NEWS

31 May 2019 - Hedge Clippings | 31 May 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

24 May 2019 - Hedge Clippings | The excitement's over, now back to work!

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

20 May 2019 - Monday Hedge Clippings - Better late than never!

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

3 May 2019 - Hedge Clippings | 03 May, 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

26 Apr 2019 - Hedge Clippings | 26 April, 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

12 Apr 2019 - Hedge Clippings | All eyes on the Federal Election. It's the economy, stupid!

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

5 Apr 2019 - Hedge Clippings | Impending election, RBA uncertainty and ASIC's sharpened teeth

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

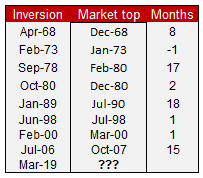

29 Mar 2019 - Hedge Clippings | Yield inversion and the "R" word

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

22 Mar 2019 - Hedge Clippings | 22 March 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

15 Mar 2019 - Hedge Clippings | Talking, talking, talking. Sooner or later you've got to walk the walk.

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|