NEWS

1 Apr 2020 - Performance Report: Ark Global Fund - Class B AUD Unhedged

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment objective of the Fund is to achieve long-term capital appreciation with low correlation to global equity markets through investment in the Underlying Fund. Fund One is a global macro fund that utilises quantitative research including machine learning techniques and fully automated trading algorithms which will aim to generate positive uncorrelated returns relative to any significant equity benchmark. The traded instruments are either major FX pairs or the most liquid exchange traded stock index, bond, and commodity futures across North America, Europe and Asia Pacific. The algorithm backtests over 10 years of tick data and in order to do so effectively requires machine learning to filter noise and identify meaningful signals, which results in statistically significant prediction of price movements. In production this processing is done in real time and the portfolio reacts to asset movements by rebalancing automatically to the desired risk exposure through the market impact optimised execution logic. Risk management layers built into the algorithm have been developed using the experience the team has gained from their decades in highly liquid fast-moving markets in the proprietary High Frequency Trading world. This allows the system to trade autonomously but safely to all trading opportunities and potential system issues, and to alert the team to any behaviour outside of strictly controlled bounds. The Fund is a 'feeder fund' which indirectly gains exposure to the underlying assets by investing all or substantially all of its assets in the Underlying Fund. The Fund may retain a certain amount of cash from the investment in the Fund for the purpose of payment of costs, fees, hedging and expenses. |

| Manager Comments | The Fund's capacity to significantly outperform in falling markets is highlighted by the following statistics (since inception): Sortino ratio of 2.11 versus the Index's 1.67, down-capture ratio of -46.73% (indicating that, on average, the Fund has risen during the months the market has fallen), and maximum drawdown of -5.24% versus the Index's -10.57%. The best performing assets for the month were: Swiss Market Index future (+6.68% of NAV), Canada TSX 60 future (+3.36% of NAV), and FTSE100 future (+1.80% of NAV). The worst performing assets for the month were: Topix future (-4.60% of NAV), Gold future (-7.97% of NAV), and Euro Stoxx 50 future (-8.45% of NAV). |

| More Information |

31 Mar 2020 - Performance Report: Harvest Lane Asset Management Absolute Return Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Harvest Lane Asset Management employs a conservative, highly selective and opportunistic approach. Using their extensive knowledge in the area of corporate actions, the Fund's managers assess each opportunity based on a thoughtful, diligent and disciplined process and invest where they believe an opportunity exists to generate above average investment returns relative to the risk incurred. Investment decisions are made without speculating on market direction, with rigid risk controls enforced to minimise the risk of large losses of investor capital. The Fund invests in securities that are predominantly listed on the ASX and occasionally in those listed in other developed markets. Equity swaps and other derivatives may be used at times to reduce risk. The fund typically holds high levels of cash in the absence of sufficiently attractive opportunities to deploy investor capital in accordance with its objectives. |

| Manager Comments | The Fund's capacity to significantly outperform in falling markets is highlighted by the following statistics (since inception): Sortino ratio of 1.39 versus the Index's 0.96, down-capture ratio of -23.56% (indicating that, on average, the Fund has risen during the months the market has fallen), largest drawdown of -6.46% versus the Index's -13.73%, and an average negative monthly return of -1.37% versus the Index's -2.55%. Harvest Lane noted they saw a reversal in February of the tightening in deal spreads they had observed over the past 12 months as investors shifted their focus from risk-adjusted returns to outright capital preservation. They have minimised the Fund's exposure to a number of deals which are as yet non-binding. The non-binding nature presents inherent risk to the transaction completing and are typically the first transactions to see widening spreads given the lack of a legal framework compelling the bidder to complete the offer. At the time of writing their February 2020 report, close to 60% of the portfolio's assets were invested in companies subject to binding transactions with a further 21% in cash and cash equivalents. Harvest Lane remain vigilant and continue to act with capital preservation at the forefront of their decision making process, particularly in the current market conditions. |

| More Information |

31 Mar 2020 - Performance Report: Wheelhouse Global Equity Income Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | To pursue this objective, the Investment Manager is responsible for actively managing, monitoring and tailoring the integration of derivative contracts alongside the Morningstar Portfolio, while taking into account changing market and stock specific conditions. The Investment Manager is responsible for maximising the structural benefits of short option positions (lowered Volatility, improved capital preservation, higher income generation), whilst mitigating, minimising and monitoring the structural negatives (variable market exposure, option expiries, collateral management and asymmetric return profiles). In addition, long derivatives positions are also used to enhance the capital preservation characteristics of the Fund in more extreme market movements. As a consequence of the integration of Derivatives, returns of the strategy, intra-cycle, are expected to vary from the underlying Morningstar Portfolio due to these characteristics. For example in weak markets, or in extended sideways markets, the Fund is expected to outperform relative to the Morningstar Portfolio. Conversely in strong positive markets the Fund is expected to underperform. |

| Manager Comments | The Fund's February return comprised -5.56% from the portfolio (in USD) and a positive return of +3.61% from the weakening of the Australian dollar versus the US dollar. Top contributors included Schneider Electric, Kerry Group, Tyler Technologies, Adobe and Sanofi. Key detractors included Western Union, Intel Corp, GlaxoSmithKline, Bank of America and United Technologies. |

| More Information |

30 Mar 2020 - Finding Defensive Funds in a Disorderly World | Insync Fund Managers

|

Australian Fund Monitors' CEO, Chris Gosselin, speaks with Monik Kotecha, CEO of Insync Fund Managers. Monik is the Chief Investment Officer of both the Insync Global Capital Aware Fund and the Insync Global Quality Equity Fund and in this video discusses his views on current market conditions and how he expects his funds to perform. Year to date (as at the end of February 2020), the Insync Global Capital Aware Fund and the Global Quality Equity Fund are up +4.48% and +2.14% respectively against AFM's Global Equity Benchmark which is down -2.05%. |

30 Mar 2020 - Performance Report: Datt Capital Absolute Return Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Our investment objectives are: 1) To minimise the risk of permanent capital loss 2) Generate a net return of 10% through the economic cycle An unconstrained, concentrated approach focused on superior risk-adjusted returns. The investment strategy: - targets long-term capital growth in a prudent manner, with an emphasis on capital preservation and low volatility in returns - aims to outperform in markets where equities are down - diversifies investments across asset classes and duration to reduce risk while maintaining relatively concentrated exposure to attractive investment opportunities - is an application of the Manager's investment process, that has no institutional constraints and is completely benchmark unaware |

| Manager Comments | In February the Fund's equity performance was negative, driven by the fall in their two largest exposures - Adriatic Metals and Alkane Resources. Datt Capital exited their holding in Whitehaven and added to their position in Alkane Resources. The manager continues to monitor a number of fixed income instruments in the distressed and special situation space. The Fund has no current derivative exposure. Current equity exposures are Afterpay, Adriatic Metals, Alice Queen, Alkane Resources, Argonaut Resources, Valmec and Yandal Resources. |

