AI infrastructure, as global hyperscalers (Microsoft, Amazon, etc) are increasing their presence in country. We believe the environment & outlook is supportive of equity market performance, which are currently on cheap valuations relative to history. • A robust economy. Real GDP is expected to grow at ~5% through 2025 per the IMF. The government is fiscally responsible (deficit of ~ 2.5% of GDP). Its external trade position is healthy thanks to resilient commodity demand and improving manufacturing capabilities. • Low indebtedness. Indonesia households are less indebted compared to many other economies, at just ~10% of GDP. For example, Australia household debt is much higher at ~116% of GDP. • Demographic Dividends. Indonesia is the world's fourth-most populous country, with ~280mn people, representing a huge domestic market. The median age is around 30 years old, a young demographic that supports both consumption and employment growth which will sustain economic expansion longer term. • Abundant natural resources. Indonesia is rich in natural resources & commodities, such as oil, gas, coal, palm oil, and minerals like nickel. These resources provide a steady stream of export revenue and attract foreign investment. In fact, There has already been infrastructure spending in this domain including large plant installations to convert the countries surface layer Nickel to be processed into battery grade nickel. Electric vehicles and batteries makers are set to invest in Indonesia to bolster their nickel supply chain.

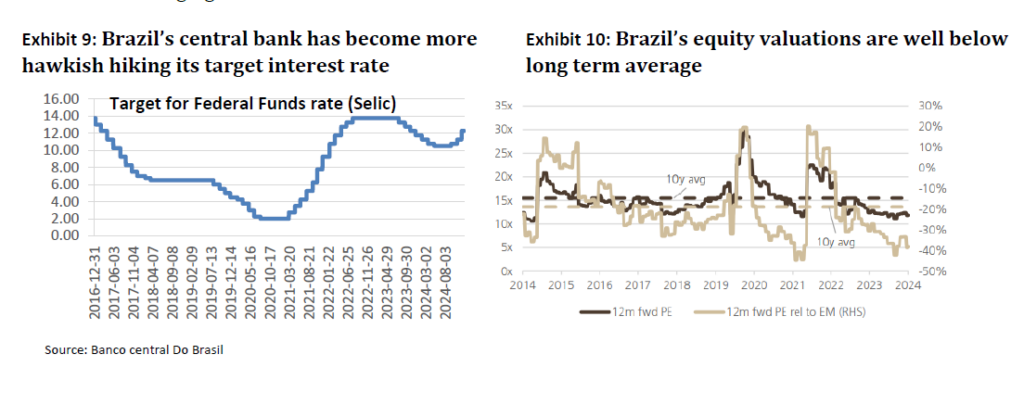

Vietnam: The next manufacturing hub to the world. Vietnam is riding the wave of current global supply chain reconfiguration, boosting its GDP growth. Greater foreign direct investment into an ever more open and market driven economy. Unemployment rate is consistently low in the country (≈2.25%). The rising middle class is in turn demanding higher quality goods and services, in an increasingly urban setting. With a population of just under 100M people, and a urbanisation rate of under 40%, Vietnam reminds us of China ~15-20 years ago. There is substantial room for growth in the coming years. As such, we believe this backdrop provides a foundation for alpha generating opportunities. • Solid FDI growth: Vietnam has been successful in attracting foreign direct investment (FDI) into the country. Commitments have been seen across thousands of projects and recent strong FDI inflow will support Vietnam's ability to continue this journey of industrialisation, boosting exports, supporting domestic investments, whilst also creating new jobs. • Manufacturing powerhouse to the world. Vietnam's ability to continue to attract significant FDI flows, even amidst the current global environment, is proof of the increasing competitiveness of Vietnam's manufacturing sector amongst global supply chains. • Increasing production demand. We have seen announcements from companies such as Apple, and its supply chain such as Foxconn, Luxshare and Goertek, moving manufacturing to Vietnam with increasing frequency. Key production of AirPod and more complex products such as Apple Watch and iPad are planned to be increasingly offshored to Vietnam over the next 3 years. • Extensive Trade Agreements in place already. Vietnam's obvious locational benefit, in close geographic proximity to China, continues to be enhanced by greater regional and country-based partnerships and free trade agreements (FTA). Vietnam has more free trade agreements in place than any other countries globally. LATAM: Near term volatility, but long-term opportunity LATAM represents roughly 1% of the world index and ~9% of the EM index. • Strong FDI inflows. LATAM remains a prospective destination for foreign direct investment (FDI), given LATAM is a resource-rich region with a rising middle class and is short on world class infrastructure. • Key global minerals suppler. The LATAM region has an abundance of natural resources. Commodity exports make up 60-90% of the region's external trade. LATAM is a key producer of critical minerals to the world, including Silver (50%), Copper (40%), Lithium (35%), and Zinc (>20%). Importance of these metals will only grow as these minerals among other rare earth metals are essential to the alternative energy transition. As developing countries, particularly in Asia, continue to grow, demand for resources will continue to intensify. LATAM will be a key supplier and beneficiary. • Nearshoring and reconfiguration of global supply chain. Nearshoring is a significant opportunity for the LATAM region in the coming years based on their geographical proximity to North America, and relatively cheap and skilled labour. Mexico's relationship with the US is already well-established, as it is the largest exporter to the US. The country's ~15% share of US imports has now surpassed China's ~14% and China's share of imports has been in decline since its peak in 2017 with further declines post the implementation of the United States - Mexico - Canada free trade agreement (USMCA). Moreover, Mexico's domestic logistic infrastructure is well developed with over 100 airports with direct flights to-and-from the US and Canada, industrial zones that are connected by over 400km of modern highway, and extensive seaports along its coast. However, the Mexican economy is highly exposed to the US economy, its largest trading partner. Near-term, trade tension can cause uncertainties in the Mexican economy. In addition, Mexico's new president has been a proponent of constitutional reforms, which introduces uncertainties for the country. • In recent months, Brazil's central bank has turned more hawkish, raising its target interest rate (Selic rate) from 10.5% to 12.25% and targeting two more rate hikes of one percent each in the first quarter of 2025. • The central bank is hiking to dampen persistent inflationary pressures, while supporting the currency. • The rate hikes reflect a balancing act as policymakers navigate the complexities of a volatile global environment and domestic fiscal concerns. Equity valuations are now at depressed levels. • The short term outlook in Brazil is less prospective relative to other emerging markets given the counter-cycle stance of the central bank in the near-term, but we believe long-term opportunities are emerging.

