NEWS

21 Sep 2018 - Hedge Clippings - 21 September, 2018

The HRC has produced (amongst other things) some memorable moments over the past 6 months, ranging from the destruction of the AMP's reputation, and that of its chairperson, the collapse of a witness in the midst of his testimony (which might have saved him from further immediate embarrassment), and overall the understanding that the consumer invariably comes second in dealings with the banking system.

The past two weeks have shone a similar light on the insurance sector, with equally horrific tales of appalling, and in some cases allegedly criminal behaviour, generally inflicted on those most vulnerable. Maybe, as one who has had to deal with an insurance company over a claim, or been on the end of a sales call, there weren't expected to be too many surprises, but surprises there were.

Charging deceased people premiums? Tick. Denying claims without just cause? Tick. What was of concern was the size of the organisations, and the seniority of those in the know, with the ability, but not the inclination, to prevent such practices.

If one had to have sympathy for a witness appearing before the HRC however, it was today's victim, Sally Loane, CEO of the Financial Services Council, the peak industry body with the unenviable task of representing, amongst others, the insurance sector. Without being the perpetrator of the actions of her members, she was made to look responsible for endorsing their collective misdeeds.

It made for uncomfortable TV, and will no doubt be replayed again and again on tonight's news and current affairs channels. With nowhere to go without condemning or damning her members, Loane resembled someone crossing a river full of crocodiles on a tightrope, whilst dodging well-aimed spears from the other side, all the while with no protection other than "I'm the CEO, and have an expert better able to answer that technicality".

Of course in her position, one question was unanswerable: Why is the insurance industry not subject to the same law that requires directors (and others) to "deal honestly, efficiently and fairly" as required by the Corporations Act?

The problem, however, is that even when applied to the rest of the banking and financial services sector, the issue seems to have been well and truly swept under the (boardroom) carpet.

Moving away for the HRC (which by the way is due to produce its interim report in time for next week's "Hedge Clippings") this week saw the US 10 year bond rate poke its head above the 3% mark again. With multiple opinions on the downward direction of Australia's housing market, one thing remains clear: The rising housing tide we've seen was caused significantly, if not totally, by 10 years of unrealistically low interest rates, and easy credit.

As those rates rise, and easy credit becomes a distant memory, so that tide will recede, most likely very quickly. Add to that the threat of Bill Shorten and a potential limit on negative gearing, and the outgoing tide may become a flood, with resultant effects on the economy as a whole.

14 Sep 2018 - Hedge Clippings, 14 September, 2018

GFC turns 10, Hedge Funds Rock turns 17!

10 years on from the collapse of Lehman Brothers, the trigger that fired a bullet that was to become known as the Global Financial Crisis, and there are a number of voices warning that whilst everything in the garden may seem rosy, there are worries that markets are heading for further turbulence.

As the recent AFM Insights article from Arminius Capital explains, the US equity market has risen by 350% from its March 2009 low, but the real growth has been in debt, thanks to central banks flooding the system with credit, and allowing eager corporate and individual borrowers to take advantage of impossibly low interest rates.

Other voices are spreading the same cautionary tale. At this week's Australian AIMA (Alternative Investment Management Association) conference, a number of respected voices, including Regal's Philip King, warned of the dangers of the valuations of some growth stocks which he fears will be unsustainable in due course.

While King is warning of the danger, he is also looking forward to the opportunity - or opportunities - which will present themselves on the short side. Given the track record of Regal's various funds, which have provided twelve-month returns of between 28% and 74%, and annualised returns ranging from 13% to 35% over a long period which included the GFC, albeit with commensurate volatility, it would be well worth listening to King's voice of experience.

The AIMA conference was followed by last night's 17th annual Hedge Funds Rock event, which combined recognition of the best performing managers across eight categories, along with raising funds for well worth charities, including Redkite which supports the families of children with cancer - with the total raised over 17 years now well over $2 million. Like the industry itself, this event has evolved over the past 17 years from a bunch of managers letting their hair down at Sydney's legendary Basement, through to last night's excellent event for almost 500 held at the Westin's Ballroom.

The award for the individual contribution to the Australian hedge fund industry went to Bronte Capital's John Hempton. For those not aware, Hempton's skills have been particularly evident in uncovering dodgy, if not fraudulent, accounting, and shorting overvalued companies. One person who will not be impressed either by the industry's recognition of Hempton, or by his expertise on the short side, would be Harvey Norman's Gerry Harvey, who once again this week came out spitting chips about the level of short sales in his beloved company.

Without going into the rights or wrongs of short selling, Hedge Clippings' view is that the best way to avoid short sellers is to clean up one's balance sheet, have accurate and transparent accounts, and focus on managing the business at hand (and in Harvey's case that means retailing, not farming). Of course that doesn't cover the situation of short sellers of stocks that are considered vastly overvalued, but if anything they are helping to ensure that valuations don't become even further stretched.

7 Sep 2018 - Hedge Clippings, 7 September, 2018

Sometimes on a Friday Hedge Clippings wonders what on earth we're going to write about. Then you get days like today where there is plenty. I guess it's either a feast or famine.

So where to start? Well, it looks as if Donald Trump is going to be upping the ante by confirming his $200 billion trade wall (that was supposed to be "war", but I guess "wall" will do just as well) with China. It is yet to be determined whether this is going to develop from a significant skirmish into a full-blown battle, and also, depending on one's point of view, whether the damage will hit the Chinese or the American economy the most.

The current view is China the most, but the answer is quite possibly both, and of course, the rest of the world will suffer serious collateral damage. However, irrespective of one's view of Trump's rhetoric, it is unlikely to be empty as he tries to prevent what he sees as China's domination of, if not the world economy, at least that of most emerging markets. Depending on whether you are American or Chinese will no doubt determine which side of the fence you sit.

Overnight Trump received an unexpected vote of confidence, or reference if you like, from Kim Jong-un who is reportedly aiming at denuclearising North Korea before the end of the Donald's first term. China's President Xi Jinping may not be so easy.

Back home in Australia ASIC seems to have been encouraged by the Hayne Royal Commission, announcing legal action against NAB for charging customers fees for no service. Expect more of the same as ASIC moves from a policy of behind doors negotiation and penalties, through to putting perpetrators in court, even before the end of the HRC. The difficulties of getting an actual conviction however, and what the court may or may not decide as retribution for any proven wrongdoing, remain to be seen.

As predicted in last week's Hedge Clippings, two other big banks played catch up with the rate rise from Westpac, and adding a couple of bps for good measure, while the RBA kept interest rates on hold as expected on Tuesday, signalling that the economy was in good shape. By Wednesday it was evident just how good a shape the economy was in, with revised numbers lifting GDP by 3.4% over the year to June. There doesn't appear to be a negative cloud on the domestic economic horizon at the moment (unlike the political one) unless the slowdown in the housing market, which the RBA has been seeking for some time, accelerates further and overly damages consumer confidence.

Finally, there were warnings regarding the dangers of passive investing. We would have to declare a vested interest in this regard as we specialise in the actively managed fund sector. Whilst we can certainly see the benefits of passive investing as a way of reducing investment costs, it can distort valuations, particularly in rising markets, based on the premise of "a rising tide lifting all ships".

The risk of passive investing however comes as markets turn downwards, when index and passive funds will see indiscriminate outflows. Just as the rising tide lifts all ships, so too it lowers them when it falls. That's when actively managed and hedge funds come to the fore, (and thus justifying their fees) by protecting capital and hopefully without adding to the outflows.

While on the subject of performance, we frequently normally keep fund performance updates to a fairly dry commentary. However, the Bennelong Long Short Equity Management's (BLSEM) August performance of 10.59% (see report) was something special, even if the manager was at pains to point out that it should not be taken as normal. We can safely mention this fund as it is closed to new investors, but it is a terrific example of how a well-managed hedge fund can work. The fund has returned 16.77% annualised after all fees over 16 years since its inception in February 2002.

An important measure of a fund's risk is the Down Capture Ratio or DCR - in BLSEM's case of minus 201%. For those not familiar with the Down Capture Ratio, a DCR of 100% indicates that the fund falls in line with the market in negative months. A figure of less than 100% indicates that the fund falls less than the market. A negative number indicates that the fund rises when the market goes down. Negative Down Capture Ratios are rare but not unknown, and one of -201% is extraordinary, particularly over a period of 16 years. This was no flash in the pan!

31 Aug 2018 - Hedge Clippings, 31 August 2018

There was plenty of teeth gnashing this week over Westpac's "out of cycle" mortgage rate rise, including from the new PM and his equally new treasurer. It's always amazing how banks are to blame when rates rise, while the politicians of the day (ok, they last a little longer than a day, but you never know) take the credit when rates fall.

While banks are fair game when they misbehave, mislead ASIC (ok that was NAB and AMP, but same, same), charge clients fees for no service etc., what is essential is that their basic operations - i.e. the margin between their cost of funding and the rate they charge their customers - are profitable. Note we didn't say fair and reasonable!

So if their funding costs (particularly offshore) are increasing, the obvious result is that mortgage rates will rise as well. We're in a global village, and the banks' offshore funding sources - estimated to be 35% - are global as well.

Given that rates have been so low for so long, and that we've seen US rates rise (and about to do so again), there should be no surprise that eventually they will increase. There have been plenty of warnings. The problem is that while rates may be moving up, and lending practices have been tightening over the past 12 months, the banks have been falling over themselves for the previous 8-10 years to shovel credit onto the willing consumer, thereby driving up household debt to record levels, and helping to fire the furnace under residential property.

Of course consumers should shop around, but that won't help them much, simply because the other banks and lenders will follow suit sooner rather than later. And while the RBA cash rate may not shift off its current floor of 1.5% for a while, with US rates tipped to rise as soon as next month the only way from here is up.

Meanwhile back to the Hayne Royal Commission: Amidst all the drama and revelations from the HRC over the past six months, what has been amazing is the sheer volume of intelligence that the Commissioner and his Counsel seemed to have lined up to skewer some hapless witness or another.

It stands to reason that much, if not most of this would have been sourced from the regulators - ASIC and APRA, and the FOS. Which begs a question: If the regulators had the information, why weren't they able to line the naughty boys and girls up themselves?

Was it the system, the regulations, a lack of resources, a lack of intention, or what?

Hedge Clippings' most likely answer is that many in the financial services sector treat ASIC and APRA, the corporate cops, the way most motorists treat the highway patrol (until they need them). There would seem to be an attitude of "get away with what you can, when you can, and hope you don't get caught". Australians have a long history - dating back to the earliest days of the first fleet - of having a well-honed disregard for regulations and authority. Maybe it's all just a game to see how far you can go.

That's worked up until now. The HRC should lead to some miscreants facing criminal prosecutions - and the resulting time in the sin bin that may well follow!

24 Aug 2018 - Hedge Clippings, 24 August 2018

Where's the leadership we deserve?

At a time when the government needed leadership, unity and stability, the combination of personal ambition and the desire for revenge delivered exactly the opposite. Irrespective of who one believed should be in the top job, the country deserved better, and only time will tell if it gets it.

Personalities, and personal ambition, and in our view a misreading of the mood of the majority of people in the street, has resulted in the running of the country put to one side, while a bunch of self-centered politicians have indulged themselves, in just the same way as their predecessors did.

The real tragedy is that the economy, while not booming, is sound and growing, employment is growing, inflation and interest rates are low (probably too low) and taxation, except for the "big" end of town, is coming down. The federal budget is forecast to make it back to a surplus way ahead of forecast, and given the potential change of government at the next election, that's probably now in doubt.

If there's one good (?) thing to come out of the debacle in Canberra it's probably that the chief destabiliser and those pulling the strings didn't win, although they'll no doubt be happy enough they've dispatched the one person - now the previous PM - they didn't want to win. The question is will they now be satisfied and pull their heads in, or will they work to destabilise another moderate?

If there's one good (?) thing to come out of the week's media focus it is that the Hayne Royal Commission wasn't on the front pages.

Meanwhile AMP's appointment gets out thumbs up - experience and ability, and hopefully prepared to make the changes necessary - or enforced by the HRC and future legislation. Hedge Clippings has previously been critical of both AMP and David Murray, but this is a good and smart move. However, there's still a long, long way to go.

17 Aug 2018 - Hedge Clippings - 17 August 2018

Hayne Royal Commission - the ongoing revelations are taking their toll on so many reputations:

ANZ, NAB, IOOF, and Ric Allert from AMP Trustees were enlightening this week at the HRC, but for all the wrong reasons.

AMP Trustees simply haven't been doing what they should have - namely looking after other peoples' money. Rather it seems they're simply looking after themselves and AMP.

Meanwhile, IOOF's board notes are akin to a second former's (not sure if in junior or senior school).

NAB played with ASIC, and indulged in some cute information timing.

ANZ played with the rules, and played with …. Other peoples' money!

It seems not to matter if it occurs at "Industry" or "For Profit" funds. Of course Hostplus need to spend hundreds of thousands of dollars taking prospective clients to the Australian Open tennis. Oops, 'so I had to take the wife and kids as well to fill a few spare seats'. What, no fund members could be found at short notice and invited along?

And it's a great use of members' funds to sponsor the footy - but I wonder which team the Hostplus CEO barracks for? Oh! Surprise, Surprise, the Richmond Tigers. And who sponsors the Tigers (and admittedly some other clubs)? Hostplus! I'm sure there are always a few seats in the sponsor's box at the MCG reserved for Hostplus' super members.

And a staff lunch? Forget the local restaurant across the road from the Hostplus offices in Melbourne's William Street. We'll just pop up the road to the Flower Drum at the Paris end of town.

Full marks to Hostplus for being a top performing fund. But that should be enough to get employers and others to park their retirement savings with them. Not for taking family to the tennis, CEO's of employers to the footy, or staff to the "Drum" for a not inexpensive Chinese meal (trust me, I've had a few there in days gone by) .

Remember, it's other peoples' money. That's taking the old adage of "looking after it as if it is your own" just a tad too far!

10 Aug 2018 - Hedge Clippings, 10 August, 2018

Are we becoming immune to poor corporate governance?

It would be unfair to call it boring, but the Hayne Royal Commission (HRC) is becoming so repetitive it's almost predictable, so much so that it's losing its shock factor.

Misdeeds at the big end of the financial system? So what? We all either knew that, or suspected it, and by now we have heard it all (or much the same) before. No wonder the banks fought so hard against the RC being established in the first place.

In any other area, the charging of fees for no service would be called for what it is - a SCAM. If perpetrated by an individual advisor they'd be struck off in quick time. But at executive and board level different rules obviously apply. The key point going forward is not how much financial pain is inflicted on executives via lost or reduced bonuses, or penalties on the banks themselves (which of course flow on to shareholders), but the potential for criminal charges to be laid.

That, to excuse the pun, might help to arrest the problem.

Whilst this might seem extreme, the reality is that theft has occurred, deliberately, knowingly, and frequently - and worse still more often than not at the expense of those most vulnerable, both as a result of their lack of financial interest or knowledge, or those least likely to be able to afford it in terms of their financial security in the future.

What is astounding is that, like at AMP, the senior ranks of the banks such as CBA and NAB knew of the theft, and did nothing to fix it - even worse, NAB did whatever they could to obfuscate to protect their position, including asking Mr Hayne to keep it confidential.

Nothing will focus their minds more than the prospect of some quiet, reflective time in a green uniform, with set meal times, and limited visiting hours.

CEO's and chairmen (and women, although there's been little apology we can recall from AMP's previous Chair) may apologise' but saying sorry is one thing. Changing the systemic cultural and operational problems are another.

By contrast, Australian Super's Mr Silk gave a "smooth as" performance, partly as a result of what seemed to be a less severe interrogation, itself quite possibly because there have been fewer misdemeanours uncovered on his watch. We'd still like to see the HRC delve into where the fees behind industry super flow - over and above purchasing shares in the New Daily. That problem's unlikely to resolved while the boards and trustees of industry funds are not required to have independent members.

Unfortunately the superannuation pie is so large, so opaque, and in many respects so distant from the majority of contributors and beneficiaries that it is going to take some serious government intervention to change the current malpractices. And while talking of change, with an election looming in less than a year from now, it's likely the "for profit" sector is likely to be firmly in Canberra's sights, while the "industry" sector will remain as opaque as ever.

Pity the poor punter!

3 Aug 2018 - Hedge Clippings, 3 August 2018

David Murray takes (yet another) tilt at ASIC

David Murray's antipathy towards ASIC goes back a long way so it was always going to be interesting to see if he would temper his comments once he took the chair at AMP.

Far from being conciliatory, this week he upped the argument considerably, whilst conveniently forgetting, or more correctly ignoring, the fact that AMP's track record with the regulator is less than exemplary.

For example, the chairman and board lying to ASIC is not something one would really like to have on one's corporate tombstone - or CV.

Neither is charging investors for services not received, nor consistently favouring in-house and underperforming products, and thereby making a mockery of the term "independent financial advice".

One presumes that David Murray's approach to ASIC follows the line that the best form of defence is "attack, attack, attack", or that other well tried defence, "deny, deny, deny".

There's no doubting that the level of compliance and regulation required by ASX listed companies (and unlisted ones if it comes to that) is significantly greater than it once was, but how each one implements ASIC's guidance can vary from company to company. What is quite obvious is that AMP's previous chair and the board took a very detailed and hands-on approach to management, and as the record shows, quite simply failed in the execution.

Going forward expect more entrenched criticism of ASIC from David Murray, but what will now be interesting will be who he appoints as CEO, and how they both manage to change the culture, practice and business model at AMP (assuming Murray intends to do so).

The market and the AMP share price will no doubt tell the story over time.

Meanwhile, next week sees a resumption of the Hayne Royal Commission, this time around focusing on the Superannuation sector. No one is likely to be surprised (although they might be shocked) at the revelations that will no doubt be exposed.

27 Jul 2018 - Hedge Clippings, 27 July 2018

The Royal Commission and the Boiling Frog

Hedge Clippings is reminded of the old adage of the boiling frog - which for those not familiar with it went as follows: If you put a frog into a pot of cold water and put it over a low flame for a long time, the frog would eventually end up "poached". However, if the frog was dropped into a pot of already boiling water it would instantly react by jumping out, and be saved.

In financial services parlance the industry has been on a long slow journey towards being poached, although maybe the Hayne Royal Commission has arrived just in time to create a "boiling frog" moment which will result in it being saved - although not without a severe scorching, and only if the powers that be, and those in charge at the big end of town, take the opportunity to change.

The (long overdue) Hayne Royal Commission has shone - or is shining - a welcome (depending on where one stands) torch on every aspect of the financial services sector. This has now been followed by the Productivity Commission's 500+ page report into Superannuation, particularly focusing on fees and poor performance, and with suggestions of a Top Ten "Best in Show" default system. Now, not surprisingly, ASIC is going to give added focus on the sector, whilst Treasury has also weighed into the debate.

Why has this been able to occur?

Simply because the majority of consumers are not financially literate, and of those that are many have the knowledge to be "self-directed". Meanwhile, most (although not all) of those heading up the industry are very financially literate, and stand, or stood, to make a motza out of the system, the lack of real scrutiny, and a lack of ethics.

Whilst easy to point the finger at the financial advisor actually providing advice to the consumer, the reality is that the real cause is the problem is the systematic and conflicted structure of the industry - be it banking, superannuation, mortgage broking or financial advice. The vast majority of advisors would prefer to give their clients independent financial advice - as evidenced by the significant numbers choosing to do so by moving to an independent AFS licensee.

Back to the Royal Commission. Round 5 is due to start on 6th August, focusing on superannuation, and will run for 2 weeks.

Round 6, slated for 10 September, will cast its eye on Insurance, while Round 7 on the 19th November will focus on policy questions arising from rounds 1-6. In between time the CEO's from the big end of town will get their time in the witness box, and anecdotal evidence suggests their minions are putting in long hours beavering away to make sure it won't be too uncomfortable for them.

Some hope.

Talking of hope, Hayne's preliminary report is/was due no later than 30 September, and the final report due by 1 February (2019). Happy Christmas holidays to Mr Hayne and his team trying to meet that deadline.

20 Jul 2018 - Hedge Clippings, 20 July 2018

It seems fund rankings are in the news in the past couple of days, whether it be super funds, or managed funds available outside super.

Taking super funds first, there seem to be two schools of thought, each not surprisingly probably dependent where the self-interest of the thinker lies.

Super Ratings tables clearly show that industry super funds have outperformed the bank and for-profit sector funds, and while they will understandably promote their performance and claim that it is due to lower fees, they will also rightly claim that asset allocation plays a significant part in their success.

On the other hand Colonial has argued that it is not a simple comparison and the options available, along with the demographics of the fund members, are significant. What is relevant is that the massive number of options and alternatives available make it incredibly difficult not only to compare funds and the returns, but also for the investor to choose the appropriate option.

Whatever the arguments the logic and argument from the Productivity Commission that across the board fees be reduced to match those available in comparable products and jurisdictions overseas, but that there should be a simple default option of the top 10 performing funds.

The complexity of the current array of choices simply makes it impossible for the average person to make an informed choice.

Moving on to managed funds outside superannuation, the tables in today's Financial Review, supplied by Mercer, make interesting reading and will equally no doubt be promoted by each of the relevant funds.

What is interesting is that when Australian Fund Monitors analyses results to the end of June (bearing in mind not all funds have reported as yet) for the past one, three and five years, there are some significantly interesting trends:

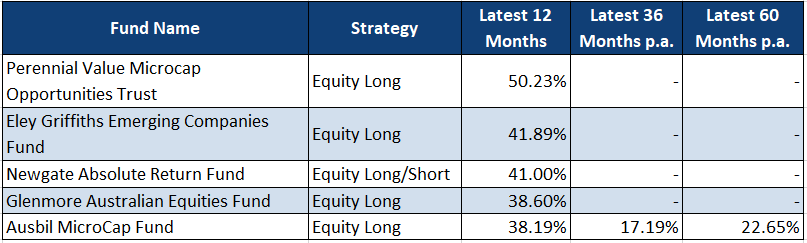

- Firstly when it comes to 12 month performance Australian equity funds (whether long only or long short), four out of the top five were early stage managers who do not yet have a three or five year track record.

- The emerging or micro-cap sector dominates, having been particularly strong over the past 12 to 24 months, particularly with the Banks and Telstra taking a battering.

- All are concentrated - it is simply impossible to provide these kind of returns when the ASX accumulation index returned 13% without significant stock picking skills (as opposed to Super, where asset allocation is a primary driver of performance).

Finally, in a rising market, with the exception of Newgate and Smallco, Long Only funds dominated.

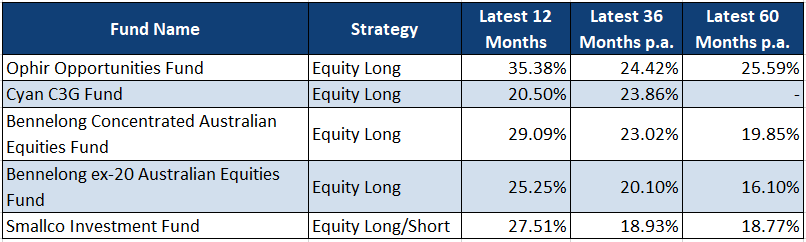

Taking the top five performing funds over three years, the table looks like this:

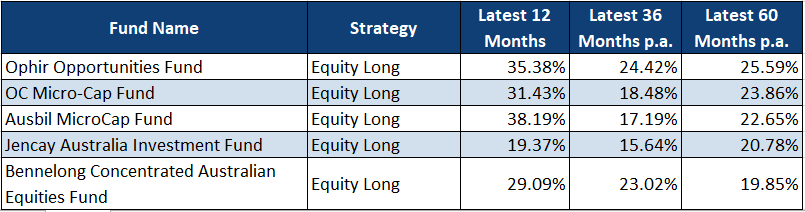

Then taking the best performers over five years, the results are as follows:

Before we receive a raft of complaints from those managers with better returns in a specific year than those listed, we applied a consistency filter, which with the exception of the earlier stage funds in the one and three year tables, took out any fund with a performance of less than 15% over either one, three or five years. Equally, the above tables only include equity based funds with a geographic mandate of Australia and New Zealand, so Asian and Global funds were excluded.

Methodology is always important when ranking and filtering funds, and purely selecting the top performing funds based on returns is always risky, simply because looking at returns, without looking at risk factors such as volatility , Sharpe ratios, draw downs and up and down capture ratios, doesn't tell the whole picture.

And of course the overall disclaimer that "past performance is no guarantee of future returns" applies - although we consider it to be highly relevant.