NEWS

27 Oct 2022 - China's deflating property market threatens wider economic trouble

|

China's deflating property market threatens wider economic trouble Magellan Asset Management October 2022 |

|

The Reserve Bank of New Zealand a year ago became the first advanced central bank to raise interest rates to cool its economy to tackle inflation. So far, the RBNZ has lifted its key rate seven times. The Bank of England, starting last December, has boosted its benchmark rate seven times too. The Reserve Bank of Australia has hiked the cash rate six times in six months; the Bank of Canada five times in seven months. The Federal Reserve has hoisted interest rates five times over six months. The European Central Bank has conducted two rate increases, one by a record amount. In the emerging world, Banco Central do Brazil has raised its Selic rate by 11.75 percentage points in 12 steps. The tally for El Banco Central de la República Argentina is eight increases that tally to 29.5 percentage points. The Reserve Bank of India has boosted its policy repo rate three times this year. What's the People's Bank of China done? It has loosened monetary policy again and again since late 2021. In December last year, the PBOC ordered the cut of the one-year loan prime rate, one of two de facto benchmark lending rates. [1] In January, the PBOC forced cuts in the one-year and five-year loan prime rates, where the five-year rate is the other de facto key rate.[2] In April, the PBOC reduced the amount banks must hold as reserves so they had more to lend.[3] In May, the PBOC instructed banks to again cut the five-year loan prime rate.[4] In August, the PBOC orchestrated a spate of rate cuts,[5] instructed banks to keep lending,[6] and organised special loans of up to US$29 billion for property developers.[7] In September, to support a tumbling yuan that trades within a daily PBOC-set band, the central bank cut the bank forex reserve ratio[8] - yet 10 days later the currency still fell below 7 to the US dollar compared with 6.35 at the start of the year. Same month, the PBOC directed state banks to cut deposit rates for the first time since 2015,[9] manoeuvred to support the yuan that still fell to a record low of 7.2 against the greenback the next day,[10] and applied tweaks to encourage lending to first-time home buyers.[11] Over the 10 months, Beijing has repeatedly announced fiscal stimulus.[12] Policymakers in China are pursuing such remedies because China's economy is hobbled in at least 10 ways. Standing out is the troubled property sector, which drives about 20% of GDP and represents about 66% of urban household wealth. The country is riddled with half-built residential buildings, which is deflating a property bubble. The history behind such worries is that policymakers super-stimulated the property market to compensate for lost exports to get through the global financial crisis of 2008-09. Since 2020, to quell overheating, however, officials under a 'three red lines' policy[13] have restricted credit to property companies, which has dented building activity and bankrupted developers (most notably, China Evergrande Group that has an estimated US$300 billion in liabilities).[14] Home prices have slid every month over the year to August.[15] Since Chinese buy off the plan, many people now own homes yet to be built - The Economist estimates that only 60% of homes pre-sold between 2013 and 2020 have been delivered.[16] Many of these dudded pre-buyers are boycotting mortgage payments - hundreds of thousands of borrowers in more than 100 cities, by some counts.[17] The property crisis so imperils the finances of local governments - they rely on land sales for much of their revenue - cities have implemented about 70 policies to support property, to little avail.[18] The property crisis highlights a second weakness. The country's business, government and household debts reached 280% of GDP in 2019 and can't rise endlessly. Central government debt at 73% of output in 2022, while low by international standards, curtails Beijing's ability to bail out the property sector[19] China's debt-fuelled property woes link into a third challenge; the stability of China's banks, especially the country's 4,000 small and mid-sized banks. In April, several small banks in eastern landlocked Henan Province failed. The fact that authorities silenced depositors entitled to compensation shocked China watchers, especially when on July 10 thugs assaulted depositors in front of police when they protested outside the People's Bank branch office in Henan's capital of Zhengzhou.[20] China's largest banks, having lent to property companies and to risky emerging countries as part of the Belt and Road Initiative, are too shaky to absorb tottering smaller banks. The concern is that a rash of small bank failures could trigger a systemic financial crisis. The perils surrounding China's banks are amplified by a fourth problem; covid-19. To enforce a zero-covid policy, Chinese authorities have locked down large cities to control the disease because they can't rely on the inferior China-made vaccines and refuse to import foreign ones. These repeated lockdowns of up to 30% of China's population have stifled economic activity, created youth unemployment of 20%, undermined business and consumer confidence, prevented people from scouting for properties and stirred protests. This lockdown blow to the economy blunts the effect of monetary and fiscal stimulus. China's wobbly banks are no longer protected by the double-digit economic growth of yesteryear, or even the 7.1% annual growth from 2011 to 2020. China's worst-ever heatwave and the linked drought is a fifth economic misfortune, even if a temporary problem.[21] Factories have been forced to cut production because hydro generation has halved.[22] Water levels have dropped enough to impede river trade. Food prices have jumped. Authorities have warned the drought poses a "severe" threat to the coming autumn harvest, when 75% of the country's grain is gathered.[23] China's sixth trial is that the rate increases implemented by about 90 central banks (according to Bloomberg's tally) are reducing demand for Chinese exports.[24] A seventh worry is that the deglobalisation fanned in part by China-US tensions deters the Western investment that drove China's economic ascension. Higher wages in China, as part of the government's spluttering push to switch from an export-and-investment-led economic model to a consumption-driven protype, deters investment too. An eighth handicap is China-US strains are cutting China off from Western technology, especially related to artificial intelligence, microchips and supercomputers. A ninth and durable impediment is China's poor demographics. A record low fertility rate of 7.52 births per 1,000 people mean the country's population of 1.4 billion is ageing and close to shrinking, commonly accepted as drags on economic dynamism.[25] A tenth handicap is President Xi Jinping's nationalistic and statist ideological bent. Xi favours state intervention in the economy. He has diverted resources to the state sector and preferred industrial ventures while curbing the dynamism of the private sector, especially that of the technology industry. Productivity, the lifeblood of rising living standards, is threatened. China's troubles mean its economy is expected to expand only about 3% in coming years, effectively at recession levels - the World Bank in October reduced its China growth forecast for 2022 from 5% to 2.8%. Such a slowdown comes with local and global consequences. Within China, the biggest risk is the public's faith in the Chinese Communist Party could be tested, especially people's confidence in Xi, China's most powerful ruler since Mao Zedong. Disagreement over an economic recovery plan is even stirring opposition to Xi inside the Communist Party, including within the supreme Politburo Standing Committee (cabinet). "For the first time since the 1989 Tiananmen Square protests, China's leader is facing not only internal dissent but also an intense popular backlash and a real risk of social unrest," assesses. Cai Xia, a professor at the Central (Communist) Party School from 1998 to 2012. [26] Any China slump would be felt around the world because China's output comprises about 19.6% of global GDP on a purchasing-power-parity basis. Many of the commodities, currencies and other assets, priced on an assumption that China will endlessly expand, could falter. Countries dependent on China (Australia, Brazil and Germany that just recorded its first trade deficit since 1991, to cite two) might struggle. Stressed emerging countries tied to the Belt and Road Initiative could suffer because China, having spent US$1 trillion on the project, is no position to release them from punishing terms.[27] A Xi-led CCP under pressure at home could double-down on 'wolf warrior' diplomacy and nationalism. Some fret it makes an invasion of Taiwan more likely.[28] China escaped the worst of the global financial crisis but its reaction may have cultivated a local brew of the same toxicity that makes it unlikely China will become the world's biggest economy any time soon, even ever. At the very least, an era of slow Chinese growth is dawning. At worst, a Chinese implosion could be the biggest blow of all for a fragile world economy. To be sure, China's economy is still expanding, the manufacturing sector is in fine shape and the country's state-backed financial system can absorb huge losses. A drop in imports is preserving China's trade surplus. China's spending on research and development now reaches 85% of that spent by the US. So innovation must be coming that will spur productivity.[29] There are no signs the masses are unruly. With its surveillance technology, perhaps no autocratic regime has been better equipped to stifle dissent. Xi is expected to cement a third term. But his power might be weakened in the process, perhaps a beneficial outcome. Rather than fuel aggression, China's economic woes might push Beijing towards a rapprochement with Washington.[30] China's slowdown at least helps the world curb inflation. Beijing's move towards a consumption-driven economy is the right long-term solution, as is prioritising high-tech and renewable sectors. But such solutions will take time. They can't quickly solve that four decades of growth have stirred imbalances that Xi is exacerbating with lockdowns, aggression abroad and an ideology that restrains economic development. Even more PBOC support might be insufficient to avoid the worst. Source: China's economic statistics come from the IMF's World Economic Outlook Database released in April 2022 unless otherwise stated. The database can be found at: imf.org/en/Publications/WEO/weo-database/2022/April. China's non-financial company, government and household debts in 2019 are from the Bank of International Settlements.

Author: Michael Collins, Investment Specialist |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund

[1] 'Chinese banks cut borrowing costs to counter economic slowdown.' Bloomberg News. 20 December 2021. bloomberg.com/news/articles/2021-12-20/chinese-banks-cut-borrowing-costs-for-first-time-in-20-months [2] 'Chinese banks cut borrowing costs as PBOC signals easing.' Bloomberg News. 20 January 2022. bloomberg.com/news/articles/2022-01-20/chinese-banks-cut-borrowing-costs-again-on-pboc-easing-signals [3] 'China's central bank takes modest easing path despite covid.' Bloomberg News. 15 April 2022. bloomberg.com/news/articles/2022-04-15/china-s-central-bank-cuts-reserve-ratio-for-banks-to-spur-growth [4] 'China banks cut key rate by record to boost ailing economy.' Bloomberg News. 20 May 2022. bloomberg.com/news/articles/2022-05-20/china-cuts-borrowing-costs-by-record-to-boost-loan-demand [5] 'China shocks with rate cut as data shows 'alarming' slowdown.' Bloomberg News. 15 August 2022. bloomberg.com/news/articles/2022-08-15/china-central-bank-unexpectedly-cuts-key-rate-to-boost-growth. [6] 'China seeks to stabilise property crisis as PBOC urges lending.' Bloomberg News. 22 August 2022. bloomberg.com/news/articles/2022-08-22/china-s-banks-trim-lending-rates-to-reverse-slump-in-borrowing [7] 'China plans $29 billion in special loans to troubled developers.' Bloomberg News. 22 August 2022. bloomberg.com/news/articles/2022-08-22/china-plans-29-billion-in-special-loans-to-troubled-developers [8] 'China cuts forex reserve ratio in bid to support tumbling yuan.' Bloomberg News. 5 September 2022. bloomberg.com/news/articles/2022-09-05/china-battles-yuan-losses-by-unleashing-foreign-exchange-onshore [9] 'China's state banks cut deposit rates for the first time since 2015.' Financial Times. 15 September 2022. ft.com/content/e9d7a148-a7af-400b-8ea3-a76c9607b188?emailId=5c0c3eae-12b0-4649-86a0-e0ed2e6a8474&segmentId=60a126e8-df3c-b524-c979-f90bde8a67cd [10] The PBOC ordered that financial institutions selling foreign-exchange forward contracts be subject to a 20% risk-reserve ratio, up from zero. The change makes it costlier to sell yuan to buy dollars in the derivatives markets. See 'China's central bank moves further to bolster the yuan.' The Wall Street Journal. 26 September 2022. wsj.com/articles/chinas-central-bank-moves-further-to-bolster-the-yuan-11664190159. 'China's offshore currency hits record low against dollar.' The Wall Street Journal. wsj.com/articles/chinas-offshore-currency-hits-record-low-against-dollar-11664333671 [11] 'China property shares rally on policy support.' Financial Times. 3 October 2022. ft.com/content/0ffa4fb4-906f-4faa-8906-8a7e07852c92 [12] 'These are China's new measures to bolster economic growth.' Bloomberg News. 25 August 2022. bloomberg.com/news/articles/2022-08-25/these-are-china-s-19-new-measures-to-bolster-economic-growth. See also 'China's stimulus: All the steps taken recently to boost the economy. Bloomberg News. 26 August 2022. bloomberg.com/news/articles/2022-08-26/china-s-stimulus-all-the-steps-taken-recently-to-boost-economy [13] Bloomberg News. QuickTake. 'What China's three red lines mean for property firms.' 9 October 2020. bloomberg.com/news/articles/2020-10-08/what-china-s-three-red-lines-mean-for-property-firms-quicktake [14] Financial Times. 'Evergrande misses deadline for $300bn debt restructuring plan.' 31 July 2022. ft.com/content/01f8a2c7-4ed1-487b-aada-ac5e2b5a9932 [15] Bloomberg. 'China's home price slump reaches a year as crisis drags on.' 16 September 2022. bloomberg.com/news/articles/2022-09-16/china-s-home-prices-fall-for-one-year-straight-as-crisis-deepens#xj4y7vzkg. The statistics are from the National Bureau of Statistics of China but its website is unsafe. [16] 'China's Ponzi-like property market is eroding faith in the state.' The Economist. 12 September 2022. economist.com/finance-and-economics/2022/09/12/chinas-ponzi-like-property-market-is-eroding-faith-in-the-state [17] Daisuke Wakabayashi. 'Homeowners boycott mortgage payments.' The New York Times. 17 August 2022. nytimes.com/2022/08/17/business/china-economy-real-estate-crisis.html [18] Bloomberg News. 'China rolls out property policies across nation to fix slump.' 14 September 2022. bloomberg.com/news/articles/2022-09-14/china-trickles-out-property-policies-across-nation-to-fix-slump. Bloomberg. 'China's home price slump reaches a year as crisis drags on.' 16 September 2022. Op cit. [19] Non-financial company debt stood at about 160% of GDP and household debt at about 60% in 2019. [20] See 'China's debt bomb looks ready to explode.' Nikkei Asia. 17 July 2022. asia.nikkei.com/Opinion/China-s-debt-bomb-looks-ready-to-explode [21] See New Scientist. 'Heatwave in China is the most severe ever recorded in the world.' 23 August 2022. newscientist.com/article/2334921-heatwave-in-china-is-the-most-severe-ever-recorded-in-the-world/ [22] Bloomberg News. 'Power crunch in Sichuan adds to industry's woes in China.' 21 August 2022. bloomberg.com/news/articles/2022-08-21/power-crunch-in-sichuan-adds-to-manufacturers-woes-in-china [23] Ministry of Agriculture and Rural Affairs of the People's Republic of China. 'China urges intensified efforts to secure autumn harvests amid heatwaves.' 23 August 2022. english.moa.gov.cn/news_522/202208/t20220823_300951.html. See also 'China's record drought is drying rivers and feeding its coal habit.' The New York Times. 26 August 2022. nytimes.com/2022/08/26/business/economy/china-drought-economy-climate.html [24] The World Bank in September warned the rate increases could trigger a "devastating" global recession. The World Bank. 'Risk of global recession in 2023 rises amid simultaneous rate hikes.' 15 September 2022. worldbank.org/en/news/press-release/2022/09/15/risk-of-global-recession-in-2023-rises-amid-simultaneous-rate-hikes [25] ChinaDaily, a government-controlled English-language publication. 'Lower living costs to boost birth rate.' 19 January 2022. global.chinadaily.com.cn/a/202201/19/WS61e75124a310cdd39bc81e1b.html [26] Cai Xia, professor at the Central Party School of the Chinese Communist Party from 1998 to 2012. 'The weakness of Xi Jinping.' Foreign Affairs. September/October 2022. foreignaffairs.com/china/xi-jinping-china-weakness-hubris-paranoia-threaten-future [27] See 'China reins in its Belt and Road Program, $1 trillion later.' The Wall Street Journal. 26 September 2022. wsj.com/articles/china-belt-road-debt-11663961638 [28] See 'War jitters. A weak China may be more warlike than a strong one.' A review of the book 'Danger zone: The coming conflict with China' by Hal Brands and Michael Beckley. The Economist. 1 September 2022. economist.com/china/2022/09/01/a-weak-china-may-be-more-warlike-than-a-strong-one [29] OECD. 'Main science and technology indicators.' September 2020. oecd.org/sti/msti.htm [30] See Victoria Herczegh. 'A confrontation China can't afford.' 27 July 2022. https://geopoliticalfutures.com/a-confrontation-china-cant-afford/ Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

26 Oct 2022 - Global Economic Outlook: a perfect storm

|

Global Economic Outlook: a perfect storm abrdn September 2022 The global economy is facing multiple, mutually-reinforcing headwinds - a scenario which is likely to lead to a deeper global recession sooner than we'd previously forecast. We now expect the Fed's rapid policy tightening to tip the US into recession by Q2 next year. The UK and EU economies are facing a huge, commodity-price induced real-income squeeze, amplified by central bank actions. In China, the rebound from the Shanghai lockdown is petering out, with the prolonging of a 'zero-Covid' policy and property sector weakness weighing on the outlook. Meanwhile, many emerging and frontier economies are caught between their own imbalances and these external shocks. The compounding effect of these various shocks means that what once looked like a series of distinct headwinds emanating from different places at different times, are now coming together into something that looks like a perfect storm for the global economy. Figure 1: Global forecast summary Source: abrdn, as of September 2022 *Forecasts are offered as opinion and are not reflective of potential performance. Forecasts are not guaranteed and actual events or results may differ materially. No US recession this year…US economic activity experienced a sharp, commodity-price driven, slowdown in the second quarter, with the economy posting two consecutive quarters of contraction in the first half of this year. While some observers insist on describing this as a 'technical recession', this is neither the formal definition of a 'recession' nor was what we saw the phenomenon we have in mind when identifying a US recession. With employment growth throughout the first half of the year running well in excess of the rate required to keep unemployment steady, it's not credible to believe the US was experiencing the breadth and depth of downturn that would be consistent with a recession. If anything, underlying demand was still too strong, with imbalances continuing to build - especially in the labour market. In the very near term the economy looks set to accelerate, boosted by the recent fall in many commodity prices. …but we expect it to happen earlier next yearDespite this 'mini recovery', we now forecast the US economy to enter a recession two quarters earlier than we'd originally anticipated. The second quarter of 2023 is now expected to mark the formal end of the current economic cycle, due to more rapid and sustained monetary tightening by the Federal Reserve (Fed), and its transmission through asset prices. But we have more conviction in the recession's inevitability than its timing given the 'long and variable' lags of central bank monetary policy. Powell at Jackson HoleGranted, financial conditions eased following the July meeting of the Federal Open Market Committee (FOMC), which suppressed our short-term recession indicators. But this development predictably proved unsustainable as it reflected a misunderstanding of the Fed's reaction function. Fed Chairman Jerome Powell hammered this point home in his hawkish speech last month at Jackson Hole, the annual gathering of economic policymakers from around the world. That's why the Fed is likely to keep rates elevated, even as the US economy enters a recession, as it awaits convincing evidence that core inflation pressures have moderated (see Figure 2). Figure 2: Elevated core services inflation will keep rates high for longer Source: Haver, abrdn, as at September 2022 What this means for the rest of the worldThis will tend to exacerbate the global spill-overs, with the Fed continuing to export tight financial conditions to the rest of the world through the dollar-based financial system. Emerging market (EM) countries with large external imbalances are likely to be especially vulnerable given the risk of capital flight and currency crises. Even in EMs where external vulnerabilities are low, the global recession will weigh on growth via trade, financial and confidence channels. China's slowdown…China's 2022 growth target is out of reach while headwinds for next year are intensifying. Monetary policy may be easing, but it's difficult to gain traction while structural headwinds from Covid restrictions and the property slump remain in place. While an exit strategy for the country's 'zero-Covid' policy may be revealed during the 20th Party Congress in October, we now think an actual exit may have to wait until the third quarter of 2023. The ramping up of infrastructure spending will help to shore up growth and reduce the risks of a hard landing. However, there are limits to how much this will help. …Europe has its own problemsEven before the US recession hits, Europe faces the prospect of huge terms-of-trade, real income and energy shocks pushing the Eurozone economy into recession by the fourth quarter of this year. Our European gas-supply scenarios envisage further energy rationing to be phased in across various sectors, particularly in Germany. The risks may materialise into even more severe outcomes. Inflation is everyone's problem (for now)Near-term energy supply shortages should keep headline inflation elevated throughout the northern hemisphere winter, especially in Europe. Beyond the short term, however, the global recession will weigh heavily on commodity demand. Supply-chain bottlenecks continue to improve despite the effects of China's zero-Covid policies. As central bank monetary tightening starts to restrict product and labour demand, the scene will be set for significant disinflation - a slowing of price rises - throughout 2023 and especially 2024. With falling headline and core inflation likely to help re-anchor inflation expectations, monetary policy can return to supporting economic growth from the second half of next year. We anticipate the appropriate path for policy, given the likely increase in unemployment and fall in inflation, will see rates once again reach the effective lower bound for much of the developed world. Political changeThe US Inflation Reduction Act demonstrates the kind of constructive, albeit modest, and market-moving legislation that can be passed should the Democrats keep hold of both houses of Congress in November's mid-term elections. However, a Republican victory would usher in another period of stasis. Elsewhere, the upcoming Italian election is likely to result in a new right-wing government, which may exacerbate tensions with the rest of the European Union. In another sign of the impact of inflation on politics, the new UK government of Prime Minister Liz Truss has significantly shaken up the policy mix, with large macroeconomic and market implications. Similar moves are possible in other European countries. Meanwhile, the war in Ukraine will roll on, and sharpen the widening divide between the West and a more closely-aligned Russia-China pairing. Most-likely scenarios lead to recession…Not only does our base-case scenario involve a global recession (see Figure 3), but adding up the probabilities of all the scenarios consistent with recession gives a combined 55% probability. This means a global recession in one form or another is more likely than not, most probably within the next two years. Figure 3: We expect an even deeper, and earlier, global recession than we had previously forecast Source: abrdn, as of September 2022 We're still concerned about imbalances in the Chinese property sector on top of those already included in our base case, motivating our 'China stress and slowdown' scenario. We also think a Covid 'vaccine escape' scenario is still plausible given what we know about viral mutations. Both these scenarios remain consistent with a global recession, but with quite different drivers than in our base case. Meanwhile, we've recalibrated our 'stagflationary shock' scenario - based on expectations of European energy shortages and EM crises - so that it also leads to global recession. That said, another, more positive, scenario - 'Fed walks the tightrope' - may deliver a soft-landing for the global economy. But it would require a lot to go right for this to happen. Author: abrdn Research Institute |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund

|

25 Oct 2022 - 10k Words

|

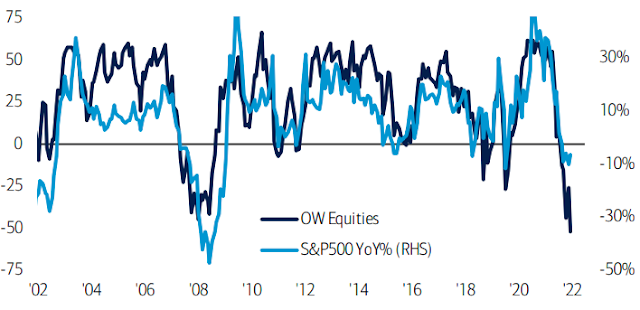

10k Words Equitable Investors October 2022 We are in to the home stretch for CY2022, the December quarter, and can paint a fairly dire picture of how investment and capital markets have faired. Global M&A activity is down 33%, while equity capital raised is down 65% according to dealogic data. Acquisitions of VC-backed businesses have dived in number, as Pitchbook charts. Gavekal shows the drawdown in dollars across equity and debt markets in 2022 dwarfs the GFC. And yet despite the declines, fund managers' equity allocations have been slashed according to both Bank of America and Goldman Sachs. In Australia, economists' inflation expectations have inched higher according to Bloomberg, while consumer sentiment has plunged based on the ANZ-Roy Morgan survey. Meanwhile, HFI Research chart's the decline in hydrocarbons in storage in the US in 2022 tracking well below prior years. EIA's own chart tells a similar story relative to the 5-year range. Global M&A in CY2022 year-to-date relative to same period in 2021 Source: dealogic, WSJ Global Equity Capital Markets activity in CY2022 year-to-date relative to same period in 2021 Source: dealogic, WSJ Acquisitions in the US of VC-backed businesses Source: PitchBook Drawdown in total market capitalisation of US equity & fixed income Source: Gavekal Research, Bloomberg, Macrobond Hedge funds and muutal funds slashed equity exposure Source: Goldman Sachs, ICI (via zerohedge) BofA Fund Manager Survey shows allocation to equities at all-time low Source: Bank of America Fund Manager Survey Survey of Australian economists' inflation expectations Source: Bloomberg ANZ Consumer Sentiment US Big 4 Storage ( Crude with Strategic Petroleum Reserve + Gasoline + Distillate + Jet Fuel) US crude oil stocks Source: US Energy Information Administration October Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

24 Oct 2022 - Investment Perspectives: A closer look at US housing

21 Oct 2022 - RBA shows some patience with a return to neutral territory

|

RBA shows some patience with a return to neutral territory Pendal October 2022 |

|

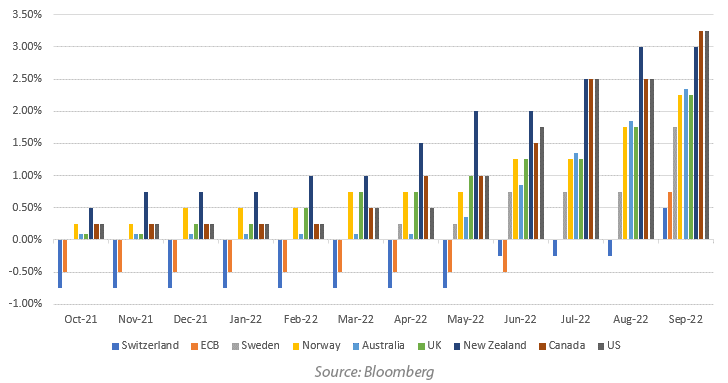

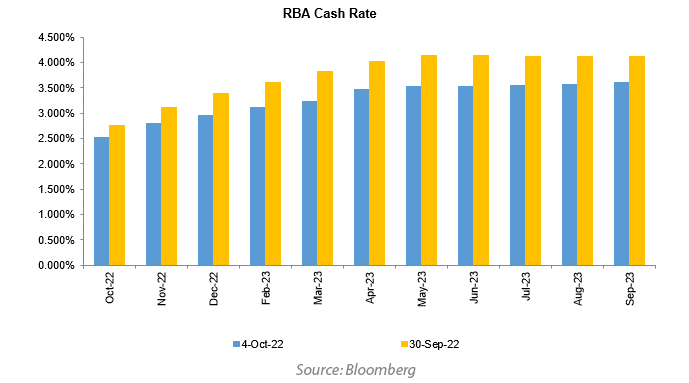

The Reserve Bank of Australia (RBA) surprised the market this month when raising the cash rate by 25 basis points to 2.60%. The market had assigned an 85% probability of the RBA hiking by 50 basis points. Governor Lowe dropped a hint last month that the pace of tightening would slow when he commented that "the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises". It was a case of a rising tide lifts all boats. As the following graph shows, central banks globally continued to tighten monetary policy aggressively in September. In Sweden the Riksbank tightened by a more than expected 100 basis points. The Federal Reserve, Bank of Canada, European Central Bank and Swiss National Bank (the last remaining member of the negative interest rate policy club) all raised their rates by 75 basis points. The RBA, Bank of England and Norges Bank were all in the 50 basis point hike camp last month.

However, unlike other central banks, the RBA has shown some patience with this move. Rate hikes normally take 2 to 3 months to show up in any data given lags between the RBA hikes and the higher rates hitting mortgages. One of the key lines out of the statement yesterday was "One source of uncertainty is the outlook for the global economy, which has deteriorated recently". The UK Government's mini budget released last month was the source of much financial turmoil last month, the moves (and lack of liquidity) were astonishing late in the month. The RBA is also acutely aware of the large amount of fixed rate mortgages that roll off over 2023. The national accounts also reflected a drop in the household savings rate, indicating that the large savings buffers that households have built over the past 2 years may start to be called upon as cost of living pressures rise. The decision to raise by a less than expected 25 basis points yesterday resulted in the market pricing in a terminal cash rate of 3.6% in 1 years time. At the end of September this was around 4.1%.  Back around neutral the RBA now thinks it has time on its side. Their hope will be for better behaved CPI numbers in the quarters ahead. The Sep Quarter CPI, due out later this month, should show elevated yet slowing CPI. Our initial forecast is for a 1.4% increase, although electricity subsidies in WA and Victoria, and a lesser extent Queensland, could mean a lower number. 1.4% would be no cause for celebration but after a 2.1% and a 1.8% in recent quarters it is in the right direction. Governor Lowe will likely take his next round of speeches reiterating their preparedness to tackle inflation with above neutral rates if needed. "The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that" was the final line of yesterday's decision. For now though, reopening of supply chains, anchored inflation expectations and falling commodity prices are working in their favour. The key domestically will be how tight labour markets feed into wage outcomes over the next year. The RBA is prepared for 3.5% to 4% increases to wages, as many agreements are now showing, but will be alert for any trend higher. Immigration is making a welcome comeback and may well impact enough in the next 12 months for the RBA to get their way. However, the jobs market is unlikely to be back at pre COVID conditions until 2024 so the RBA patience, although welcome, may be tested again. Author: Tim Hext, Portfolio Manager and Head of Government Bond Strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

20 Oct 2022 - The Rate Debate: Are central banks at risk of blowing up markets?

|

The Rate Debate - Episode 32 Are central banks at risk of blowing up markets? Yarra Capital Management 04 October 2022 The RBA hiked rates for the sixth consecutive month. With lead indicators showing signs of inflation coming off the boil and European banks starting to see stress, cracks are forming in the credit and equity markets. Have central banks tightened too aggressively risking a recession? Speakers: |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

19 Oct 2022 - Around the world in 200 Meetings, Mary Manning: Sustainable Futures

|

Around the world in 200 Meetings, Mary Manning: Sustainable Futures Alphinity Investment Management October 2022 For the first time since COVID, the Sustainable Futures conference took place in New York bringing together sustainable leaders from across the world. Mary Manning shares the details from her trip where she visited big tech and consumer companies in New York, Seattle and Toronto. Speakers: Mary Manning, Portfolio Manager & Elfreda Jonker, Client Portfolio Manager This information is for advisers & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

18 Oct 2022 - 'Small Talk' - Mood Swings

|

'Small Talk' - Mood Swings Equitable Investors October 2022 The market mood swings continued. Huge gains to get things rolling then a sharp reversal, felt most during the US trading session. Maybe the Reserve Bank of Australia (RBA) contributed to the positive start to the week globally when it raised interest rates by less than expected, leading to speculation the US Federal Reserve and others may be of a similar mind. But the Cleveland Fed President said that she has "not seen any evidence to warrant slowing the pace of hikes". Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

17 Oct 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||||

| Schroder Specialist Private Equity Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| Alceon Real Estate Corporate Senior Master Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

| Bell Global Sustainable Fund (Hedged) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile

|

|||||||||||||||||||

| Bell Global Sustainable Fund (Unhedged) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

17 Oct 2022 - The Inflation Reduction Act will drive US' efforts towards net-zero

|

The Inflation Reduction Act will drive US' efforts towards net-zero 4D Infrastructure September 2022

What is the Inflation Reduction Act? On 16 August 2022, President Biden signed the IRA into law having passed through Congress based on the Democrats holding a majority in both houses. The IRA includes US$369 billion in climate and energy spending, the largest energy transition focused spending package ever in the US. It's expected to put the US on track to achieve a 40% greenhouse gas (GHG) reduction against 2005 levels by 2030[1] - which is still a little off Biden's communicated target of a 50-52% reduction[2]. Background to the legislation The components within the IRA were derived from the larger legislative package proposed by the Democrats, the Build Back Better Act (BBB), which was abandoned due to its perceived impact on the budget deficit. Moderate Democrat senator, Rep Manchin, was a key objector to BBB, but was convinced of the merits of the IRA and had the deciding vote in pushing the legislation through the Senate and signed into law. What is included in the package? The IRA spending package incorporates a number of high-level targets, with spending allocated to each. These goals include[3]:

The spending package is primarily financed through the establishment of a new minimum corporate tax rate of 15%, and increased powers of the Internal Revenues Service (IRS) to enforce tax payment. Specific support mechanisms to assist in facilitating the energy transition process are included in the table below. These are intended to improve the economics of clean/renewable energy production to incentivise their adoption. This is not an exhaustive list of mechanisms included in the IRA. Source: White & Case: Inflation Reduction Act Offers Significant Tax Incentives Targeting Energy Transition and Renewables Benefits for US infrastructure-focused companies The IRA improves the economics of clean/renewable energy production for utilities and contracted generation companies in 4D's investment universe. This in turn improves their competitiveness, fast tracks investment and theoretically boosts earnings growth. It should also reduce the cost of energy for the end customer through the application of regulation or competitive dynamics. Regulated energy production Regulation sets the level of returns that utilities can earn on renewable and clean energy investments. Therefore, the improved economics of renewables and clean energy production facilitated through the IRA is passed onto customers through lower energy bills. This improved customer affordability and bill headroom allows utilities to increase the level of investment in the energy transition and grid support, while maintaining affordability. This increased investment is expected to improve earnings growth. Specific regulated utility companies that are likely to benefit from mechanisms included in the IRA include American Electric Power (AEP-US), CMS Corp (CMS-US) and Portland General Electric (POR-US). Contracted energy production For contracted generation companies, or companies that produce clean energy fuels (clean hydrogen, carbon capture) under long-term contractual arrangements, the IRA should result in improved returns. Although, depending on the intensity of competition, these improved returns could be diminished in exchange for lower energy costs for customers. All scenarios should incentivise increased investment and growth for companies. A number of large European-based renewable/clean energy developers have indicated optimism associated with the IRA including Enel SpA (ENEL-MI), Energias de Portugal SA (EDP-LS) and Iberdrola SA (IBE-ES). A standout US contracted generation developer which is likely to benefit from the IRA is NextEra Energy (NEE-US). Midstream oil/gas Midstream companies which are attempting to extend the longevity of their business model by diversifying away from fossil-based commodities to clean fuels such as biofuels, renewable diesel, renewable natural gas, low/no carbon hydrogen and facilitating carbon capture, are likely to have more investment opportunities due to the IRA. The tax credits, rebates, and grants supporting these newer clean fuels improve their economics, making them a more attractive (and realistic) investment proposition. Midstream names such as Kinder Morgan Inc (KMI-US) are going to benefit from the improved carbon capture tax credits, while Enbridge Inc (ENB-CN) investment opportunities will improve through a number of the clean energy credits. Unknown impacts of the legislation As outlined, the spending package is expected to be partially financed through the implementation of a minimum corporate tax rate. The impact on infrastructure companies' cashflow will depend on individual company factors, but could have detrimental ramifications for some. Conclusion The IRA's passage into law in a major piece of legislation in supporting the US' efforts to decarbonise its economy while supporting efforts to develop vertical supply chains for clean/renewable energy in the US. The many support mechanisms included in the legislation primarily improve the economics of clean/renewable energy, and reduce the end cost for customers. Specific infrastructure companies in 4D's investment portfolio that are likely to benefit from the legislation include NextEra, American Electric Power, Enel, CMS Corp, Iberdrola and Kinder Morgan. |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure Fund[1] Environmental and Energy Study Institute: Historic US$369 Billion Investment in Climate Solutions Preserves a Pathway to Keep Global Warming Below 1.5°C - 16 August 2022 [2] President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S. Leadership on Clean Energy Technologies - 22 April 2022 [3] Summary of the Energy Security and Climate Change Investments in the Inflation Reduction Act of 2022 - https://www.democrats.senate.gov/summary-of-the-energy-security-and-climate-change-investments-in-the-inflation-reduction-act-of-2022 [4] The Wage and Apprenticeship Requirements are measures which aim to ensure that 1) contractors and subcontractors are paid in line with commensurate job wage requirements; and 2) a proportion of the workforce are filled by qualified apprentices. The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

.jpg)

%20-%20HFI%20Research.png)