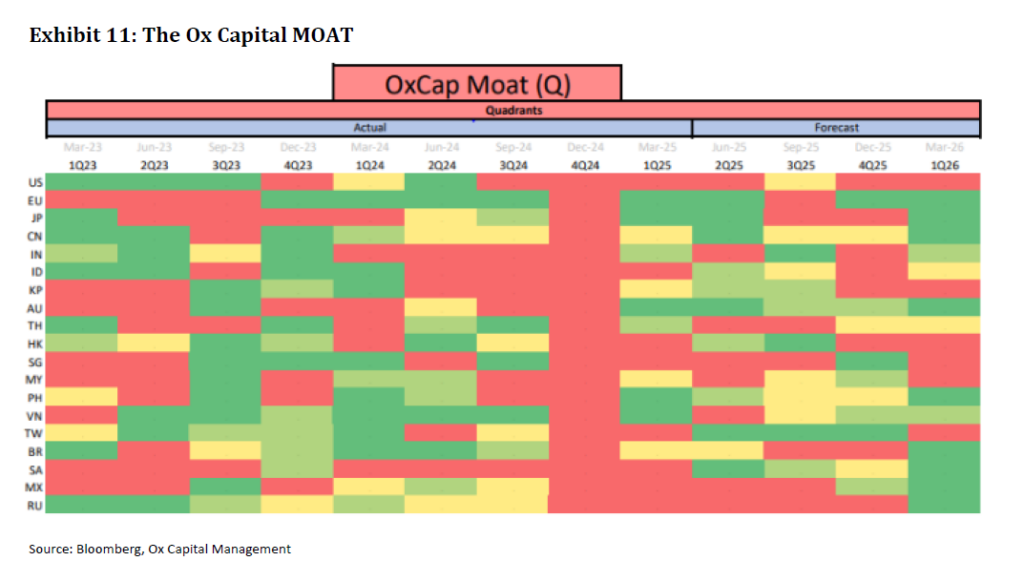

India: Attractive long-term fundamentals, but economic slowdown will impact equity performance The economy in India has been going though economic reforms over the last decade. However, it took the banking system just as long to recover from the last capital expenditure boom bust cycle. India has a vast population with over 1.4bn people, but income levels are low. It is a rising power, which adroitly manages relationships between USA and China. • Recently, there are clear signs that the economy is slowing down after several years of strength post-COVID. We are seeing weak loan growth amongst banks, a worsening credit cycle in the credit card and micro-finance sectors. The sudden slowdown in economic activity caught many companies unaware. Almost 50% of companies in the market missed their quarterly earnings recently. On average, they were expected to grow earnings 9% from a year prior, but many companies reported barely flat earnings. Furthermore, many sectors were caught up, including autos, consumer stables, power generators. • Apparently, Indian consumers have exhausted their excess savings accumulated during COVID. Similar to other economies, urban consumers in India are squeezed by higher cost of living, such as rental and slowing wage growth. This round of consumption slow down coincides with tighter spending discipline by the government, as well as higher interest rate. As inflation is currently running "hot", chances of rate cuts have diminished. • Despite macro-economic uncertainty, valuation of the market remains expensive. With growth slowing down, the sky-high valuation will likely not be sustainable. The MOAT (Macro Overlay Aggregate Tracker): Our propriety quantitative model is pointing to a promising environment for EM growth in 2025 as inflation in many economies is stable to declining. We note: • Asia's outlook remains positive through the year. • The Chinese economy is putting in a bottom and outlook is improving throughout 2025. • Indonesia's and Vietnam's outlook remains positive. • Taiwan's growth profile continues to be strong and improving. • LATAM remains challenging near-term. • Both Brazil and Mexico are less prospective in 2025 • In contrast, the outlook looks challenged for US through the year .

In summary, we believe we are at an inflection point for EMs and current valuations are providing an attractive entry point. Many EM countries have strong underlying economic fundamentals. Inflation is trending lower in many EMs allowing central banks to cut rates while a slower global growth outlook is set to benefit emerging economies with endogenous growth drivers. The recent USD strength and inflationary impulse in the US has made US products and wages expensive compared to the rest of the world. The decreasing competitiveness argues for a weaker USD, which can be triggered if signs of slowing US economic growth emerges. We reiterate the persistent large federal government debt and the uncertainties in implementation of new US government policies are likely to temper expectations of continue USD strength, especially given its significant appreciation to date. Funds operated by this manager: Ox Capital Dynamic Emerging Markets Fund Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriaten |

27 Feb 2025 - Did DeepSeek cause an AI paradigm shift?

|

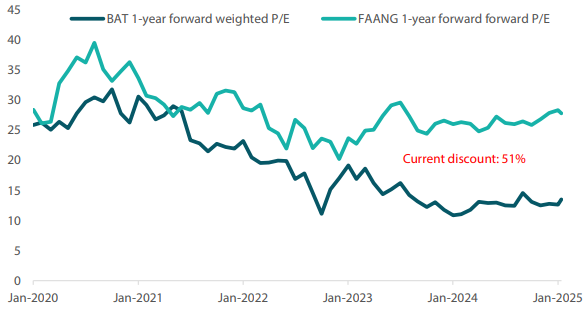

Did DeepSeek cause an AI paradigm shift? Nikko Asset Management February 2025 DeepSeek: an AI industry upstartNot too long ago, the term artificial intelligence (AI) was found only in the realm of science fiction novels. It was featured prominently in works such as Phillip K. Dick's "Do Androids Dream of Electric Sheep?" which the cult movie classic "Blade Runner" was based on, and Isaac Asimov's "I, Robot", which also inspired a movie of the same name. Fast forward to today, and the term has since become synonymous with all things digital. It encompasses everything from the smart robot vacuum cleaner assiduously hoovering up all the dirt on your home floor, to the virtual assistant on your smartphone answering all the queries you throw at it. Looking at the multibillion-dollar industry that has coalesced to allow these applications to proliferate in all aspects of daily life, we would assume that massive capital expenditure and time are needed to develop infrastructure and train AI programmes. However, a small, independent research laboratory based in Hangzhou, China, appears to be challenging this conventional wisdom. Founded by entrepreneur Liang Wenfeng, the AI startup's DeepSeek chatbot has roiled the tech world. DeepSeek has performed nearly as well, if not better, than AI models from Microsoft-backed OpenAI's ChatGPT, Meta's Llama and Amazon-backed Anthropic's Claude. What is truly surprising, however, is that the company claimed to have spent less than US dollar (USD) 6 million to build its AI model--approximately ten times less than the amount Meta spent on its product--and achieved this feat in just two short months. Conventional wisdom dictates that companies use Nvidia's expensive, cutting edge H200 or B200 graphical processing units (GPUs) to train their AI models for optimal results. Prevailing sanctions prohibit US companies from selling advanced computer chips to mainland China; however, the programmers of DeepSeek were apparently able to produce results with the older H800 GPUs by wringing out every last bit of performance from them. The revelation shocked the tech industry and sparked a selloff in the shares of semiconductor firms including Nvidia, Broadcom and Micron. In our view, these developments could lead to changes in the way AI models are trained, particularly from a cost and efficiency perspective. DeepSeek's innovation in the field has established that the "mixture of experts" 1 (MoE) approach, which requires less computing power and time, coupled with the "reward system" 2 are as effective as the more resource-intensive chain-of-thought 3 reasoning approach. Falling costs will mean lower barriers to entry, allowing more companies to partake in AI development and grow the ecosystem at a more rapid pace. Additionally, open source AI models, like DeepSeek's, which make the programme's source code available for public use and modification, have now been proven to perform just as well, if not better, to proprietary models from Big Tech. We believe the trend towards using open source inference models with narrower parameters will persist. As a result, we expect to see broader adoption and implementation of AI applications across both corporate and government sectors in the days ahead. We had previously touched on the subject of AI models improving in terms of efficiency and cost-effectiveness in our article A Fundamental Change for AI? Although semiconductor firms such as Nvidia were sold down on fears that their chips might face lower demand, we believe it would be premature to write them off. DeepSeek's AI model training is still based on Nvidia's GPUs and their CUDA software, albeit on older hardware. Hence, we still expect healthy demand for such chips as the training of AI models continues to intensify. China's underrated tech sectorFrom our perspective, the markets may have been discounting China's tech sector, represented by Baidu, Alibaba and Tencent (BAT), in comparison to the broader US industry represented by Facebook, Amazon, Apple, Netflix and Google (FAANG). It is only recently that the markets have started to recognise the potential value of Chinese tech startups, like DeepSeek, which have the prowess to compete on the global stage. Valuation-wise, we have observed that US FAANG firms are approximately twice as expensive as their BAT Chinese counterparts. Chart 1: BAT stocks at a significant discount compared to FAANG stocks

Source: Goldman Sachs, February 2025 Meanwhile, competition within China's domestic market is already intensifying as AI models from Chinese firms such as Baidu, Zhipu and Bytedance's Doubao are being launched. Tech giant Alibaba is even claiming that its Qwen 2.5 version AI model is superior to DeepSeek's V3 AI model. We expect these developments to eventually enable users to switch models in their applications at a low cost. As a case in point, we are now seeing international firms like Perplexity, a San Francisco-based developer of a conversational search engine, incorporate and offer DeepSeek's AI models on their platforms. These events are in line with what we had discussed in the Asian equity outlook 2025, where we explored the implications of generative AI transitioning to the next level of development following massive capital expenditure. Roadblocks to further AI adoptionA major obstacle standing in the way of broader AI usage in light of DeepSeek's claimed breakthrough is the escalation of US-China geopolitical tensions. A technological arms race between the world's two largest economies will certainly hinder any progress in building an ecosystem that would propel AI applications to the forefront of worldwide adoption. There are already news reports that US officials are investigating how DeepSeek was able to procure Nvidia-made AI chips in spite of the ban, and US government workers are prohibited from using the application due to national security concerns. Should the US further tighten export controls to stem the flow of AI chips and technology to China, we believe that it would affect the speed of future AI model training there as domestic supply is currently unable to make up the shortfall. We therefore believe that chip independence should remain a priority for China in order for the country to continue its advancements in the AI field. Data privacy is another significant concern. The integration of AI into all aspects of the internet makes it even more challenging to regulate the personal information we allow to be collected online, given the data-intensive nature of such systems. Then, there is the issue of AI "hallucinations" where generative AI chatbots produce misleading or entirely wrong information due to incorrect or skewed data that the AI model is trained on. This problem reflects an old adage from Computer Science 101: "garbage in, garbage out". However, as AI technology matures, this risk is decreasing as improved data, better architecture, reinforced learning and guardrail filters improve the user experience. Finally, there is the million-dollar question of how AI can be monetised to help enterprises address business pain points. We believe that companies engaged in content production, autonomous driving, robotics and industry-specific SaaS stand to benefit the most from the greater adoption of AI models. Beyond the monetisation question, AI-enhanced efficiency in areas such as automation, robotics, inventory management, cyber security and targeted advertising are significant benefits that no CEOs of large corporations can afford to ignore. In our view, the fields highlighted here have the most potential for robust, sustainable returns. Full steam ahead for AIThe speed at which AI applications are becoming part and parcel of daily life is breathtaking, with DeepSeek's apparent breakthrough merely accelerating an inevitable, fundamental change in the field. We firmly believe these breakthroughs are the key components needed for sustainable, long-term returns. We also are firm believers in the Jevons Paradox, an economic theory that suggests that as technological advancements increase the efficiency with which a resource is used, the overall consumption of that resource actually increases rather than decreases. We have seen this with improvements in fuel efficiency resulting in more people driving, in turn increasing total global fuel consumption. A similar phenomenon was seen during the Industrial Revolution as an improvement in the efficiency of steam engines did not reduce coal consumption but led to a boom in coal demand. We believe that the AI industry is highly likely to follow a similar pattern, leading to even greater long-term demand for AI-related applications. Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. 1 A machine learning approach that divides an AI model into separate sub-networks (or "experts"). 2 A method in which AI algorithms are trained to make decisions by being rewarded or punished for their actions. 3 An approach allowing models to break down complex problems into simpler steps that can be solved individually. Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information Please note that much of the content which appears on this page is intended for the use of professional investors only. |

26 Feb 2025 - Performance Report: TAMIM Fund: Global High Conviction Unit Class

[Current Manager Report if available]

26 Feb 2025 - Politics, Markets, and How Biases May Cost You

|

Politics, Markets, and How Biases May Cost You East Coast Capital Management February 2025

How Political Bias Can Undermine Investment Decisions - and Why a Rules-Based Approach Wins The past several months have been a case study in how politics can divide not just a nation, but also its investors. The transition of power in the United States has reignited debates, strengthened ideological loyalties, and--perhaps most significantly for markets--shaped investor behaviour. A recent study, Political Climate, Optimism, and Investment Decisions by Bonaparte, Kumar, and Page (2009), sheds light on an often-overlooked aspect of this intersection: how political preference influences risk-taking in financial markets. The findings are striking but not entirely surprising. Investors tend to be more optimistic about the domestic economy and take on riskier exposures when their preferred political party is in power. Conversely, when their party is out of office, their outlook becomes more pessimistic, and they reduce risk exposure. This behavioural shift has real consequences, leading investors to make decisions that are influenced more by personal ideology than by market fundamentals. At ECCM, we appreciate the importance of political discourse and the broader role it plays in shaping economic policy. However, we also recognise that politics and profitable investing don't always mix well. Allowing political biases to dictate investment decisions can be costly, especially in a world where market trends move independently of electoral cycles. This is why our trend-following strategies remain politically agnostic. They are designed to remove cognitive bias from investment decision-making, ensuring that capital is allocated based on market price movements rather than sentiment or political affiliation. By following a systematic, rules-based approach, we aim to capture significant market trends--whether they emerge in times of political stability or uncertainty. Markets have historically moved higher under both Republican and Democratic administrations in the U.S., and similar trends hold true across different political environments globally. The key to long-term success isn't aligning investments with a preferred political ideology; it's having a disciplined approach that adapts to market conditions, no matter who is in office. Conclusion As we continue to observe political shifts and the narratives they inspire, we are reminded of the importance of staying focused on what truly drives returns. A rules-based investment process helps protect against the risks of letting short-term political sentiment dictate long-term financial outcomes. By remaining politically neutral in our investment strategies, we ensure that our clients' capital is positioned to benefit from opportunities wherever and whenever they arise. At ECCM, our educational foundations are in finance and psychology. With extensive trading experience and long-term dedication to quantitative trading systems, we seek to provide our clients with our carefully developed approach to navigating the complexities and vagaries of markets. Wholesale clients can find more information on ECCM and our flagship ECCM Systematic Trend Fund at our website and Australian Fund Monitors. Funds operated by this manager: |

25 Feb 2025 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

25 Feb 2025 - Investment Perspectives: The investment case for Safehold

25 Feb 2025 - What happens after the first RBA rate cut?

24 Feb 2025 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

24 Feb 2025 - Magellan Global Quarterly Update

|

Magellan Global Quarterly Update Magellan Asset Management January 2025 |

|

Arvid Streimann explores significant market trends and explains how the global strategy is set to take advantage of new opportunities while keeping an eye on potential risks. Arvid also talks about the recent adjustment to the portfolio's maximum cash level and comments on the market impact following Trump's election. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Core Infrastructure Fund, Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged) Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |