NEWS

20 Jun 2023 - Australian Secure Capital Fund - Market Update May

|

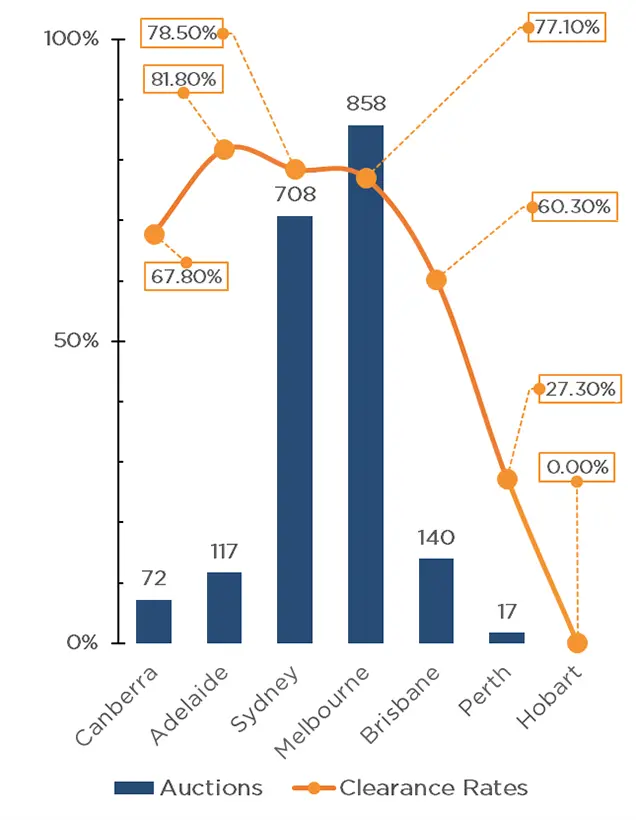

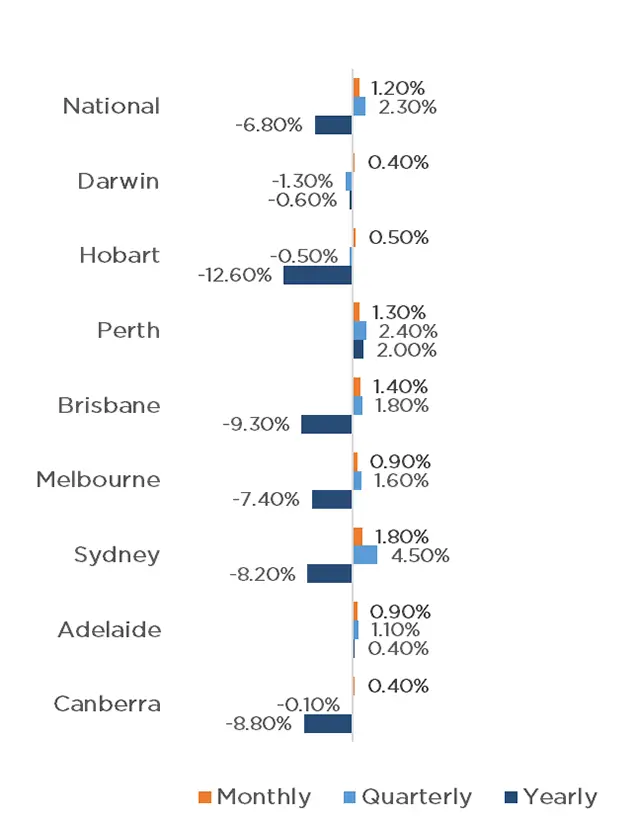

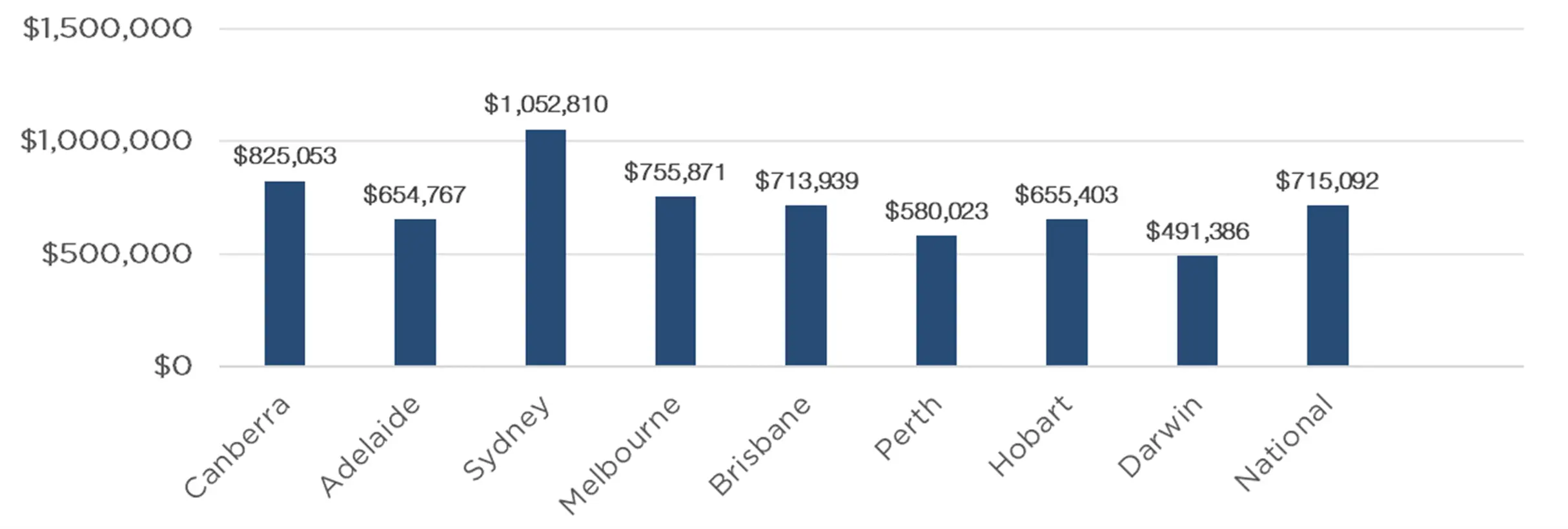

Australian Secure Capital Fund - Market Update May Australian Secure Capital Fund June 2023 The Australian housing market continues to bounce back despite further interest rate rises, with CoreLogic's national Home Value Index rising by 1.2% in May. The capitals and the regions both performed strongly, with all capital cities recording a month-on-month increase, and only regional Victoria decreasing. Once again, the capital cities performed well with Sydney leading the way with a 1.8% increase, followed by Brisbane (1.4%), Perth (1.3%), Melbourne (0.9%), Adelaide (0.9%), Tasmania (0.5%), Darwin (0.4%) and Canberra (0.4%). Performance across regional areas was also largely positive, with only Victoria experiencing a reduction in values (-0.5%). The Northern Territory and ACT, maintained values, whilst New South Wales (0.5%), Western Australia (0.5%), Tasmania (0.7%), Queensland (0.8%) and South Australia (0.9%) all experienced growth. The property market continues to experience a lack of supply, with the last weekend of May holding just 1912 auctions, well below the 3226 that occurred on the same weekend in 2022. This lack of supply is likely the factor propping up property prices. Melbourne (858) and Sydney (708) led the way with significantly more auctions taking place than the rest of the country with Brisbane (140), Adelaide (117), Canberra (72) and Perth (17) all well below previous year figures. Whilst the total auctions were down considerably, clearance rates were exceptionally high, with a weighted average of 75.9% across the capital cities, well above the 59.3% last year. Adelaide had the highest clearance rate across the country, with 81.8% (up from 73.6% last year). Sydney and Melbourne also performed strongly with 78.5% and 77.1% respectively, well above the 56.4% and 60.4% last year. Canberra recorded 67.8% (64.4% last year) with Brisbane also outperforming last year, with 60.3% (51.2% last year). Perth was the weakest performance of the cities, with only a 27.3% clearance rate, down from 42.1% last year. Clearance Rates & Auctions 22nd - 25th of May 2023

|

16 Jun 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - May Glenmore Asset Management May 2023 Equity markets were mixed in May. In the US, the S&P 500 rose +0.3%, the Nasdaq rebounded sharply +5.8%, whilst in the UK, the FTSE 100 declined by -5.4%. In Australia, the All Ordinaries Accumulation index fell -2.6%, driven by ongoing investor caution around the impact of interest rate hikes by the Reserve Bank of Australia. The technology sector was the top performing sector, as investor sentiment continues to recover after materially underperforming in 2022. Consumer discretionary was the worst performer, with multiple ASX listed stocks flagging consumer spending is weakening due to rising interest rates and cost of living pressures. Gold stocks also underperformed in the month. Small cap stocks significantly underperformed as investor funds moved to the perceived safety of larger cap stocks. As an example, on the ASX, the Emerging Companies index fell -6.4%, whilst the Small Ordinaries Accumulation index declined -3.3%. In bond markets, the US 10 year bond yield rose +20bp to close at 3.66%, whilst the Australian 10 year bond rate increased +26bp to 3.60%. Both movements were due to increased inflation expectations. In currency markets, the A$/US$ declined -2% to close at US$0.65. Commodities were broadly weaker in May. Brent crude oil declined -8.6%, copper -6.5%, iron ore -5.0%, whilst gold -1.2%. Thermal coal fell sharply, down -27.3%. The numerous interest rate hikes implemented by the Reserve Bank over the past 12 months are clearly having an impact on consumer spending, as evidenced by multiple ASX listed retailers announcing profit downgrades in recent weeks. Whilst some components of the CPI basket are declining (eg. Commodities), other parts such as power prices and wages are still rising (eg. Recent 5.75% award wage increase which commences on 1 July). Services inflation in particular, continues to be too high, as businesses across the board increase prices. With regards to interest rates, given inflation is proving more difficult to reduce to the Reserve Bank's targeted band of 2%-3%, it now appears likely that the RBA will need to lift rates 2-3 more times in this cycle. One theme that continues to impact the fund's relative performance versus benchmark is the underperformance of small/mid cap stocks on the ASX, noting the fund has a strong skew to this part of the market. Whilst this has been negative for the performance of the fund in recent months, we strongly believe this focus will produce some outstanding buying opportunities for longer term focussed investors over the next 6-12 months. The Fund continues to see numerous attractively valued stocks across a wide range of sectors and is well capitalised to take advantage of this current short term investor bearishness. Funds operated by this manager: |

15 Jun 2023 - The Rate Debate - Ep39 - Monetary policy changing the goalposts

|

The Rate Debate - Ep39 Monetary policy changing the goalposts Yarra Capital Management June 2023 Australia has been delivered another rate hike in an attempt to "quash" inflation. This month Darren debates with special guest Tim Toohey, Head of Macro and Strategy, the risks posed by rising wages and weak productivity growth, and why the RBA continue to change its goalposts to drive down inflation.

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

14 Jun 2023 - Demographics: how population changes will reshape global growth

|

Demographics: how population changes will reshape global growth abrdn June 2023 Low fertility is a problem for countries. Many developed markets (DMs) are starting to struggle with ageing populations and their associated social and economic issues. Meanwhile, it could be a problem even for emerging markets (EMs), which face a slowdown in the growth of their 'working-age' populations over the next 30 years. Last year, we published two papers - Emerging market demographics 'in focus' - implications for growth and the rise of the global middle class and Emerging market demographics 'in focus' - implications for equilibrium real interest rates - that examined the issues in developing economies. Our latest on the topic, Towards the peak: How the rise and fall of populations affects economic growth, seeks to advance the discussion by looking at things from a global perspective and asking what this may mean for investors. Population divergenceThe world's population is expected to grow by a further 1.7 billion people to reach 9.7 billion by 2050, according to the latest United Nations data. However, these numbers hide big differences between and within EMs and DMs. For example, the US' population is expected to increase by some 37 million by 2050, while Germany's could fall by some 4 million over the same period. Lower fertility in some European countries could be partially alleviated by immigration. Meanwhile, the number of people in developing economies is expected to continue growing, driven mainly by countries in Africa and developing Asia. That said, the population of the largest emerging market, China, began shrinking in 2022. Its impact on growth...EMs will drive global economic growth - accounting for some 75% -- in the coming decades. China and developing Asia alone will be responsible for some 60% of that. Despite their own demographic challenges, EMs will likely grow between two and 2.5 times faster than DMs (see Chart 1). Chart 1: Global GDP increasingly driven by Asia Source: Haver, abrdn, as at February 2023 India and Indonesia are set to join China among the world's top seven largest economies by 2050. What's more, Nigeria will be just outside the top ten (No. 11), while the Philippines, Pakistan and Vietnam will occupy places within the top 25. India and Indonesia are set to join China among the world's top seven largest economies by 2050 On the other hand, big oil producers - Russia, Saudi Arabia and Norway - will slip down the rankings as the world transitions to low-carbon energy sources. We found in our two previous papers that, while the percentage of 15-64-year-olds in EMs (often used as a proxy for the working-age population) is shrinking, the impact on growth isn't as bad as feared because social changes mean that people start and stop work later. What's more, there's a lot of scope for human capital - the economic value of a worker's skills and experience - to grow in EMs as more people attain higher education levels. That said, the next three decades will see labour playing a less important role in potential growth, as demographics hold back capital-stock growth. This means potential growth could fall close to zero in the Eurozone and Japan by 2050. But China's ability to improve the quality of its workforce could help offset the effects of its ageing population. ...and impact on productivityProductivity has been in gentle decline for many economies since the 2007/08 global financial crisis and we don't see much hope for a return to the boom years of the 2000s. Commodity-exporting countries have experienced productivity decline for years, while institutional weakness and political instability pose risks in EMs. The potential for demographics to create negative feedback loops, including for productivity, could result in additional risks. Ageing populations can strain the sustainability of social welfare models and public debt, which could reduce public spending in other areas and spur emigration. These risks are greatest in the ageing societies of China, Thailand and developed Asia. Other at-risk regions include Latin America (excluding Argentina, Mexico and Peru), central and eastern Europe, Japan and the Eurozone area. Only a few markets could see productivity improve if a feedback loop operates between demographics and growth. Pakistan, the Philippines, Israel, Nigeria and South Africa are among these as they benefit from improving dependency ratios - due to relatively youthful populations and falling birth rates. What this means for investorsHere are five things for investors to consider:

Author: Robert Gilhooly, Senior Emerging Markets Research Economist and Michael Langham, Emerging Markets Analyst |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

13 Jun 2023 - Chat GPT and the implications of this new technology

|

Chat GPT and the implications of this new technology Magellan Asset Management May 2023 |

|

Magellan Investment Analyst, Adrian Lu explains what Chat GPT is, how it works and what impacts this could have on society. He also discusses what this means for Microsoft and Alphabet. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

9 Jun 2023 - Quay podcast: The surprising trends emerging in real estate

|

Quay podcast: The surprising trends emerging in real estate Quay Global Investors May 2023 Chris Bedingfield speaks with Bennelong Account Director, Mai Platts, about the latest results from reporting season, Quay's current portfolio positioning, the opportunities in residential and self-storage, and the ongoing impact of inflation and bank failures.

"Interestingly, based on the latest set of results, and remember the banking crisis started to occur in March, our companies by and large were still able to access the debt markets, and they've still been able to access credit through their banking relationships. We haven't seen any real major disruption yet in terms of what our companies are able to do."

Funds operated by this manager: Quay Global Real Estate Fund (AUD Hedged), Quay Global Real Estate Fund (Unhedged) For more insights from Quay Global Investors, visit quaygi.com The content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

8 Jun 2023 - Don't Worry About Beating the Market

|

Don't Worry About Beating the Market Marcus Today May 2023 |

Individual investors can march to the beat of their own drum, giving them a significant advantage over professionals.

It is a simple question and goes to the heart of any investor's journey. My answer is, do you want to beat the market? The benchmark indices were set up so you can measure your performance against a bunch of stocks and compare your performance with your peers. So who are your peers, and does beating them really matter? Fund managers love benchmarks, as it gives them the best marketing tool: beat the index, and you get to market the heck out of your fund. It is what the benchmarks were designed for. You get your own wiggly line of performance above the market wiggly line, and off to market you go. It is not rocket science. Magellan was brilliant at it. Here's my opinion on beating the market: it's rubbish. What is the point in outperforming the market if the market is going down? Your aim is not to beat the market, but to deliver an absolute performance. Your mission, if you choose to accept it, is not to beat the market but to make money. The idea is to create wealth, not lose less money than the index. The index, after all, does not always go up. When you are retired, try paying your bills and living life with the 'outperformance'. If the index has been going down for the last five years, and your portfolio hasn't gone down as much…well, good luck. Forget beating the benchmark. That may not get you there if the market is rubbish. Of course, the investment boffins will tell you that the index always goes up over time. You just have to pick that time! Instead of trying to beat the benchmark, you would be much better served by setting a target that your investment pie needs to reach over time, to allow you to enjoy the lifestyle (hate that word) that you desire. Absolute returns should be your goal. Benchmark returns are for funds that want to market their genius. Your goal should be that self-imposed target of growing your pie. One thing I know for sure is that investing is tough. There are no easy answers. Professional (?) fund managers find it tough. They have huge resources and a massive advantage over retail investors, and yet, they still fail. I sometimes find it worrying that so much effort has gone into so little improvement over an index ETF - especially if the benchmark is your thing. It will not guarantee that lifestyle you desire though. There are no guarantees with investing. Past performance is not indicative of future results. You only have to look at many fund managers' performance to see that - even Cathie Wood has the odd bad year. For retail investors, what you do have is flexibility and choice. Big funds cannot move that quickly. They think that a 5% cash holding is being defensive, but you could go to 100% cash. You do not move markets when you buy and sell. Stealth. It means that you have that flexibility. Use it. But use it wisely, as with any great power comes great responsibility. Tax is one issue and selling winners rather than losers is another. Want to Gain an Edge?How do you gain an edge to make absolute returns? The simple answer to gaining an edge is to use inside trading. Isn't that illegal? Of course, it is. And we do not want to go to the 'big house'. But when I talk inside trading, my definition is different. Inside trading, in my eyes, is using every piece of available information to try to gain an advantage. We all try to game an advantage after all. But how? Insider Trading means watching what directors are doing in their stocks. It means watching what the funds are doing. It means opening your eyes when you are walking around. Trying to derive clues as to the investment picture from everyday experiences. Read as much stuff as you can. Try to connect the dots. Use every weapon in your investment arsenal. Do not just rely on Technical Analysis alone. Don't rely on Fundamental Analysis completely. Do not swallow broker research whole. Being strapped to one method of investing limits you. Take a holistic approach. Look at what is happening around you. What products do you use and what do others use? The Franking EdgeWhen you look at the Australian market it is dominated by big resources and banks, big opportunities abound every day. We are also blessed with dividend imputation which makes us fairly unique in the world. As we approach the banking sector results and those fat franked dividends, use that to build wealth. Asset allocation and portfolio construction make a huge difference. Timing the market is tough. Sometimes being too cute is sub optimal. If you do not have the time or the inclination, and index performance is good enough for you, an Index ETF is the way to go. A200 or IOZ have the lowest fees. But if you really want to build wealth, then absolute performance should be your goal. Treat it like a job. Get serious about it. Making money requires effort. Making anything requires effort. Buying a charting program and having it spit out stocks to buy or sell is not the best solution. You need to embrace all the tools you can. Here at Marcus Today, we know of one member that has turned $150,000 into $50m in the space of a few years. All his own doing. Try doing that in an Index fund. That beats an ETF. How did he do it? Lots of research and belief in the project. Bit of luck too, no doubt. Always helps. But the more work you put in the luckier you will become. Author: Henry Jennings, Senior Market Analyst |

|

Funds operated by this manager: |

7 Jun 2023 - Why I think tech and small caps could rally this year

|

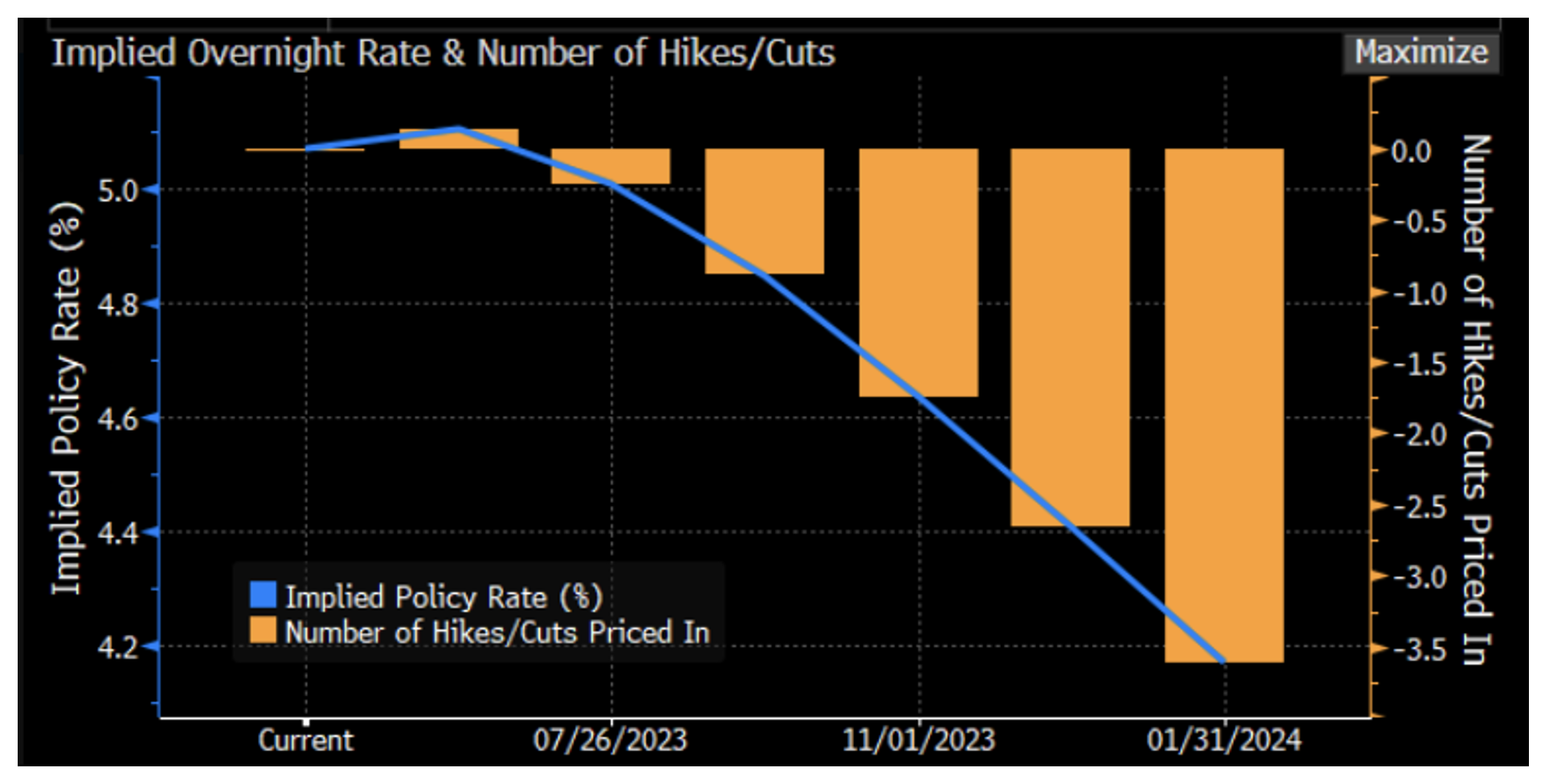

Why I think tech and small caps could rally this year Montgomery Investment Management May 2023 With inflation finally coming down, it looks like the U.S. Fed Reserve could soon stop lifting interest rates and start cutting, possibly as early as this year. That's great news for equity markets, which tend to rally when rates are lower. And it's particularly good news for technology stocks and small caps. U.S. interest rate markets currently reflect investor expectations for a rate cut by the Federal Reserve before the end of the year, and more than three rate cuts by the end of January 2024. That's just seven months away! Clearly, the market is rather bearish about the prospects for the American economy, but earnings season doesn't appear to lend any credence to predictions of an economic collapse. With earnings season now well underway, only a third of companies have yet to report. Of the two-thirds that have reported, earnings growth has come in at negative three per cent year-on-year, according to JP Morgan. The result, thus far, is significantly better than the negative nine to twelve per cent hitherto anticipated, and suggests some reappraisal of rate expectations might be necessary. Last week we saw the U.S. indices rally after a stronger than expected jobs report. In the not too distant past, news of strong jobs would be met negatively amid expectations of consequent rate hikes. Now, it seems, equity investors are enthused by strong jobs that a recession is less likely. Last Wednesday, Federal Reserve Chairman, Jerome Powell, reminded those investors expecting early rate cuts that the labour market remains robust if not hot. He also submitted the prediction that there will not be a recession in calendar 2023. Judging from the current reported results from corporate America, it certainly seems the Fed Chair is right. The Bloomberg chart in Figure 1. reveals current consensus rate expectations and confirms the noted expectations of at least three cuts before the end of January next year. The magnitude of the divergence between Powell's comments and the market's expectations is unusual. Figure 1. U.S. Rate cut expectations

Source: Bloomberg So, what needs to happen for the market to be right? While anything is possible (another pandemic perhaps?), it seems the requirements will be difficult to achieve before the end of January 2024. For example, inflation would need to fall to the Fed's target of circa two per cent relatively quickly. That's not out of the realms of possibility as the annualised rate of U.S. CPI over the past six months is just 3.6 per cent. Incidentally, we have frequently reminded investors that deflation is very good for innovative growth stocks. The fall to 3.6 per cent annualised consumer price index (CPI) is very positive for equities and explains the 20 per cent jump in the Nasdaq since January 1st, this year. But the path from 3.6 per cent to two per cent is not guaranteed. The strong jobs market and strong earnings from corporate U.S. suggest there will be bumps and delays to the Fed reaching its target. And presumably, even if the Fed's target of two per cent inflation is achieved, it won't immediately start cutting rates unless that CPI print is associated with weakness in the economy, in corporate profits and consequently, the jobs market. So, the next question might be, could the labour market weaken from here? Layoff data has now risen to its highest level in two years. (From 2019 onwards we began warning investors that when the spigot of Private Equity and Venture Capital money dried up, layoffs would be seen in the "profitless prosperity" sub-sector of the tech industry - the sub-sector NYU Professor Scott Galloway referred to in 2019 as suffering from "Consensual Hallucination". See the article How soon till we see the collapse of profitless prosperity¹ and From Private Equity to Zombie - The ABC of Capitalism.² So, can the labour market weaken quickly enough to justify multiple rate-cut expectations by January 2024? While the media is now breathlessly reporting the not-so-widely-anticipated layoffs in profitless technology businesses, there would have to be a much broader and more dramatic increase in unemployment to produce the necessary weakness that would validate significant rate cuts. The final question then, can the U.S. tip into a deep recession this year if the jobless rate doesn't accelerate quickly and inflation doesn't drop to said target of two per cent? First, it is worth keeping in mind that some experts believe that current two per cent real rates are not as "restrictive" as the Fed chairman has asserted. If they are accommodative, then the economy might just side-step a recession altogether. The tumult in the banking sector may be a precursor to some credit tightening, and perhaps that is the source of economic weakness, but there are lags associated with such transmission mechanisms, not least because regulators will do everything in their power to avoid it. And let's not forget that the inverted yield curve means long bond rates are accommodative and therefore supportive of investment. If the market's investors have the rate cut scenario wrong, it could mean their predictions of a recession are also wrong. In the event, investors conclude the economy is growing and disinflation remains in place, equities will continue to rally and potentially strongly. Further gains in the Nasdaq and perhaps even small companies would not surprise remembering, since the 1970s, the combination of disinflation and economic growth has been very good for innovative and growth stocks. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund ¹ https://rogermontgomery.com/how-soon-till-we-see-the-collapse-of-profitless-prosperity/ ² https://rogermontgomery.com/from-private-equity-to-zombie-the-abc-of-capitalism/ |

6 Jun 2023 - ESG Policy: The real-world impacts

|

ESG Policy: The real-world impacts Magellan Asset Management May 2023 |

|

Elisa Di Marco, Portfolio Manager - MFG Core International and Core ESG Fund, discusses ESG-linked government policies, the real-world impacts of these policies and the importance of proxy voting |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

5 Jun 2023 - Meta Platforms - AI Winner

|

Meta Platforms - AI Winner Insync Fund Managers May 2023 Excluding China (where US social media companies are generally excluded) Meta Platforms Family of Apps are used monthly by a staggering 90% of the world's connected population. Meta has a long history of investing into AI. For years, Meta has employed a world-class AI research team that has been publishing industry-changing research. Even though we can't see it, Meta has, for years, used AI to recommend posts in our feeds, moderate content, and target ads behind the scenes in Instagram and Facebook.

Source: Netbasesquid.com Meta is currently incorporating AI more visibly into his company's products. They are deploying AI technologies to assist advertisers optimise their spend across different mediums with the company saying it's improved its "monetization efficiency," or how much the company makes off of ads they sell on Reels, by 30-40 percent on Instagram and Facebook. Insync significantly increased the Fund's exposure to Meta when shares were trading below US$100 in November 2022, as investors were fretting over how much the company was spending on the Metaverse. What was not appreciated was that 80% of their investments was spent on their core business including AI. Meta shares are today trading in excess of US$200. Meta Platforms has 80% gross margin, over 19% net margins (which includes an expense/deduction of R&D spend of $35.4bn), and returns on invested capital in excess of 25%. It is an extremely profitable business which is in a strong position to benefit from the exponential deployment of artificial intelligence Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |