NEWS

26 Jun 2024 - 10k Words | June 2024

|

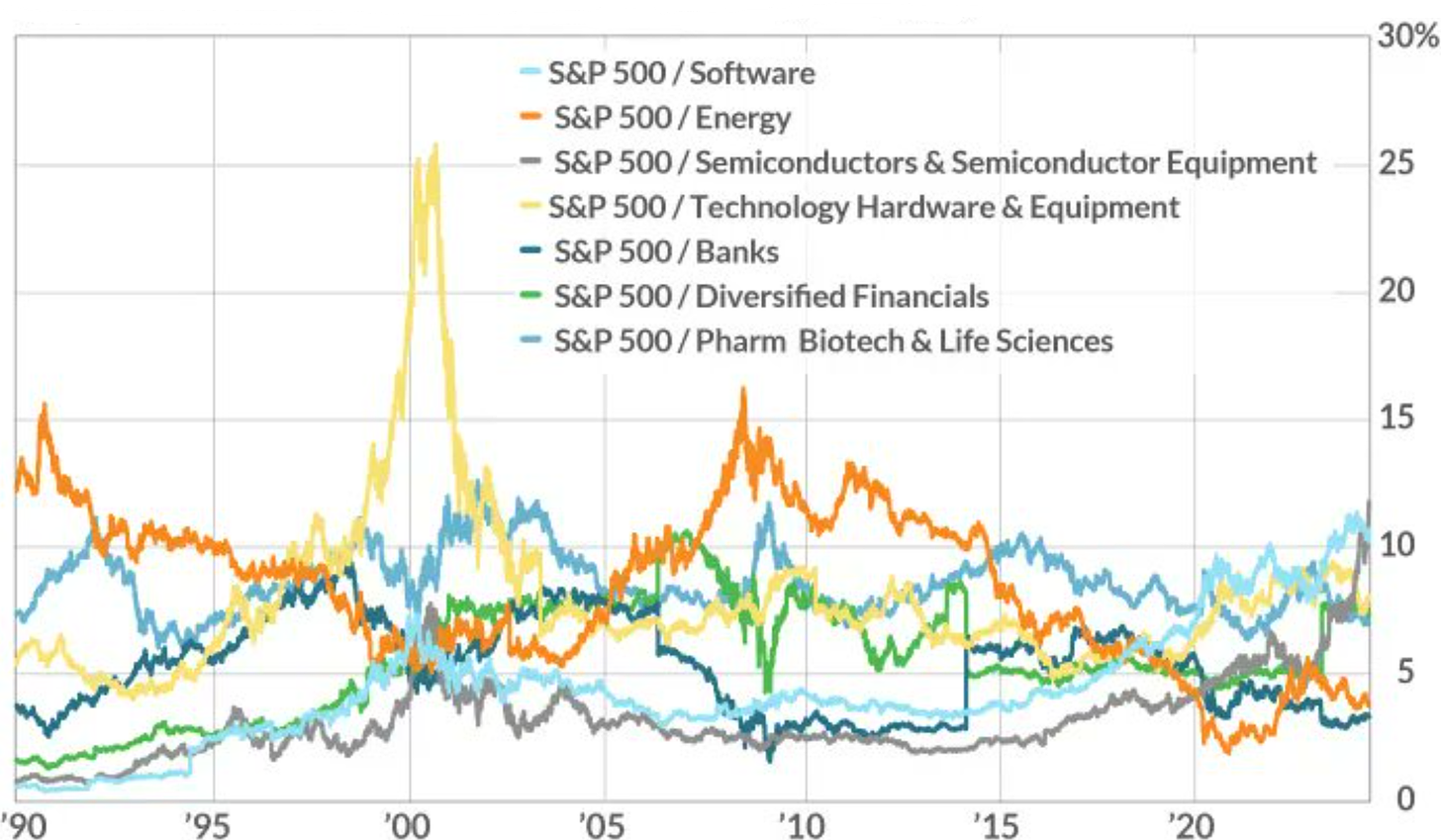

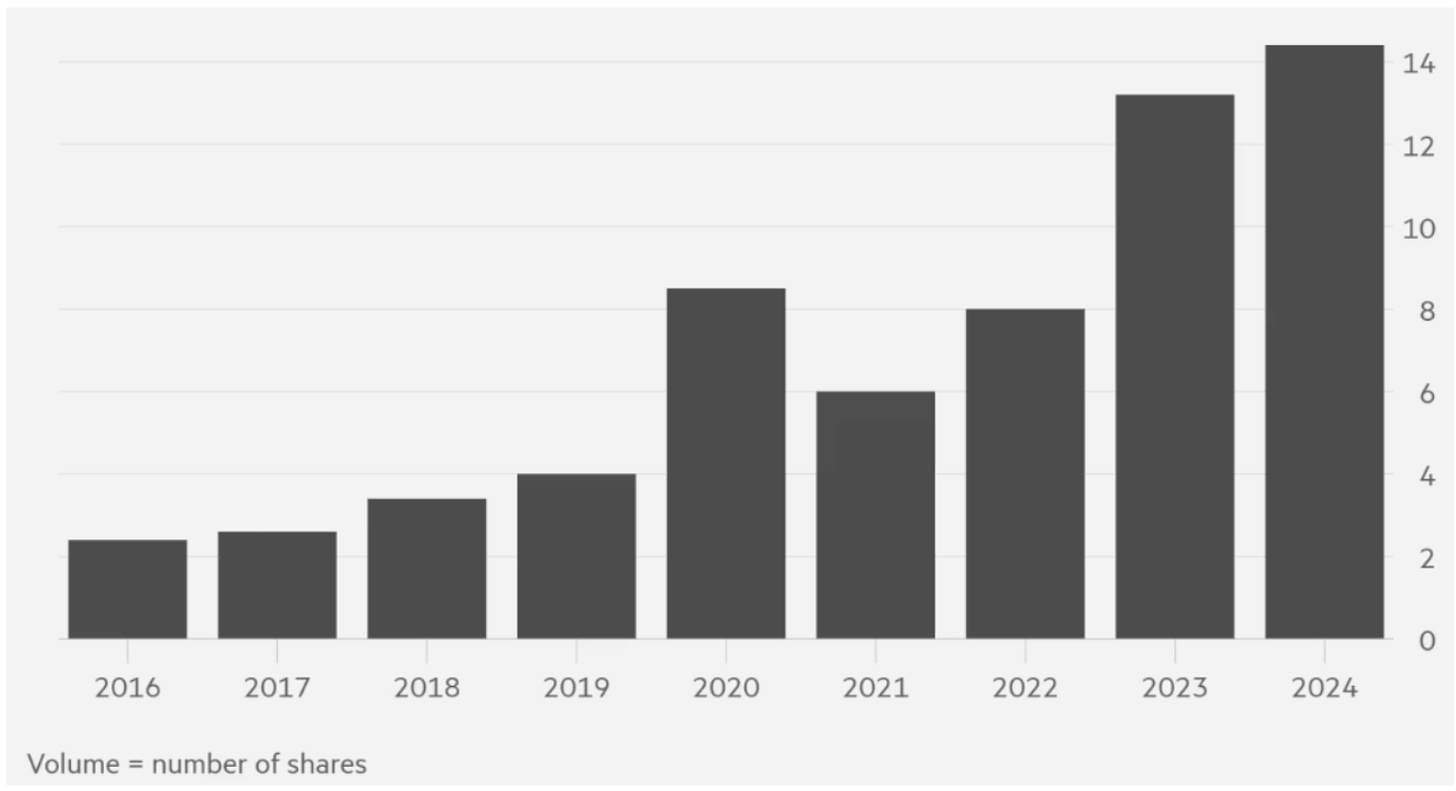

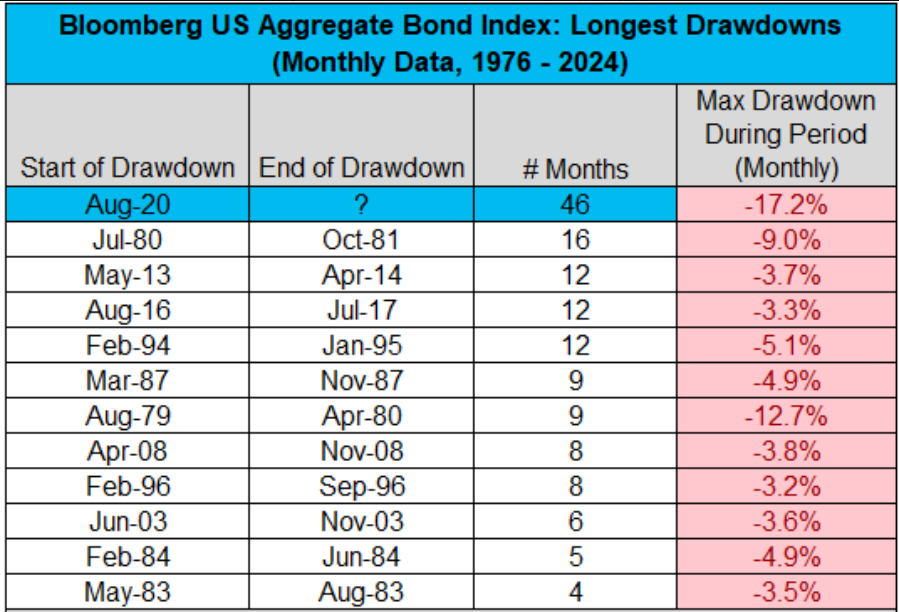

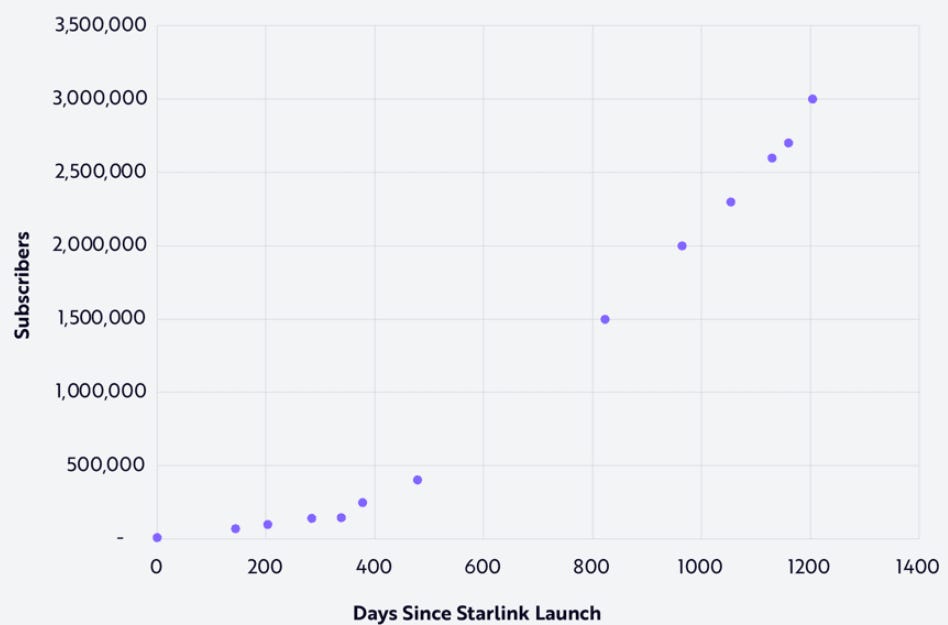

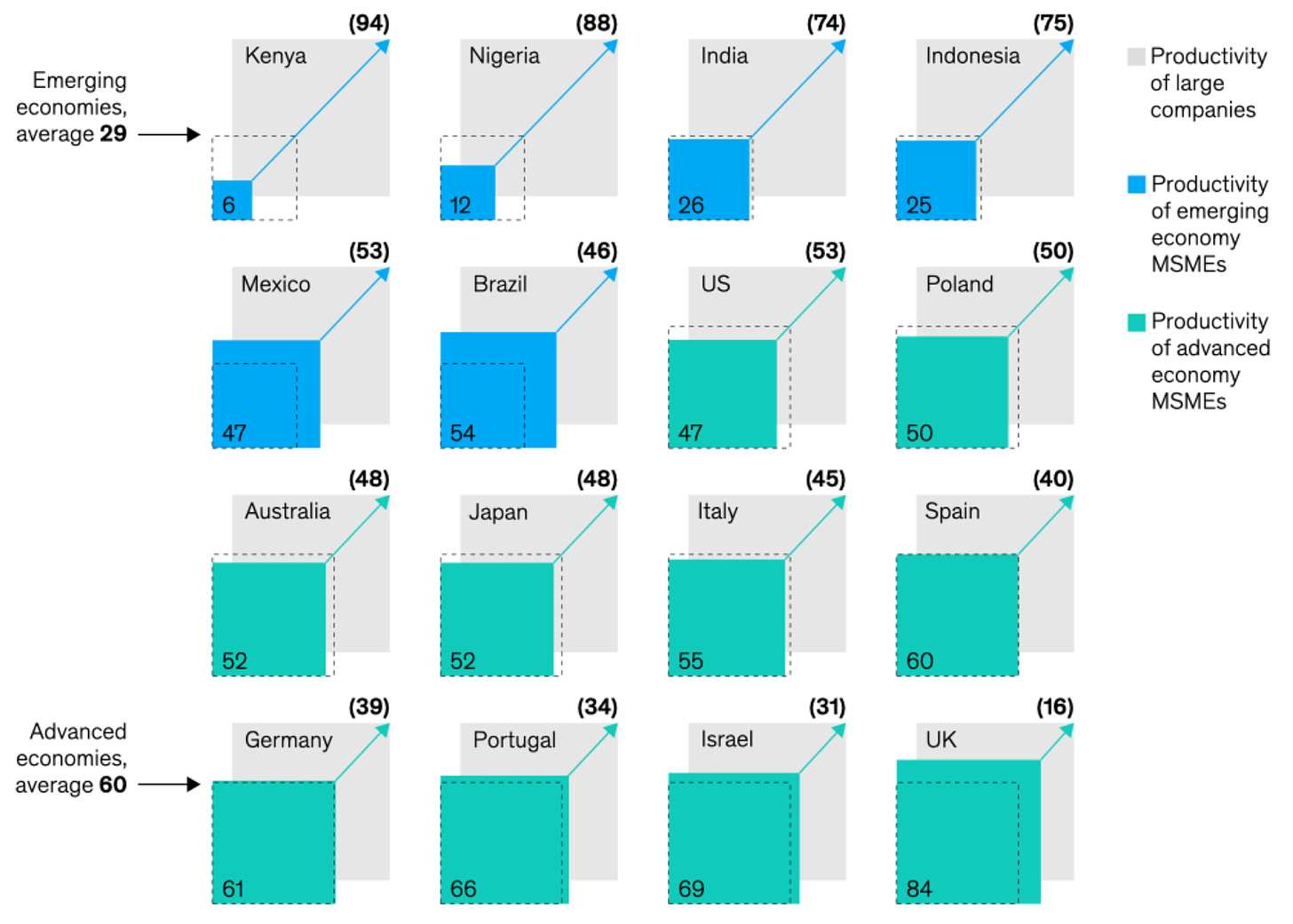

10k Words Equitable Investors June 2024 We have semiconductors snatching the sector title in equities as penny stock activity also rise in the US (not so much in Australia; and no mention of GameStop here, sorry). B2B SaaS growth moderates - as have tech EV/Revenue multiples - and strategists are now looking at strong US corporate earnings growth - will it drive capex or will it fall short itself as demand cools? The Atlanta Fed's GDP indicator has certainly dropped in recent days. Over in the US bond market, we are witnessing possibly the longest ever drawdown. Meanwhile, the Federal Reserve last held rates steady for over a year in the lead-up to the global financial crisis. Finally, we take a look at Starlink satellite customer numbers scaling up and the varying productivity chasm between small and large enterprises across nations. Semiconductors emerge with the heaviest weighting in the S&P 500 Source: FactSet (via @jessefelder) Share of US equities volume accounted for by "penny" stocks (trading at <$US1 a share) Source: Financial Times

Estimate of ex-S&P/ASX 300 volume relative to total ASX volume Source: Equitable Investors, Iress Net new sales for all "B2B" SaaS companies on ProfitWell Metrics since Jan 1, 2022 (seven-day growth rates, seasonally adjusted) Source: ProfitWell

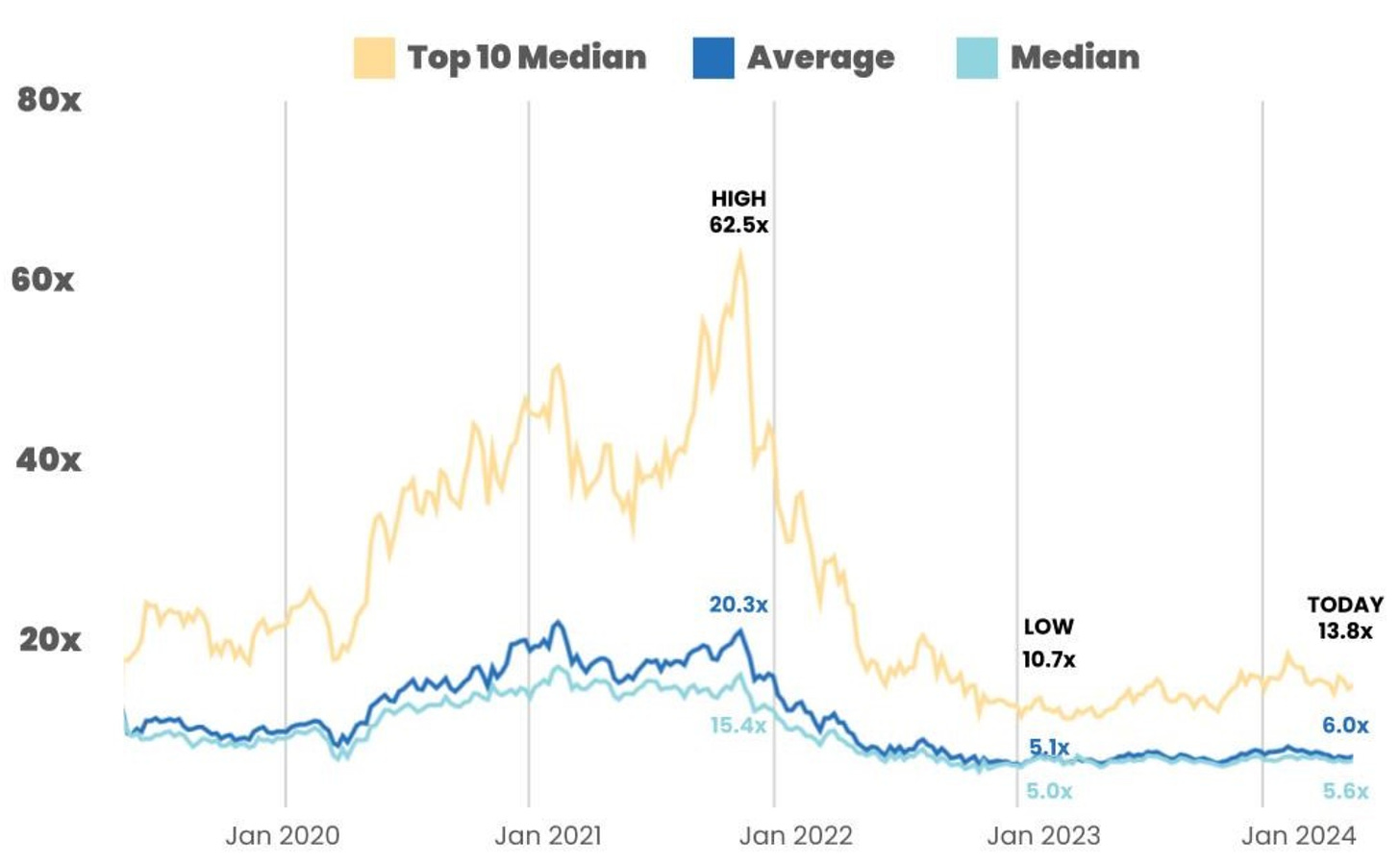

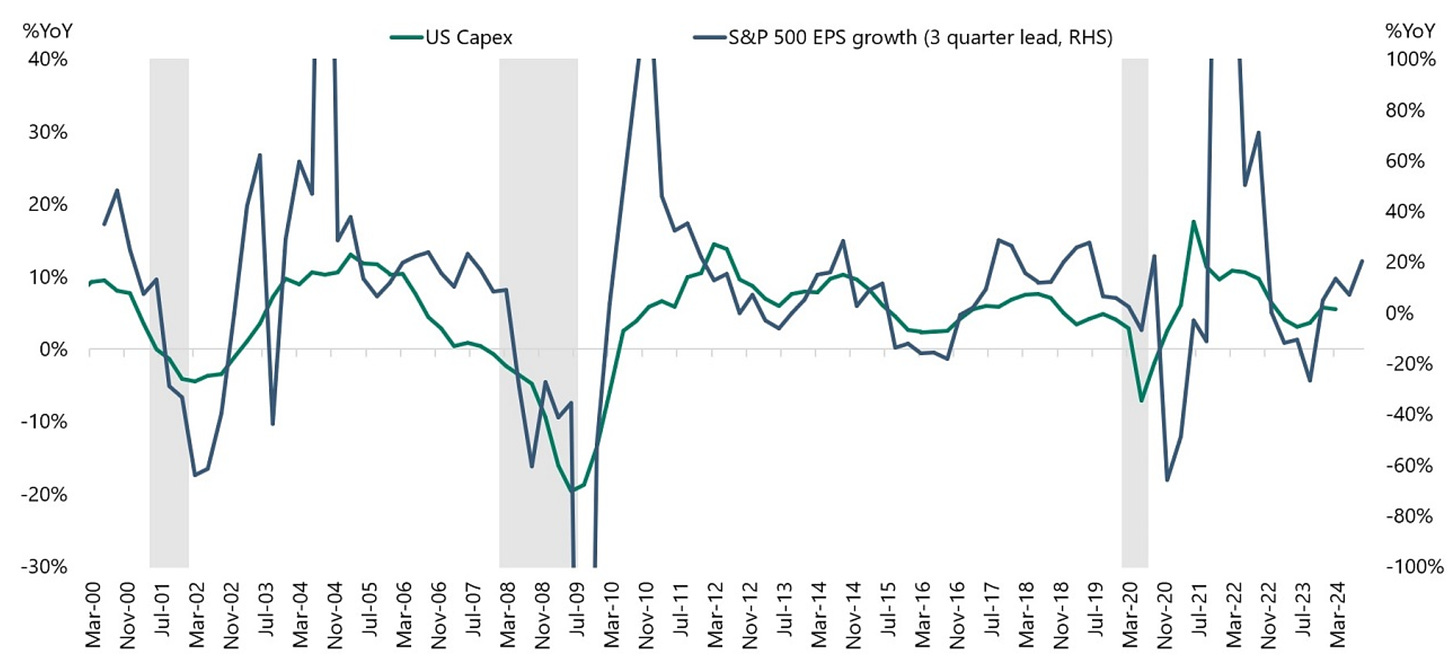

Technology sector EV/NTM (next 12 months) revenue multiples Source: Mostly metrics Strong S&P 500 earnings growth as lead indicator for capex spending Source: Apollo Chief Economist (BEA, S&P. Haver Analytics)

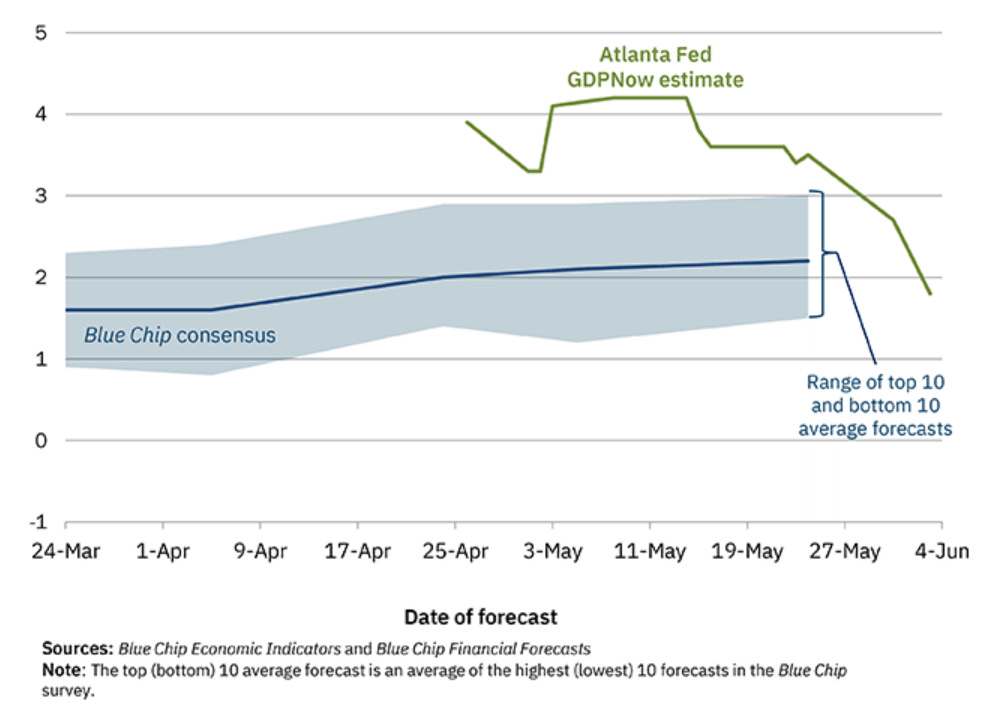

Evolution of Atlanta FedNow GDPNow real GDP estimate for 2024 Q2 Source: Atlanta Fed US Bond Market in a drawdown for 46 months Source: Creative Planning, @CharlieBilello One precedent for the Federal Reserve undertaking a long hold Source: Bloomberg Source: ARK Productivity of "Micro-, small, and medium-size" enterprises relative to larger firms by country Source: McKinsey June 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

25 Jun 2024 - Australian Secure Capital Fund - Market Update

|

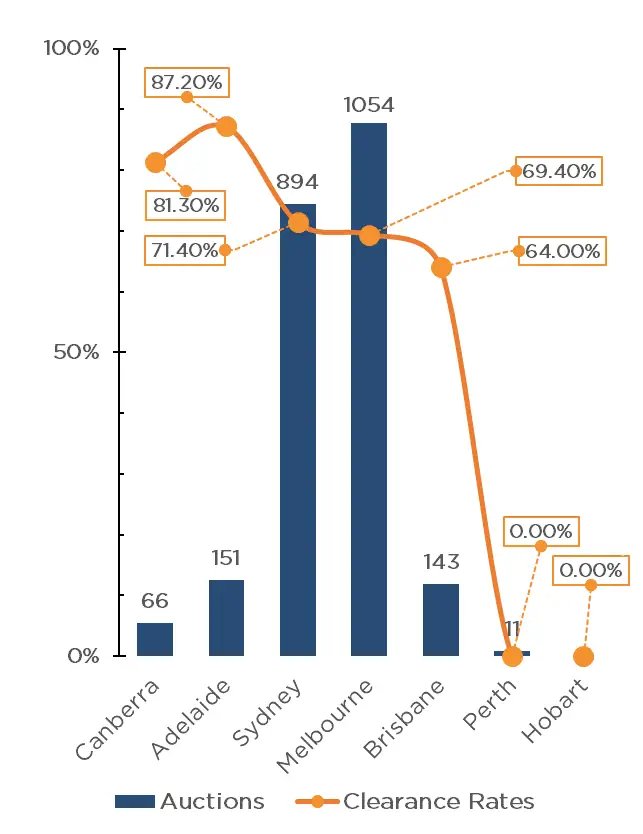

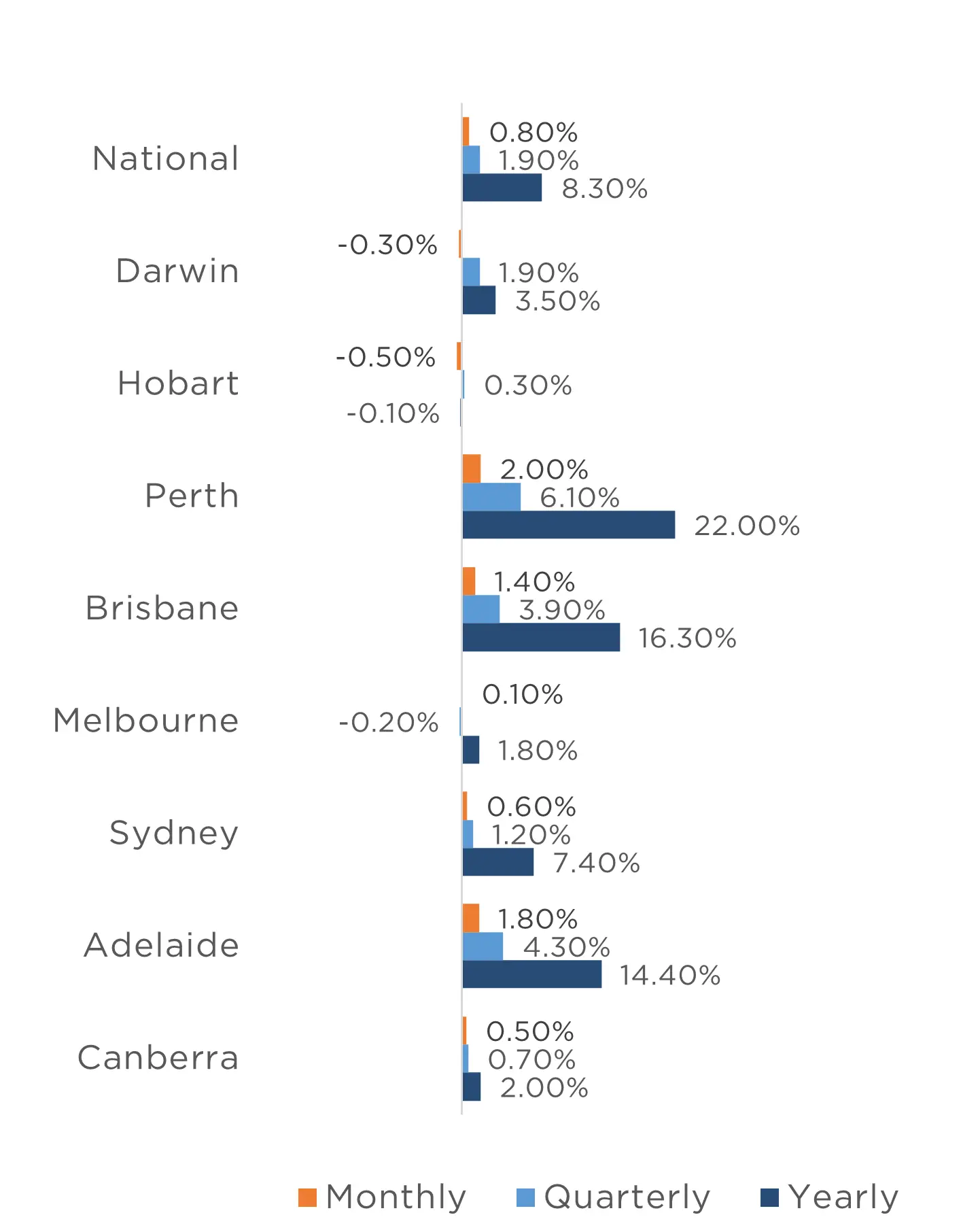

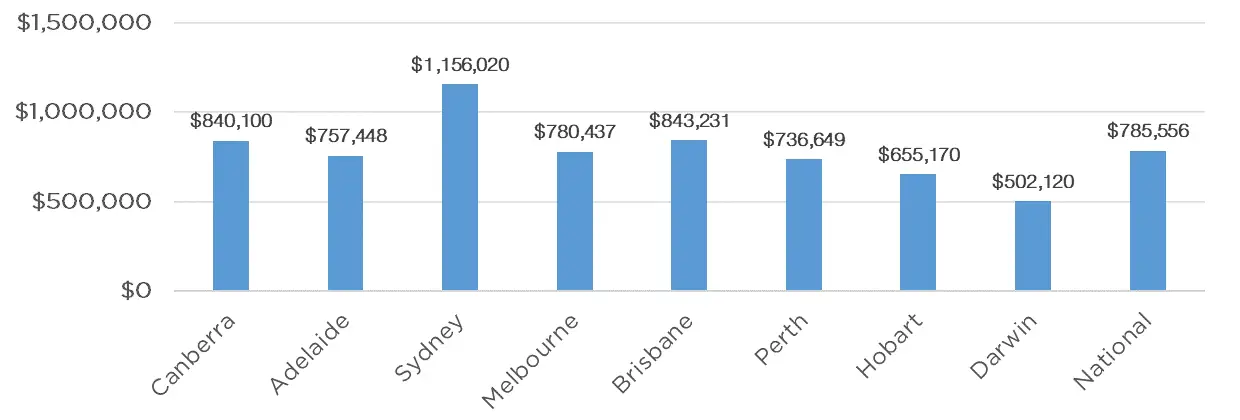

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund June 2024 For the 16th consecutive month, property prices across the capital cities have risen, with CoreLogic's Home Value Index reporting a 0.8% increase for the month of May, the largest monthly gain since October 2023. The regions also continue to experience growth, with a combined 0.6% increase. Perth continues to be the highest performing market, increasing by a whopping 2% for the month, with Adelaide and Brisbane also recording strong growth of 1.8% and 1.4% respectively. Sydney, Canberra and Melbourne also experienced growth for the month, increasing by 0.6%, 0.5% and 0.1% respectively, whilst only Hobart and Darwin recorded a reduction in dwelling values, of 0.5% and 0.3% respectively. The RBA is scheduled to next meet on the 18th of June. Whilst we believe a further increase to interest rates is unlikely, the undersupply of new housing and low tenancy vacancy rates should, in our view, ensure property prices remain strong regardless of the RBA decision. Clearance Rates & Auctions week of 2nd of June 2024

Property Values as at 1st of June 2024

Median Dwelling Values as at 1st of June 2024

Quick InsightsInvestor's RushLoans in the investment property market spiked in April, new home loan commitments to investors jumped 5.60% from March, the fastest rate of gain since November 2021. Commonwealth Bank senior economist Belinda Allen said, "There's no end to price impacts from the lack of supply and strong demand. It's economics 101″. Source: Australian Financial Review Australian Apartments Up AgainThere has been a 26% national increase in apartment selling prices, primarily benefiting higher-end developments, this surge alone is driving the rise in new home completions to 28,000 this calendar year. This figure marks the highest in four years, compared to the previous total of 32,000. However, Urbis director Mark Dawson emphasized that without a corresponding decrease in borrowing or materials costs to make lower-priced unit projects financially feasible, the current spike in completions might taper off in the future. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

24 Jun 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Maple-Brown Abbott Australian Small Companies Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Acorn Capital NextGen Resources Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Acorn Capital Micro Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Impax Sustainable Leaders Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Invesco Global Real Estate Fund - Class A | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

21 Jun 2024 - India's election and implications for equities

|

India's election and implications for equities Nikko Asset Management June 2024 Despite the predictions of exit polls and contrary to market expectations, the 2024 Indian parliamentary elections saw Prime Minister Narendra Modi's Bhartiya Janta Party (BJP) secure only 239 seats, falling short of the 272 needed for a majority. This was a significant decline from the 303 seats the BJP won in the previous 2019 elections. The National Democratic Alliance (NDA), the political coalition led by Prime Minister Modi's BJP, still managed to secure 291 seats. With crucial support from pre-alliance partners in the states of Andhra Pradesh and Bihar, the NDA is set to lead the government. However, it will be a coalition government with a smaller margin. On the other hand, the opposition Indian National Developmental Inclusive Alliance (INDIA) has made unexpected gains, securing 234 seats, while the Indian National Congress (INC) nearly doubled its seat count to 100. The BJP's allies will now have greater bargaining power, which could extend to cabinet decisions and crucial reforms. This means the BJP will need to include its allies in important decision-making processes. Prime Minister Modi's government may now have a reduced majority but Indians have voted for his government for a third term, signalling a desire for policy continuity and continued reform momentum. Election outcome indicates rural distress, need for large-scale job creationThe post-result analysis suggests that voters are discontent with issues like unemployment and inflation, and a more populist manifesto may have carried greater appeal. India's growth story remains resilient, but there seems to be a disparity between household consumption growth and real GDP growth. In the post-pandemic period, India has been witnessing a K-shaped consumption recovery, with demand from the affluent or premium segment doing well and with demand for entry-level and mass-market goods remaining subdued. The lower end of the income pyramid has struggled following the pandemic and limited fiscal support has amplified the situation. To widen benefits from economic growth and reduce income disparities, India, in our view, will need a broad-based recovery in the capex cycle as construction is the largest generator of jobs outside of agriculture. We believe that the government will have to focus more on job creation and expanding the manufacturing sector while maintaining its focus on infrastructure development and digitalisation. Government spending may change, but fiscal situation unlikely to deteriorateThe Indian economy has seen growth led by investments, partially encouraged by government initiatives, while consumption has lagged. The election outcome could result in a partial reorientation of government spending. However, we still believe that the government will maintain its focus on macroeconomic prudence. There could be a shift towards subsidies at the expense of some capex, but we do not see a significant impact in the near term nor any deviation from the interim fiscal deficit target of 5.1% of GDP. If government reflationary policies are enacted as a result of political necessity, this could result in slower fiscal consolidation. Supply-side reforms are likely to continue, while factor market reforms may prove difficult to implement. India's fundamentals remain strongIndia's economic fundamentals remain robust. Reforms in India have generally survived political challenges, and we expect the government to maintain the pace of governance and administrative reforms. However, the more complex reforms involving land and labour need greater consensus building. Therefore, while near-term uncertainty is high and the political backdrop is slightly different, the broad direction of reforms and macroeconomic factors remains unchanged. We continue to remain very positive on the longer-term potential of the India equity markets. With Prime Minister Modi sworn in on 9 June, the immediate focus is on government formation and the political jostling between and among parties. The cabinet now has some new members from coalition partners. We will focus on the final budget, which is most likely to be put together early in July, to assess the policy direction. The first 125-day agenda of the new government will be a key event that will set the direction of economic reforms. We believe that the agenda will focus on digitalisation, infrastructure, industrialisation and governance-related reforms. Focus on companies with sustainable returns undergoing positive fundamental changeIn the short term, the Indian equity markets are likely to be volatile. However, now that the election uncertainty has been resolved, we believe that over the medium term, there will be a strong corporate capex and credit cycle. In addition, a multi-year buildup in domestic savings is expected to funnel into equities and potentially provide a further boost for consumption. From a longer-term perspective, this could be an opportune time to assess quality business franchises in India. We continue to focus on companies with high free cash flows, low balance sheet leverage and high return on capital. Currently, we have a favourable view on sectors such as financials via large private sector banks, consumer discretionary via the automobile sector and communication services. Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

20 Jun 2024 - Remembering Daniel Kahneman

|

Remembering Daniel Kahneman East Coast Capital Management June 2024

The "Grandfather" of Behavioural Economics In late March, psychologist and economist, Daniel Kahneman, passed away at the age of 90. His work with Amos Tversky and others helped to establish the field of behavioural economics, including explaining cognitive biases and heuristics, and developing Prospect Theory. In 2002, Kahneman was awarded the Nobel Memorial Prize in Economics "for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty". Kahneman also wrote best-selling books including Thinking, Fast and Slow. Kahneman's insights in the world of trading highlight biases such as overconfidence, herding behaviour, and loss aversion. His work is highly relevant for trend following managers, whose quantitative systems seek to exploit market inefficiencies. In this article, we provide a brief taste of some of Kahneman's work and how trend following is consistent with his elucidation of human behaviour. The Reflection Effect One aspect of Kahneman & Tversky's seminal Prospect Theory is the Reflection Effect, which describes how people's appetite for risk changes when we think about the same decision focusing on gains or focusing on losses. Kahneman and Tversky demonstrated that people are risk averse in the domain of gains, and risk seeking in the domain of losses. For example:

That is, people will tend to take a risk to avoid losses, and will avoid risks to lock in gains. They will even make different decisions based on how a problem is framed. There are studies around breakeven effects which further show risk seeking in the domain of losses. Experiments were conducted where people were studied at horse tracks, and found that punters placed riskier bets (longer odds) towards the end of the day, when they were on average already making losses - that is, they tried to win back their losses to break even. We can see this effect in force when investors hold on to losing stock market trades, hoping they will go back up to break even, or even take on riskier trades to try to win back losses. Trend following systems are designed to overcome the Reflection Effect. Where human psychology instinctively has us locking in gains, trend following systems let profits run. When human psychology tends to steer us to take bigger risks to avoid losses, trend following systems are designed to limit losses through consistent and unemotional stop loss levels. Emotions vs Rationality in Markets Although those of us who are schooled in the field of Finance are taught the Efficient Market Hypothesis - that asset prices reflect all available information, behavioural economics highlights the role of emotions in decision making. Cognitive biases such as overconfidence, herding, information bias and loss aversion may help to explain market bubbles / "irrational exuberance" as well as "over-reactions" contributing to market crashes. For example, Kahneman and Tversky found that people will typically extrapolate broadly from narrow data sets, which they called the Law of Small Numbers. To illustrate this effect, consider:

We can see that this cognitive bias may result in flawed decision making, and irrational market behaviours. Trend following systems are designed to attempt to exploit irrational market conditions, and to avoid cognitive biases through systematic approaches to trading. Our strategies at ECCM are tested over long term, deep and broad data sets to avoid information biases and enhance objectivity. At our website and our YouTube channel you can view our video "Embracing Objectivity Through Systematic Trading", in which ECCM's founder and CIO, Adam Havryliv, and Strategy Ambassador, Richard Brennan, talk more about our approach to statistical analysis and how we seek to avoid cognitive biases. Conclusion Daniel Kahneman and his colleagues developed highly influential and insightful studies which have helped to explain human behaviour and in turn market dynamics. We recognise his work and the impact he had on our understanding of financial markets. At ECCM, our educational foundations are in finance and psychology. With extensive trading experience and long-term dedication to quantitative trading systems, we seek to provide our clients with our carefully developed approach to navigating the complexities and vagaries of markets. Wholesale clients can find more information on ECCM and our flagship ECCM Systematic Trend Fund at our website and Australian Fund Monitors. Funds operated by this manager: |

19 Jun 2024 - The outlook is sunny for global travel

|

The outlook is sunny for global travel Yarra Capital Management May 2024 Travel and holidays are important to many people as they represent a break from the norm, a chance to escape mundane reality and experience something exciting and possibly exotic. They are a chance to reconnect with family and friends away from the stresses of daily life and can provide significant benefits for our physical, mental and emotional health. The forced lockdowns imposed during the pandemic era reinforced the value of holidays for many of us, and in our view there has been a meaningful shift toward experiences that cuts across generations. So much so that in a time when the cost of living has risen dramatically, rather than cutting back on holidays people continue prioritising their importance. Having normalised significantly during 2023, international tourism is well on track to return to pre-pandemic levels in 2024, underlining why we feel this ongoing Future Quality investment trend is still worth pursuing. Successful recovery of global travel For the last couple of years, the global travel industry has been going through the process of normalisation following the pandemic-imposed restrictions that brought worldwide travel to a halt. Planes were grounded, accommodation closed and staff were laid off or siloed; consequently, the sector's recovery has taken time to rebuild to its former scale. This normalisation has taken place against a backdrop of strong consumer demand. As lockdown restrictions were lifted, many consumers were eager to rebook holidays that had been either cancelled or postponed. The unleashing of this pent-up demand meant that, according to the UNWTO World Tourism Barometer, international tourism reached 88% of pre-pandemic levels in 2023. As investors, we were quick to spot the investment opportunity that the normalisation of travel would represent. But now the recovery appears to be almost complete, it is time to reconsider the ongoing strength of this investment theme. Ongoing growth drivers Our analysis has determined that there remain several key ongoing drivers of growth for the travel industry. Firstly, while the market expectation that demand has now normalised seems fair, we found that one key factor is largely being ignored: the re-emergence of the Chinese outbound traveller. COVID-19 lockdowns were in place for a lot longer in China than anywhere else in the world and therefore travel restrictions have only just been fully lifted. Given the significant size of the Chinese population, the process of restoring the operational outbound capacity for flights will take time to reach its former scale and demand was initially subdued amid lingering concerns over COVID-19 and tepid economic growth. Yet, the importance of Chinese travellers should not be underestimated. In 2019, they represented the world's largest share of outbound tourists, contributing around US$250 billion to the global economy. Signs are positive that Chinese travel will rebound this year, with domestic trips over the China Lunar New Year holidays increasing 34% compared with 2023 and marking a 19% rise on 2019 levels. Travel and tourism have also been highlighted as the best-performing elements of China's otherwise lacklustre economy.

Chart 1 - Number of outbound Chinese tourists (in millions)

Source: Bloomberg, April 2024.Secondly, a new travel cohort is emerging from developing countries - India as a prime example - where rising gross domestic product per capita means more people will be able to afford to travel in the future. While this also includes China, it particularly encompasses the wider Asian region and has resulted in UK airport Heathrow increasing its forecasts of passenger numbers this year due to the growth in Asian routes. Finally, artificial intelligence (AI) is being embraced by the travel industry initially to enhance the booking experience for flights, accommodation and car hire, as well as boosting call centre efficiency. However, going forward, AI applications could encompass advertising strategy, marketing content and greater personalisation. Another factor to consider is supply and demand. Given that the demand is clearly there, it would be expected that at this stage of the cycle new accommodation would be being developed at an aggressive rate. However, due to concerns around commercial real estate and higher borrowing costs, that supply growth is not coming through, and is creating further inflationary pressures on overall holiday prices. Future Quality FindersHaving discussed and reviewed our investment thesis around global travel, we still need to apply our Future Quality lens to find the companies that will attain and sustain rewarding returns not only today but, more importantly, for tomorrow. In our view, many quality companies are directly benefitting from the positive tailwinds in global travel, from booking companies to manufacturers of luggage and travel accessories. We currently favour Booking.com, Amadeus and Samsonite. Focusing on luggage manufacturer Samsonite, having re-engineered its manufacturing footprint and streamlined its costs during the pandemic, we felt its management did a good job of positioning the company for more profitable growth in the future with brand equity and pricing power largely intact. We expect the ongoing recovery in travel, particularly among business travellers, will continue to drive revenue growth and, with a lower fixed cost structure, the business has the opportunity to earn margins somewhat higher than the traditional norm. By seeing further and envisioning the investment opportunities of tomorrow, we aim to invest in not only what is, but what will be. Contrary to popular perceptions, we anticipate that global travel will endure as a long-haul investment journey. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

18 Jun 2024 - Investment Perspectives: The opportunity in Canadian housing

17 Jun 2024 - Manager Insights | East Coast Capital Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Richard Brennan, Strategy Ambassador at East Coast Capital Management. The ECCM Systematic Trend Fund has a track record of 4 years and 4 months. The fund has outperformed the Barclay Hedge Global Macro benchmark since inception in January 2020, providing investors with an annualised return of 17.34% compared with the benchmark's return of 7.75% over the same period.