| More Information |

27 Mar 2020 - Hedge Clippings | 27 March 2020

|

|||||||||||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

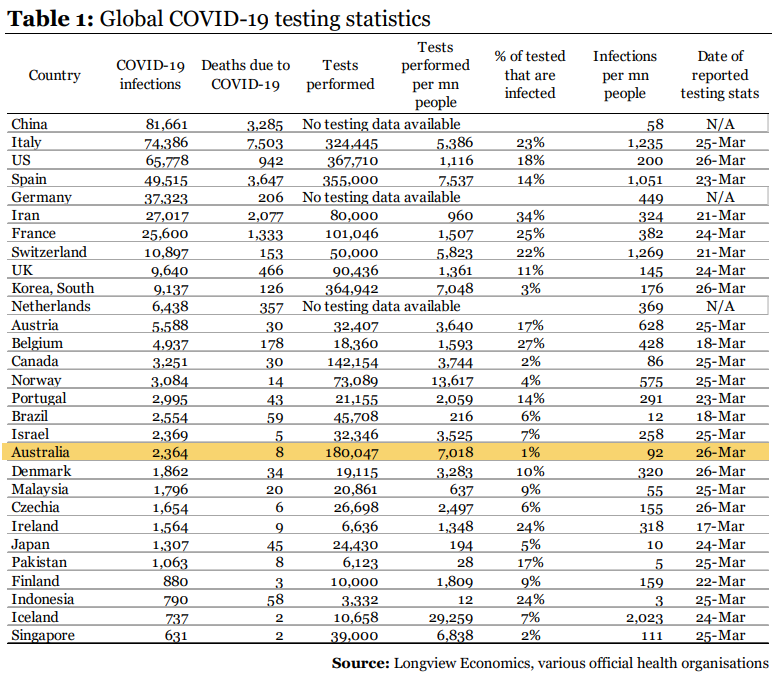

27 Mar 2020 - COVID-19 | Analysis from Longview Economics

27 Mar 2020 - Performance Report: Bennelong Twenty20 Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is managed as one portfolio but comprises and combines two separately managed exposures: 1. An investment in the top 20 stocks of the markets, which the Fund achieves by taking an indexed position in the S&P/ASX 20 Index; and 2. An investment in the stocks beyond the S&P/ASX 20 Index. This exposure is managed on an active basis using a fundamental core approach. The Fund may also invest in securities expected to be listed on the ASX, securities listed or expected to be listed on other exchanges where such securities relate to ASX-listed securities.Derivative instruments may be used to replicate underlying positions and hedge market and company specific risks. The companies within the portfolio are primarily selected from, but not limited to, the S&P/ASX 300 Accumulation Index. The Fund typically holds between 40-55 stocks and thus is considered to be highly concentrated. This means that investors should expect to see high short-term volatility. The Fund seeks to achieve growth over the long-term, therefore the minimum suggested investment timeframe is 5 years. |

| Manager Comments | Bennelong's view is that the volatility currently plaguing markets is telling of markets' fear of uncertainty. At this stage, Bennelong believe the virus is a short-term disruption and that it could pass within the next few months. Once it has passed, they expect the outlook for equities to be favourable; markets will be looking ahead with the benefit of low interest rates, possible fiscal stimulus and some pent-up demand. Looking beyond the short-term view of the market, Bennelong have taken the opportunity to selectively up-weight their position in holdings that were heavily sold off but in which they continue to see long duration growth that will resume in time. They are also proactively managing risk by focusing on quality, and in particular, durable businesses with strong balance sheets. |

| More Information |

27 Mar 2020 - Performance Report: DS Capital Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment team looks for industrial businesses that are simple to understand; they generally avoid large caps, pure mining, biotech and start-ups. They also look for: - Access to management; - Businesses with a competitive edge; - Profitable companies with good margins, organic growth prospects, strong market position and a track record of healthy dividend growth; - Sectors with structural advantage and barriers to entry; - 15% p.a. pre-tax compound return on each holding; and - A history of stable and predictable cash flows that DS Capital can understand and value. |

| Manager Comments | The Fund's focus on protecting investors' capital in falling markets is highlighted by the following statistics (since inception): Sortino ratio of 2.96 versus the Index's 1.01, down-capture ratio of 26.05%, largest drawdown of -8.80% versus the Index's -13.73%, and average negative monthly return of -1.43% versus the Index's -2.59%. |

| More Information |

26 Mar 2020 - Finding Defensive Funds in a Disorderly World | Kardinia Capital

|

Continuing the theme of "Defensive Funds in a Disorderly World", Australian Fund Monitors' CEO, Chris Gosselin, speaks with Kristiaan Rehder, Portfolio Manager of the Bennelong Kardinia Absolute Return Fund. Kristiaan shares his views on the current economic climate and how he expects the Fund to perform. To highlight the Fund's defensive nature, its largest drawdown throughout the GFC was -6.02% versus the ASX200 Accumulation Index's -47.19%. As at 29 February 2020, the Fund had returned +4.50% YTD against the Index's -3.08%. |