|

13 Jun 2024 - Data Dependency and Fiscal Stimulus Complicate Inflation Fight

|

Data Dependency and Fiscal Stimulus Complicate Inflation Fight JCB Jamieson Coote Bonds May 2024 Financial markets have dealt with a large volume of economic data and communication from central bankers in recent weeks. Despite some overly sensationalised media coverage and short-term predictions, we believe that the central banks' messaging has remained consistent across jurisdictions. The US Federal Reserve (US Fed), the global leader in setting market trends, and the Reserves Bank of Australia (RBA) domestically, have both cautioned patience with monetary policy, as already restrictive settings continue to work through the system, lowering growth and demand whilst bringing inflation back towards target. This process is frustrating in the day to day, in that inflation data doesn't move in straight lines - seasonal factors, annual price increases, one-off adjustments, flash sales, and other variables create a bumpy, unpredictable, and somewhat volatile path. Even well-resourced teams of economists at major investment banks consistently get their estimations markedly wrong, reflecting the inherent volatility in this process. Take the latest CPI quarterly release in Australia, which was widely predicted to be 0.8%. When the actual figure came in at 0.96% (rounded up to 1.0%), the unexpected result triggered a significant market reaction, leading to the removal of any expectations of a rate cut from the RBA. What makes this even more galling for forecasters is that with a monthly inflation series, they already have about two thirds of the dataset before the quarterly figures are released. This makes forecasting errors even more surprising and exacerbates the market's reaction when a when a relatively small portion of new data has an outsized impact. This may be more detail than you require as you read this over your morning coffee. Of course, forecasting errors can also work in reverse, as we have seen some large undershoots versus expectation over time. Yet the sequencing of these dataset surprises drives market sentiment, and sadly, central bankers are now wedded to react to a 'data dependent' approach, risking falling behind the curve. The key takeaway here is that while inflation in Australia peaked at 7.8% in the fourth quarter of 2022, it has since steadily fallen to 7.0%, 6.0%, 5.4%, 4.1% and now 3.6% over the preceding quarters. This downward trend, though slightly slower than the RBA forecasts, has been the direction of travel for 18 months. The fight against inflation is not yet over, but it is well advanced, whilst the battle rages on under restrictive interest rate settings. The US economy, which has long been the 'exception' in a souring global macroeconomic story, has suddenly slowed significantly. Whilst the incoming numbers remain solid, they are markedly weaker than we had received previously, with a shock miss on components like GDP, the employment report (Non-Farm Payrolls), initial unemployment claims and a host of second-tier manufacturing and activity data. This has taken the US "economic surprise" index to a negative reading. Markets are now focused on how the interplay of slower growth will affect prices (and inflation) in the coming quarters, trying to calibrate the timing of central banks that have become unashamedly 'data dependent'. The significant failure of models used to calibrate policy through the COVID-19 period has made central bankers highly reactive, no longer willing to back their judgements on years of policy learnings and economic theory to move policy ahead of the cycle. Ordinarily, as growth slowed, central bank policy levers would already be in motion to address the slowdown and expected cooling inflation outcomes associated with weaker demand, acknowledging that policy works with long lag times. Now, as data dependency is 'policy de jour', the danger is that economies may slow more than necessary before central banks act to curb a downturn. This delay could lead to more severe corrective measures, as central banks struggle to address a substantial loss of economic momentum. We have heard various terms to describe economic trajectories, such as 'hard,' 'soft' and 'no' landing. If, like an aircraft, the economy hits stall speed, the pilots' attempts at recovery will be a lot more severe than if they'd simply eased up a little ahead of time. Central bankers are often criticized for waiting until ''something breaks'' before taking decisive action. This was evident during the Global Financial Crisis (GFC) over a decade ago when rates were held at similar levels to today until a catastrophic episode was unavoidable, prompting rates to be slashed by more than 5% to jump start economies and reverse the damage caused by overly restrictive rates from the pre-2008 period. With this concept in mind, our baseline position at the start of the year was that central bankers would aim for a non-stimulatory rate cutting cycle in the back half of 2024. This was expected to be led by Europe or the US, commencing around the middle of the year. Such a strategy could help smooth the economic cycle, offer some relief to consumers and borrowers, and ideally avoid the negative consequences of keeping rates too high for too long. That is still seemingly on track for Europe, with the European Central Bank (ECB) likely leading the way, followed by Canada, the UK and New Zealand. However, the expected timing for the US to lead the rate-cutting cycle has shifted further out. An interesting development is Sweden's Riksbank, which just leapfrogged the pack by cutting rates from 4.00% to 3.75%, whilst observing similar economic outcomes to our own domestic data, weak growth, deeply negative retail sales and cooling (though still above mandate) inflation. Perhaps some central bankers are still moving ahead of the curve. In the US, the trend has slightly reversed, with inflation moving from a low of 3.1% up to 3.5% over the last five months. Despite this uptick, the US Fed retained its easing bias and reduced the scope of its Quantitative Tightening program during its May meeting, helping solidify expectations around bond yields. A short covering rally followed thereafter, which all asset markets have enjoyed, lifting bonds and equities alike. From prior communications, the US Fed indicated its intent to cut rates, retaining an easing bias. However, the slight increase in inflation has complicated the process, delaying market expectations for rate cuts to later in the year. While monetary policy is fighting the good fight against inflation with restrictive policy settings, US fiscal policy remains highly stimulatory, with public spending running at around ~6% of GDP. Much of the economic growth in the US has been fueled by this large public sector spend, which has been exceptional against other jurisdictions and looks to continue in an election year. As a result, this continued fiscal stimulus could create some friction in achieving normalisation of inflation. The RBA has found that recent surprises in our own inflation were predominantly due to education and insurance, which we think has heavy seasonal annual reset, and is unlikely to be repeated in following quarters. Calling the near-term inflation pathways remains difficult. Plenty of things can work sequentially against further progress in the near term, like a stimulatory federal budget, larger fair work outcomes on minimum wages, geopolitical flare ups driving energy prices higher or global shipping disruptions to name a few. On the other hand, there are reasons for optimism. Oil prices are well off their highs despite recent geopolitical tensions involving Israel and Iran. Slowing economic activity has tempered discretionary spending, as evidenced by deeply negative retail sales. We've also seen declines or stabilisations in rent and used car prices. In the 10 years prior to COVID-19, Australia's average quarterly inflation rate was 0.52%. If we assume that the next few quarters are much higher at 0.8%, inflation could fall to 3.2% by the end of the third quarter, against the RBA estimate of 3.8% by year end. These contrasting forces create a complex landscape for policymakers, and while there is room for inflation to fall below the RBA's forecasts, data dependency will continue to drive monetary policy decisions. The uncertainty surrounding these various factors suggests that flexibility and careful analysis will remain critical as the RBA navigates the path ahead. Author: Charlie Jamieson, Chief Investment Officer Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) |

12 Jun 2024 - Assessing the "rizz" of the private credit market

|

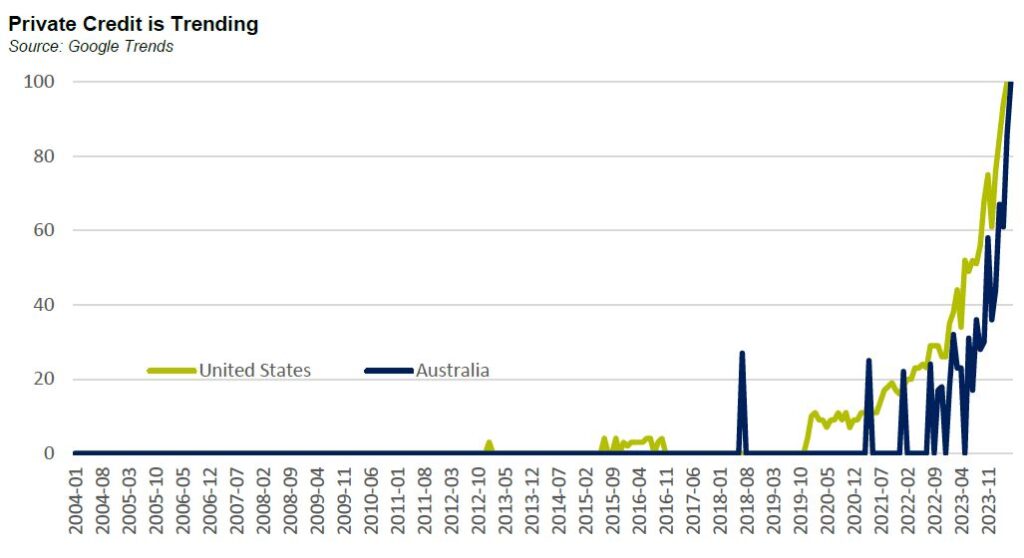

Assessing the "rizz" of the private credit market Challenger Investment Management May 2024 The Oxford Word of the Year 2023 was "rizz". An abbreviation of charisma it is used to refer to an individual who has a lot of style and is attractive to others, albeit not just in their appearance. As Dennis Denuto said in the classic Australian film, The Castle, "it's the vibe." Suffice to say that Dennis didn't have much "rizz" and neither do I, a point which was made clear to me by my kids when I tried to use "rizz" in a sentence. If you aren't a Gen Z-er but are a keen observer of financial markets, it would not be a surprise if your word of the year was "private credit". A quick Google Trends search shows the dramatic increase in interest in private credit that started in 2020 and ramped up considerably in 2022 and 2023. Notably Australia has lagged the United States with interest only peaking in late 2023.

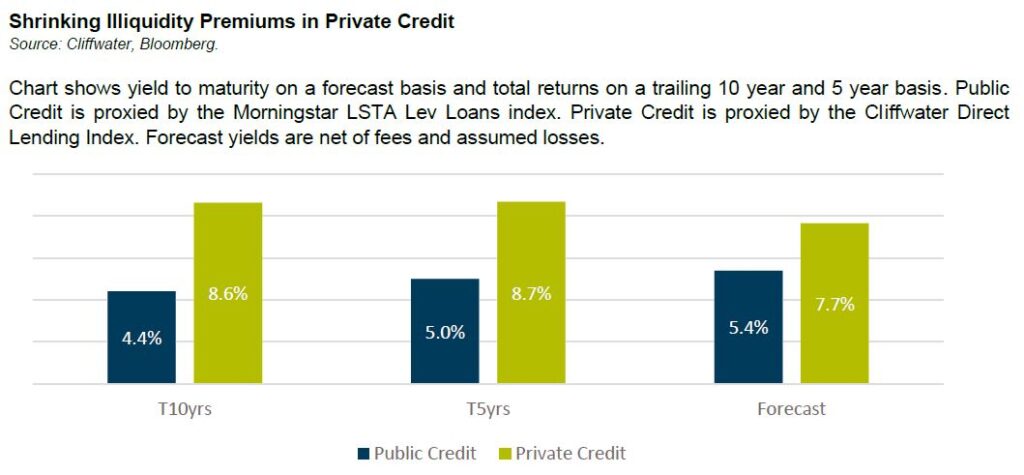

The level of interest in private credit inevitably raises the question of whether it has peaked. In the United States there have been a number of recent data points which suggest the private credit opportunity may not be what it once was. Firstly, funds raised by private credit funds slowed in the first quarter of 2024. According to Preqin, private debt managers raised US$30.6 billion in Q1 taking total funds under management to US$1.7 trillion. This is the lowest Q1 figure since 2018. Interest rates and inflation were the top two concerns for investors. The fourth quarter of 2023 was also slow with only US$42 billion raised, the slowest end to the year since 2018. The terms of the funds are typically 6-8 years and dry powder (capital raised but not yet invested) was estimated at US$400 billion in September 2023 implying there is still plenty of capital available even if fund raising continues to slow. Secondly, returns in private credit are moderating. With so much capital flowing into the sector it was inevitable that returns would slow. Cliffwater now expects a long term illiquidity premium (measured as the difference between the expected return on the CDLI index unleveraged after fees and losses to the return on the Morningstar LSTA Lev Loan index after losses) of 2.25% per annum. This compares to an excess return of 4.2% p.a. in the ten years prior.

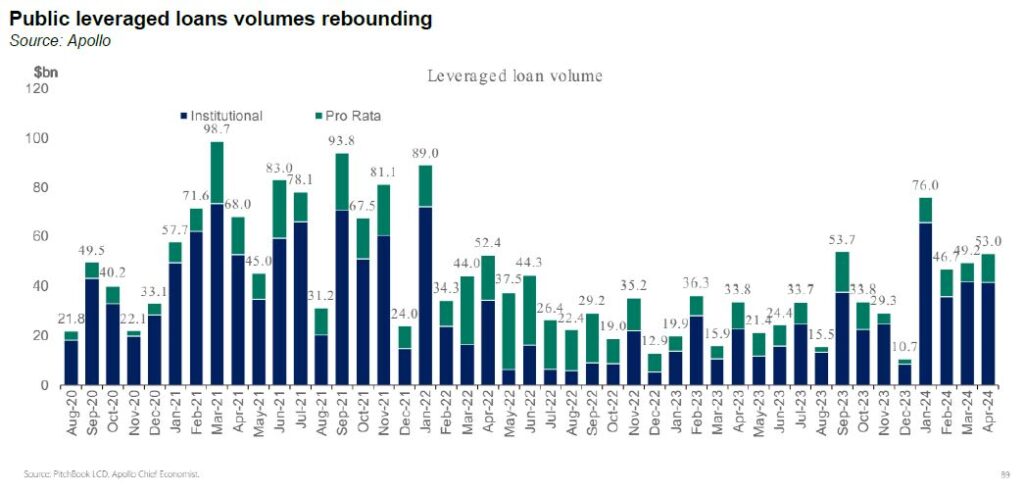

Thirdly, the growth of the private lending market might have outpaced the supply of private lending opportunities. In other words, we may have reached a point whereby private lenders are competing with public markets and banks for new deals. In 2023 private credit lenders provided a US$5.3 billion loan package to Finastra Group, refinancing existing syndicated debt raising the question of what the private lenders were providing that public markets couldn't. The sharp contraction in credit spreads seems to have reversed this trend in 2024. As shown below public leveraged loan issuance levels have picked up from 2022/23 levels. According to Pitchbook, in 2023 around US$20 billion in publicly syndicated loans was taken out by private direct loans. In 2024 through April, over US$13 billion of private direct loans have been refinanced by publicly syndicated loans.

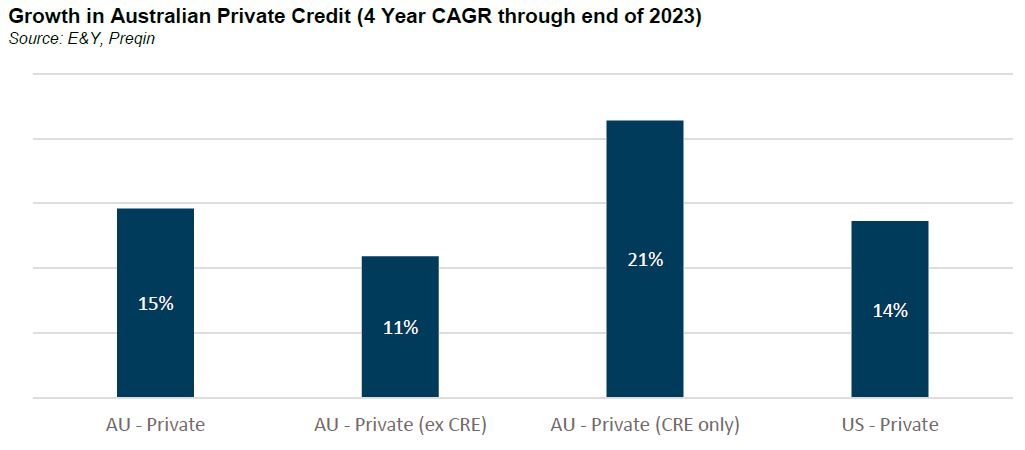

And in another important data point, Bloomberg reported in May that a large US private lender, HPS Investment Partners actually capped inflows into one of it funds to manage the imbalance between demand for private credit and the supply of opportunities. Of course, there are two interpretations of the supply argument. One is that public markets are lacking discipline and pricing risk too low. The other is that private lenders have become too large and are now competing directly with public markets rather than filling the gaps around them. Both are probably true to some extent. Our conclusion is that we have probably hit the peak in private credit in the United States. That's not to say that it is a poor investment now but perhaps not the slam dunk it was 5-10 years ago. An illiquidity premium of greater than 2% per annum is good, but maybe doesn't have the rizz it had a few years back. But how about Australia? Are we past the peak in Australian private credit? In assessing this question, the first thing to note is that until recently Australian private credit definitely didn't have the same amount of rizz as US private markets. This is consistent with the Google Trends data and the level of understanding from investors and advisors who had barely scratched the surface of these markets before COVID. Data on funds raised in Australian private credit markets is hard to come by but anecdotally there has been exponential growth the number of private credit managers claiming to be active in Australia. According to E&Y's annual survey the growth in Australian private credit has outpaced the growth US private credit markets but only if you include CRE debt as we show below.

So, growth in Australian private credit is really about growth in commercial real estate lending. Non-CRE lending has grown at a more moderate place which aligns with our lived experience. Australian markets are also less transparent than the United States when it comes to returns. Our anecdotal view is that illiquidity premiums were never as large in Australia as they were in the United States and haven't compressed nearly as much and we continue to guide investors to expect an excess return of around 2% per annum. Supply-wise the Australian market has never competed with public high yield markets for the simple reason that Australia has never had much of a public high yield bond market. In Australia, the main competition for private lenders is banks for whom non-financial corporate loan exposure growth slowed to around 6% in the 12 months to March 2024. Looking at major bank Pillar 3 disclosures it seems as though loan growth for sub-investment grade corporate credit exposure was around 8% over the past 12 months. This implies that banks were actively but not aggressively competing in corporate direct lending markets in Australia, consistent with our experience. So, while there may not be as much rizz in the US private lending opportunity, we think there is probably still some left in Australia. Indeed, if there is a credit cycle down under, the opportunity for alternative lenders to fill the gaps left by the banks could be significant, especially in non-CRE lending which has experienced less growth. Watch this space! Funds operated by this manager: Challenger IM Credit Income Fund, Challenger IM Multi-Sector Private Lending Fund For Adviser & Investors Only |